Trading the News: Strategies for Steem/USDT

Hello everyone! I hope you are all doing well and enjoying life with the blessings of Allah Almighty. I am happy to take part in the exciting challenge hosted by SteemitCryptoAcademy community . So, without any further delay, let's dive right in! Shall we ? ........, Okay , Okay😊! .

Question 1: Understanding News-Based Trading |

|---|

There is no rocket science or complexity comes from the concept of news in trading. It’s just being an alert guy on how various happenings can influence the market. News such as regulations, partnerships, or macroeconomic updates can create big price movements.

For me, traders who are news-oriented gain a huge advantage. Yeah, it’s noticing the key to opportunities trending before the market altogether takes note. And you know what? This turns into a rather energetic and exciting strategy for news trading.

When a new coin is listed to an exchange, for example, prices might pop. Pop also is because of regulatory updates or optimism for it or panic, which the last shoe to exist as their characteristic doesn’t quite fit them. Yeah, the market does move fast; therefore, everything’s about timing in this approach.

It’s also important to learn the sentiment in news. Is it positive or negative? How lasting might the effect be? I feel that doing this analysis to strong risk management is the recipe for success. Yeah, you need to be super sharp and informed while trading the news.

You know what? It’s not just reacting, but it’s also being ready for what could happen. Not rocket science; therefore, trading the news is an art, i.e., knowledge on timing and strategy to seize market opportunities.

Benefits of News Trading

1. Quick Profit Opportunities:

As you got it right, any news can cause a explosive increase in prices wether Cpi report, any else tweet. For more instance, if a large platform like Binance adds Steem or any other token any one possible, there will be high trading activity targeting Steem/USDT where greed traders will grab any chance first.

2. Market Awareness:

I also do believe that trading the news is a useful way to stay updated with the current trends. For example , the Steem price fluctuations due to the use of Steem initiative, evolution of a major Steem blockchain, or any possible changes any kinda in the Steem/USDT rates necessary for trading in the long term.

3. High Volatility Benefits:

You know what? We know that volatility in a positive or negative in the world economy is not always unfavourable. This is only because of Steem has proved capable of developing huge price movements in the wake of positive announcements such as new partnerships Engaging Steem.

Hazards of News Trading

1. Misinformation or Delays:

Indeed and no doubt, using fake or delaying in news can indeed mean huge loss making. Lets suppose, if There all Steem has been working on is getting regulated, the failure to do so or news on in that front are likely to push the Steem/USDT price significantly in downwards or against .

2. Overreaction to Events:

In my opinion , markets not always friend market always tend to overcompensate or undercompensate news and this makes the price swings unforecastable. A simple technical adjustment might lead to ‘’excitement’’ in the Steem/USDT market.

3. Emotional Trading:

In most of my time i mention Emotional trading is always worst than doing technical errors , it may be rather straining to trade on news. When ever there is high volatility and you find yourself what do always not that be static with your plane , it is possible for the trader to make the wrong decisions due to the resulting panic.

Consequently, news-based trading presents not only exceptional prospects for financial transformation but it is also crucial to be as cautious as enthusiastic about undertaking such business. Understanding, Responding right and Emotion regulation is vital when implementing this particular strategy.

Question 2: Analyzing the Impact of News Events |

|---|

Steem see many ups and down in the form of , listing on major exchange Binance , than some of time its effect by Cpi reports , Iran messile attack on Israel etc . I am going to talk about how news can rock the Steem/USDT market with two examples; one good, one bad. We know that both of the types of news can result in huge price moves and traders can not afford to be out of the game.

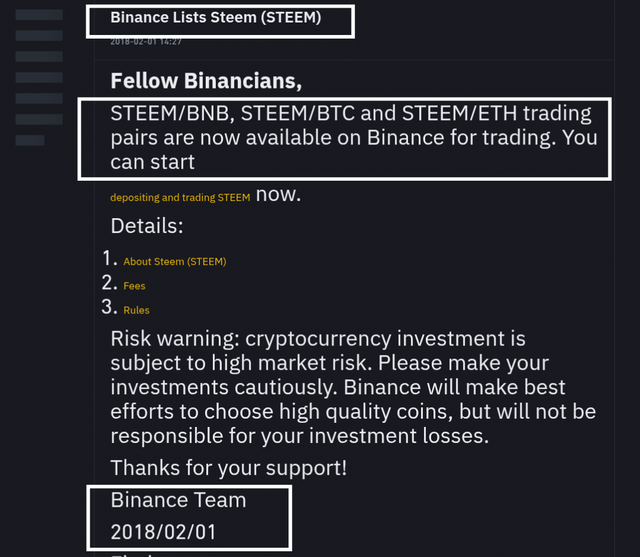

Positive Event: A Major Exchange Listing

For the first time the exchange (Binance) where Steem was added back in 2018 is one of the biggest on the steemit. Now you know what? This kinda news was exciting to the community for many as it opens the door to higher liquidity and global exposure.

In my clear opinion, such listings raise confidence for a one's cryptocurrency. As per my research, the price of Steem increased by almost 35% within 24 hours after the announcement — the price jumped from 0.16$ to 0.22$. There was a great chance for traders to make profit from the hype, yes.

Binance listed steem Binance listed steem |

|---|

Negative Event: Hive Fork Controversy

On the one side: The Drama Relating to Hive hard fork in March 2018. I am not sure that everyone expected it, however the division of the Steem community has caused a lot of uncertainty. What I mean is that the future of Steem was uncertain for some of the big investors after some of the bigger developers had moved on, to Hive.

Consequently, Steem’s price was severely depressed. In a few days it went from $0.44 to $0.20 between feb 15 to March 18 and was down 60% which is not a low move. Indeed, it was not a great time for traders who bought during what was a terrible time to do so.

Cointelegraph posted Cointelegraph posted |

|---|

Steem price reaction on 4H timeframe Steem price reaction on 4H timeframe |

|---|

Conclusion

In conclusion, to methese examples illustrate the double edged sword of news based trading. A listing can get prices pumped, and controversies can get them sunk. After all, we know by now that reacting fast and remaining informed are important elements. You could say that understanding the context and understanding risk make all the difference.

Discuss the price action and market sentiment surrounding the event.

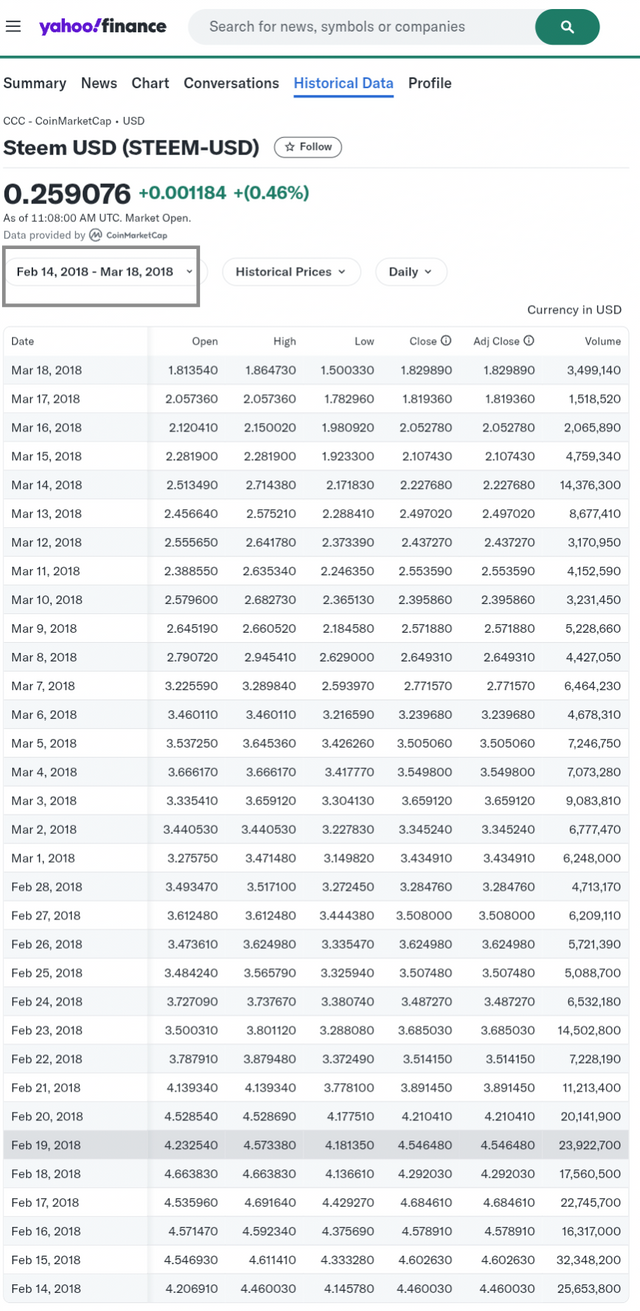

In the following research i will demonstrate that from February 14 to March 18, 2018 , there were events that cause the Steem/USDT market extreme volatility.

February 14, 2018: Acquisition Announcement

On February 14, 2018, (Justin Sun) steemit founder, Tron founder, acquired Steemit Inc..., the main point was for the Steem blockchain. The community has reacted to this acquisition with saveral concern about centralization within the Steem community. Upon the news, Steem price had some wobbles as the market digested it.

Hive Hard Fork Announcement

Community members responded to concerns about centralized blockchain and announced Hive, a decentralized blockchain launching in feb of 2018 . The market sentiment was dampened by the uncertainty created by this impending hard fork, which is another reason why prices of that asset tended to be quite volatile.

Price Action Overview

During this period, Steem's price exhibited notable movements:

February 14, 2018: After the acquisition news, the price swung about.

March 18, 2018: Before the Hive hard fork, the price was extremely volatile as traders awaited what was to hit the network.

Market Sentiment

From February 14th to March 18th, 2018 there was a period of heightened uncertainty and division among the Steem community. The acquisition dented the idea of centralization, while Hive hard fork is a move towards decentralization. These also influenced trading behaviors where some investors took profit from their positions because of uncertainty, and another expected the possibility to make gains from the new Hive tokens.

In depth technical, through price movements

Bother one look to Yahoo/finance data. Have you observed Steem/USDT was very volatile from February 14 to March 18, 2018 ? , due to market sentiment. Steem first opened on February 14 at $4.20, closed at $4.46; stable, optimistic. But as March drew near, pressure kept falling on the market. Less than a month later, the price had dropped sharply, to $3.23 on March 6, a 27% decrease.

A decline in markets, as a result of uncertainty within the market, as well as external factors which influence sentiment in regards to cryptocurrency. Steady on March 8, Steem recovered to $2.79 for a few hours, but couldn’t hold up. By March 18th, the price of Bitcoin dropped a further $0.08 to $1.82 dropping 26% of the total decline.

|

|---|

Conclusion

So its now cleared that between February 14 and March 18, 2020, the event scenario makes clear how both governance decisions and community responses impact cryptocurrency markets. Such developments, of course, are of critical importance for traders to appropriately negotiate market volatility.

17 Feb , Steem price 4.43 17 Feb , Steem price 4.43 |  29 Feb , steem price 3.25 29 Feb , steem price 3.25 |

|---|

19 March , steem price 1.5$ 19 March , steem price 1.5$ |

|---|

Question 3: Designing a News-Based Trading Strategy |

|---|

Criteria for Selecting Imporaive News

The first step we need to in designing an effective Steem/USDT news based trading strategy will is to find news which has a big impact on market sentiment and price movement. Here let we need to focus on:

a) Exchange-Related Announcements:

We pretty well know that exchange listings or delistings are instantly volatile. A news about Steem on a high profile exchange like Binance or bitget can drive price surge as i mentioned already in 2018. Just as a delisting could also cause a sharp drop.

b) Regulatory Developments:

I do think that the regulatory updates around the blockchain & cryptocurrency policies in major markets like U.S., or Europe are important. To give an example , if we apply favorable regulations to the decentralized platforms, it would be then increase confidence in Steem, causing its price to rise.

c) Blockchain Upgrades or Forks:

You know what? Price is susceptible to having a longer lived impact for the news which is specific to the project, especially regarding major upgrades or hard forks (e.g. the Hive fork in past). The positive developments could represent growth, or contentious forks could lead to more uncertainty and risk.

d) Macroeconomic Trends:

Said ‘external factors‘ can be the bigger announcements like inflation reports or rate changes on interest rate changes that affect the broader crypto market. Then, by proxy, Steem/USDT is affected.

e) Social Media Trends:

Social media buzz can be an indicator of market sentiment somehow , although I am not sure everyone does. Its effect can be amplified by news shared by the influential crypto accounts or platforms.

Now using these criteria to prioritize , traders will be able to filter impactful news, time their entries and exits and align their trading strategies to these dynamics of the Steem / USDT market. Would you like to see further steps?

Tools for monitoring and analyzing news events

News Events Monitoring and Analysis Tools

With Steem/USDT there are certain tools you need when trading to catch market moving news before everyone else. Let me break it down for you:

1) Crypto News Platforms

Now since i shared a post above , in the first i am going to ask a question , Have you heard of CoinDesk or CoinTelegraph? All your sources for crypto news are these. These platforms have got you covered whether it’s a new listing or a regulatory update. Bookmark them, I would say!

2) Social Media Buzz

Twitter (now X) is a goldmine. Follow accounts like @ Steemit and main crypto influencers seriously. And hashtags? They’re super useful— you can get a quick pulse on the market with # STEEM or # CryptoNews.

3) All-in-One Trackers

You know what’s great? While prices are all CoinMarketCap and TradingView show, they also share news and analysis. What if you see a Steem spike and know exactly what caused it.

4) Custom Alerts

I absolutely love Google Alerts and think it’s an underrated gem. Get updates straight to your inbox set up one for "Steem news." RSS feeds? It’s also a lifesaver for staying ahead.

5) Community Hubs

Platforms like Steemit and Reddit are the heart of the action when it comes to community driven insights. Here, traders and developers share insider tips, updates and even rumors.

6) Sentiment Analyzers

I also don’t know that if this should be tried i mean limitedly be in use like a tools LunarCrush, but they’re great for getting a sense of market mood lastly. Is it a hyped crowd or a panicked crowd? That’s how much knowing can make or break a trade.

With these tools, you are not only reacting…but ahead of the news. That’s everything in crypto trading.

Entry, exit, and risk management rules tailored to news-driven volatility.

First of all let me tell you that it can be a dangerous way in trading that making decision sololey based on news. Any how here’s a structured plan to navigate the chaos:

Entry Rules

Analyze the News Impact:

First ask your brain if the news is positive, negative, or neutral. For example, a Steem listing on Binance might be a buy after that, making it sell the next time it is delisted.Set Technical Triggers:

You want to look at support/resistance zones or a 15% price move (with high volume) so that you can confirm the market’s reaction before you enter.Enter in Phases:

But instead of investing all money at once, you should enter in 2-3 parts to prevent being trapped in a fakeout.

Exit Rules

- Profit Targets:

Set realistic goals. For example:

- If a 15% gain, you will exit 60% of your position.

Exit fully at moment that Steem approaches a big resistance level.

Stop-Loss Discipline:

Stop loss mist , With stop loss orders, place 5-10% below your entry price, so that if something unexpected reverses, you don’t lose everything.Time-Based Exits:

If after 6 hours of entering the price has not jumped significantly, it’s time to get out, because the news may have already been priced in.

Risk Management Rules :~

Position Sizing:

Do not risk any more than 5-6% of your total capital on any trade. Based on volatility adjust position size.Volatility Buffer:

During high impact days, widen your stop loss by 10-15% to account for swings in price (e.g. 10-15%).Avoid Overtrading:

I always think it’s easy to get lost in the news hype. Stay in your plan and do not chase prices for the missed initial move.

With these structured rules in place, you can ride the news driven volatility and manage the risk to profit.

Question 4: Managing Risks in News Trading |

|---|

Slippage: When Market Moves Faster Than You.

What is slippage Well trading news events with slippage is one of the big challenges of trading. This occurs when the price of any very moves faster than you can enter an trade and for example get your order executed at a worse price than you expected.

Well let explain in easy way — you have set a stop loss to protect yourself , but the market goes right by it and you end losing bigger than you had envisioned. It’s one of those things, I believe that really frustrates traders when they are happening, especially at volatile times. For this reason, it is wise to use limit orders instead of market orders so that your trade occurs only at that price you have picked.

You can give yourself a feel for how quickly things move while not risking real money with news releases by practicing in demo accounts.

Overreaction: Letting Emotions Control the Wheel

Let me explain something that happens to a lot of traders even to me few months befor, and also especially during big news events: overreaction. We all know what I mean, panic, then fear, perhaps greed, whispering, “Jump in now” before you have got a chance to think.

When the dust settles the coin price settle ,& prices stabilize, many traders regret their decisions and the market becomes chaotic since many traders rush to buy or sell. I just mean it is very easy to get swept up in emotion in the moment and so it’s about discipline, you need to trade according to your plan.

Before you do anything, just stop for a moment and ask yourself, “Is this news really big enough to drive such big change?” But taking a break can help you become mindful, inject focus into your thinking, and make better decisions.

Misinformation: Trust, But Verify

Misinformation is also another a sneaky risk when it comes to trading. You know what? Some news is not always reliable special when you obey a one blogger and you can end up losing generously if acted upon by rumors or unprocessed data.

Social media brings up a story that you heard about a company’s big breakthrough, you jump right in, only to realise later it was never truly there. I don’t know if there’s anything you can do to totally avoid this, but along with finding out information about an event, you can keep the information coming from trusted sources.

Do not diractly act on any story that is in the news unless you only hear about it from reliable sources and find the facts to be true before acting.

Lack of Preparation:

And in the last I will tell you one thing, the market does not hold for anyone and going into a fire unprepared is like entering a storm without an umbrella. But not all traders understand how some news can affect the market.

For instance, an interest rate hike will make currency pairs free rein to swing wildly, and some traders will jump in without any idea what to expect. The solution? Preparation is key. By watching the economic calendar you can watch for the big events.

In addition, I also think it is important to educate yourself on how different news will impact your chosen market, like oil prices react differently to political news versus stocks. Planning ahead will enable you to be pointed in the right direction to navigate the storm rather than get swept away from it.

Question 5: Leveraging Technology for News Trading |

|---|

I will explain this simply. Let say when you trade on the news, trading tools like sentiment analysis, trading bots and news aggregators can really take the hassle out of trading if you make use of them in the shooting fast world of crypto.

Sentiment analysis tools first scan what people are saying online about a coin or which token, whether it is on X , Insta..... or the news, and let you know whether the outlook is good or not. For instance, you can use tools like LunarCrush or The TIE to determine if people care (or do not care) about Bitcoin. This action helps you to act quickly before the prices shift.

Trading bots are in today personal assistants for traders. All you need to do is tell them what to do, and they will buy and sell when they should without requiring your input. These are the tools that people use for this — 3Commas or CryptoHopper for example. What is great about these bots is that they do no get emotional like humans do. They hold true to the plan and help you avoid bad decisions when panic sets in should the market crash.

Next there is aggregators such as CryptoPanic & CoinDesk where all the important news are accumulated in one place. Take for instance a breaking news on a big exchange down, you will know instantly, and you’ll be ahead of everyone.

The best part ? All of these are applicable tools that you may combine. Spot trends using sentiment analysis, check the news aggregator to confirm what is happening, and have a bot trade for you. Even more advanced are platforms such as Nansen which mix sentiment and blockchain data.

And in a nutshell, these tools help you learn better, act faster, and think smarter, at least when the globe is on fast-forward.

kind Regards

@artist1111

Adieu, folks!

May the winds of fortune

carry you to greatness!

May the winds of fortune

carry you to greatness!