Steemit Crypto Academy Contest / SLC S23W5: Steem/USDT Order Book Trading – Mastering Market Liquidity Strategies

Hello everyone! I hope you are all doing well and enjoying life with the blessings of Allah Almighty. I am happy to take part in the exciting challenge hosted by SteemitCryptoAcademy community . So, without any further delay, let's dive right in! Shall we ? ........, Okay , Okay😊! .

1️⃣ Question : Understanding Scalping in Steem/USDT |

|---|

Scalping is a super-fast trading style where traders make many small trades within minutes or even seconds. Little profits guide the trading activities of scalpers because they execute trades quickly based on accurate market analysis.

Day traders analyze broad trends while holding positions for hours but swing traders maintain trades for days to weeks by using large-scale market movements. When traders practice scalping they operate at sprint-level intensity by executing high-speed trades which contrasts with other strategy methods that work at a marathon pace.

Scalpers achieve success by delivering rapid executions and strong risk management together with RSI and MACD technical indicators. Short-time trading with daily accumulated earnings equals the transformation of many small pieces of money into large amounts. This method follows the “pennies make dollars” philosophy.

The market condition of Steem/USDT shows regular price changes which makes scalping an effective strategy. Much like free markets that operate through efficient competition (as the Constitution supports fair trade policy), scalping discovers its chances from market fluctuations.

Discipline serves as the deciding factor between success and failure in the world of trading because it can both propel you forward and set you backwards.

Discuss why Steem/USDT is a suitable (or unsuitable) pair for scalping.

I don’t think Steem is the best currency for scalping. Well, why do I say this?

The initial significant problem resides in low liquidity. Scalping depends on quick trade execution yet insufficient market participation at specific moments makes trading entry and exit a tough task. The profits of scalping are easily diminished by the occurrence of slippage when traders fail to achieve their expected price goals.

Snapshot Snapshot |

|---|

Another concern is limited volatility. The Steem/USDT trading pair produces limited market movements that make it hard to perform scalping although sharp volatility is necessary for this strategy. A lack of sufficient price fluctuations makes it difficult for market scalpers to discover successful buy and sell opportunities.

Then there’s market depth. Remarkable performance as a scalping platform demands wide order books that preserve tight spreads between asking and bidding prices. The Steem market operates at a level similar to an empty suburban street because transaction processes occur either slowly or to prices different from expectations.

Lastly, there are technical factors. High-frequency trading tools and institutional-level execution speeds are essential instruments for most scalpers who operate in the market. The infrastructure along with exchange support within Steem occasionally proves incompatible with ultra-fast trading practices.

So, while I love Steem for many reasons you know but when it comes to scalping, it just does not feel like “the right battleground.” It’s like bringing a bicycle to a Formula 1 race—it just doesn’t fit

2️⃣ Question : Best Indicators for Scalping Steem/USDT |

|---|

It takes swift decisions together with exact market timing technique to practice scalping. Profits from small price movements rely on technical indicators RSI, MACD, Bollinger Bands and Moving Averages when traders execute their trades.

In the following section i will demonstrate how RSI and MACD and Bollinger Bands and Moving Averages can assist in Scalping Steem/USDT activities.

1) Relative Strength Index (RSI) – Spotting Overbought & Oversold Conditions

Using RSI data allows scalpers to determine both overbought phases (above 70) and oversold phases (below 30) for Steem. The RSI generates valuable signs of market trend shifts which hip traders need for efficient scalp trading.

Example : A scalper might acquire Steem/USDT when its 1-minute RSI falls to 25 since it suggests a brief recovery period. Scalpers should place sell orders at RSI level 75 to benefit from quick market profits but before the upcoming price decrease.

(RSI) – Spotting Overbought & Oversold Conditions (RSI) – Spotting Overbought & Oversold Conditions |

|---|

2. Moving Average Convergence Divergence (MACD) – Identifying Momentum Shifts

Using RSI data allows scalpers to determine both overbought phases (above 70) and oversold phases (below 30) for Steem. The RSI generates valuable signs of market trend shifts which hip traders need for efficient scalp trading.

Example : A scalper might acquire Steem/USDT when its 1-minute RSI falls to 25 since it suggests a brief recovery period. Scalpers should place sell orders at RSI level 75 to benefit from quick market profits but before the upcoming price decrease.

(MACD) – Identifying Momentum Shifts (MACD) – Identifying Momentum Shifts |

|---|

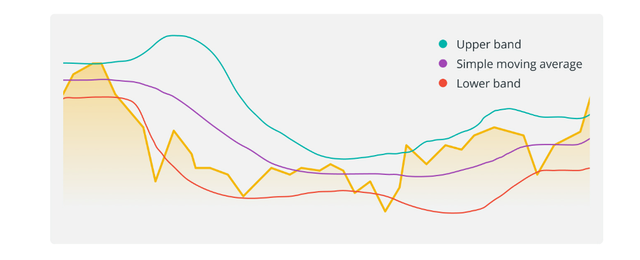

3. Bollinger Bands – Measuring Volatility and Price Breakouts

The volatility bands in Bollinger Bands consist of a center moving average which serves with upper and lower bands to represent market fluctuations. Price movements that reach the lower band indicate market overselling whereas upper band contact signals market overbuying conditions.

Example : A Steem scalpers could buy their position when price rises off the lower band and should exit near the middle or upper band area to get a quick profit. Trades outside of Bollinger Bands indicate robust market momentum which is suitable for fast price movements in trading.

Bollinger Bands – Measuring Volatility and Price Breakouts Bollinger Bands – Measuring Volatility and Price Breakouts |

|---|

ScreenShot ScreenShot |

|---|

4. Moving Averages (MA) – Identifying Short-Term Trends

Short-term Exponential Moving Averages (EMAs) like the 9 EMA and 21 EMA help scalpers track quick price trends.

Example: If Steem/USDT’s 9 EMA crosses above the 21 EMA on a 1-minute chart, it’s a bullish sign—perfect for a short scalp trade. A downward crossover suggests a sell signal.

Moving Averages (MA) – Identifying Short-Term Trends Moving Averages (MA) – Identifying Short-Term Trends |

|---|

Final POV

With these indicators in combination Steem scalpers can identify great opportunities, minimize risk, and traders can faster trade.For example, a trade which is trading on the circumstance that RSI is below 30, price tests the lower Bollinger Band and MACD is giving a bullish crossover would be a great scalp entry. Scalping success is all about precision, patience and speed!

3️⃣ Question : Developing a Scalping Strategy |

|---|

A good Steem/USDT scalping plan must include a specific formula to determine entry and exit points, position size and stop-loss placement so as to have a low risk and a maximum profit.

RSI entry and exit zones RSI entry and exit zones |

|---|

Scalpers rely on Technical Indicators and Small Time frames (e.g. the **1 min or 15 min chart) take advantage of the small price swings and movements.

To set up aonus scalping position, trers must first herald a profitable market siuation with RSI, Bollinger Bands and Moving Averages. An upcoming long entry happens when the RSI drops below 30, that means an over sold criteria is met or overlapped with the price at the Lower Bollinger Band. The 9-period EMA crossover of 21-period EMA is a more confirmation that the buy signal. The best entry price is at the first bull close above LB.

The position size is derived by defining risk per trade. If the trader have a $1,000 bankroll and risk 1% per trade, the maximum loss cannot exceed $10. In case of a 0.5% stop-loss set points below entry, the trade volume is defined as: (Trading per transaction) ÷ (Distance of stop-loss) = Trading volume. If Steem is trading at $0.20, a 0.5% stop-loss equates to $0.001 per Steem. Trades size is then 10,000 Steem.

For exit points, traders take at least 1:2 risk-to-reward ratio. If the **stop-loss is set to 0.5% the take-profit is placed 1% above entry price. This also means that if a trader buys in for $0.20, the target mix sell price is $0.202. By trading multiple trades effectively often orientated to such point of view these scalpers can make several small profit that will add up taking some time to accumulate and guaranteeing great returns consistently.

Illustrate how traders can efficiently execute multiple trades.

Efficient execution of multiple trades in Steem/USDT scalping requires precise timing, quick execution, & automated risk management. Traders often use one-minute or five - minute charts for rapid decision-making.

Let suppose is that some trader with $2,000 has a 0.5% per trade risk indicated by, Risk per trade = $2,000 × 0.005 = $10 that. If entering at $0.2100 with stop-loss at $0.2085 (15 pips), the position size looked like:

Position Size = Risk Per Trade ÷ SL Distance

= $10 ÷ 0.0015 = 6,667 Steem units.

The profit is:

Profit = 6,667 × 0.0010 = $6.67.

By doing this process 5 times per session, total winnings would be $33.35. Traders employ limit orders for entry, stop-loss orders for the protection from loss, and trailing stops to maximize profit. Automation with trading robots or hotkeys makes it quicker for execution so traders can catch more little profits.

Daily time frame Daily time frame |

|---|

On the daily chart, STEEM is priced at $0.1327, is above the 9-EMA ($0.1324), a slip bullish. But the Bollinger Bands (BB) indicate that the price is in vicinity of area for the bottom band going from $(0.118.0-0.1611), also meaning volatility is low and price would like to stay there is consolidating phase.

The RSI (14) at 37.89 shows that the instrument is approaching over-sold level meaning potential up correction should sellers pressure decrease.

15min Time frame 15min Time frame |

|---|

The 15 minute chart steem/usdt is showing a price level of $0.1328, the 9 period ema $0.1323, a near minor up trend. Bollinger Bands (BB 20,2) : A range of $0.1313 (middle band) to $0.1388 (upper band) is showing the price trading near lower band, meaning accumulation going on. The RSI (14) at 43.10 is neutral in its momentum and not overly overbought or oversold.

Volume analysis gets an unemployment reading of a 9-period SMA of 7.953K providing an indicator that there's a weak buying interests. Scalps should look for $0.1310 (support) to hold steady and potential run up to $0.1340 (resistance) with sustained volumes.

A move above $0.1340 while RSI turning above 50 would suggest short term uptrend. Alternatively, a slide below $0.1307 could be sustained by sellers. Since the volatility is low, a scalping strategy should be focused on trade in a limited price range and speed.

4️⃣ Question : Risk Management in Scalping |

|---|

Risks Associated with Scalping

Scalping fast trading strategy performs with accuracy and discipline, Managed well also the Investment. Though it claims a high return on investment, it also holds an equal amount of risks that professional traders are value knowing. Below are some major risks involved in steem/usdt scalping:

1. High Transaction Costs

Scalping involves making multiple trades over a short period of time thereby resulting in additional opportunity expenses. The exchanges, alas, charge maker/taker fees, which can rapidly add up and lessen overall profitability. Using a simple example, if a trader settles and leaves 50 trades per day, with a 0.1% fee per trade their accumulated fees would be:

50×2×0.1%=10% of total capital traded

Therefore profits have to be over this to remain profitable.

2. Market Volatility and Slippage

Scalping dominates during volatile conditions, but again, unclear price changes might result in slippage—where the implemented price departs from the predicted price. If a trader sets a buy order at $0.1325, and they are low on market liquidity, it fills at $0.1330, then they have already lost $0.0005 per token, hurtting potential gain.

3. Liquidity Issues

For scalping to work, you have to need high liquidity to enter the markets to get into your position as well as this position the exits of it quickly. However STEEM/USDT is often illiquid, offering substantial challenges when getting large position into the market without a massive price movement. This in turn raises the risk of order.delay or Unfavorable fill, especially during the downtimes.

4. Emotional and Psychological Pressure

Scalping needet immediate reaction under pressure. The requirement to observe charts continuously and be prepared to make split-second trades can indeed result to stress, emotional and fatigue decision-making causing revenge trading or overtrading, both of which can be destructive.

How Traders Can Minimize Losses, Leverage Control, Prevent Liquidation Threats While Scalping STEEM/USDT

Scalping STEEM/USDT is the application of high accuracy and a tight control over risk management. Because **scalping is a matter of high frequency trading, the participants need to have a very robust approach to capital protection, to effective leverage management, and to avoiding pairs running into liquidation. Below are top ways to manage risks.

1. Stopping for every Trade Setting Stop-Loss

A stop loss protects against a losing trade and closes it before significant losses take place. Given that scalping profits are tiny, a fairly tight stop-loss should be placed @ 0.2% to 0.5% below the entry while eliminating some of the wrong potential early losses. Take the instance, suppose if the trader enters at $0.1325, setting a stop-loss at $0.1318 (- 0.5%) prevents against sudden falls.

2. Using Proper Position Sizing

Overleveraging leads to rapid losses. Traders should **trade wit only 1-2% of their account per trade. If a trader have $1,000, they can risk $10 to $20 per trade her formula be :

RiskPerTrade=AccountBalance×RiskPercentage

=1000×0.02=20

This way, even a series of losing trades will not capitalize on drawdowns in the account.

3. Managing Leverage Effectively

Leverage does not only magnify profits but also losses. lutiliser un leverage faible (p.ex. 3x à 5x) garantit une plus grande préservation du capital. For example, at 5x leverage, a 2% price drop results in a 10% loss. The price of STEEM is very unstable, so excessive leverage can quickly close out positions.

4. Avoiding Overtrading and Emotional Bias

Scalping can develop an addictive behavior, this is called revenge trading after losses. Traders should establish a daily loss limit (e.g., 5%) and exited the market once it’s achieved. Needless risks can be averted by doing planned trades according to signal rules rather than the emotions.

5. Using Limit Orders over Market Orders

Market Order Trade is executed at the price of the best available, but slippage which increases a loss. Limit orders enable traders to buy/sell at a desired price to minimize on execution risk. In instance, if a trader want to buy at $0.1320, it use a limit tutorial to ensure the sale is hold at this indicate absolutely no corroborate price bolster.

6. Trading Only During Market Hours of High Liquidity

STEEM/USDT liquidity vary, scalping in low-volume situation enlarge the risk of slippage . Trading during trading peak hours when the **order book is richer in liquidity allows trades to execute more smoothly.

5️⃣ Question : Real-World Scalping Case Study |

|---|

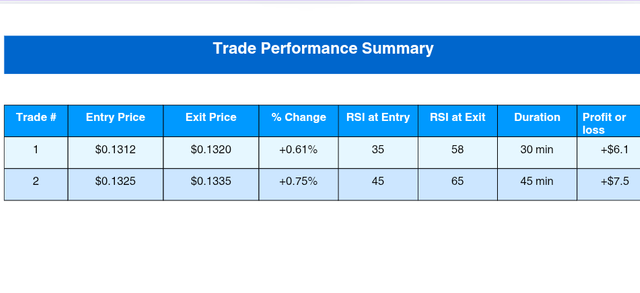

A scalp trader decided to trade STEEM/USDT with a 15-minute time frame, using an informational RS, BB, EMA(9) for proper entries and exits. The market was showing range-bound movement with price oscillating between $0.1305 and $0.1335.

At 12:00 PM, the price was also entering into the lower Bollinger Band at $0.1310 while RSI bottomed at 35 for oversold condition. The trader got into a long position at $0.1312, anticipating a mean reversion. Support for a stop loss was taken at a level of $0.1305 (-0.53%) to defend in case of breakdown.

By 30 minutes the price bounced back to the middle Bollinger Band $0.1322 coincided with EMA (9) as resistance. RSI reached 58, signaling potential exhaustion. The trader shut down the deal at $0.1320, achieving 0.61% profit at a single deal.

However Velocity of the market changed when volume picked of at 2:00 PM caused STEEM to pierce resistance, $0.1335. The trader adjusted by **trend following strategy and trading on pullbacks instead to mean-reverting trades.

|

|---|

Key Takeaways

- Run conditions ready to go– Bollinger Bands and RSI were in agreement-bulls are low risk if correct.

- Scalping must be adaptable – The trader shifted from range-bound scalping to trend-following when the trend commenced.

- Risk management was used for capital control. – A three key stop loss strategy stopped over-loss and yet small winning was walked in.

Through the analysis of the price Action and adjustment of the tactics the trader improved performance, ensuring permanent profits and minimizing the subsidence of risks, in STEEM/USDT scalping.

kind Regards

@artist1111

Adieu, folks!

May the winds of fortune

carry you to greatness!

May the winds of fortune

carry you to greatness!