SBD and Stablecoins: Challenges, Opportunities, and the Future

Hello everyone! I hope you are all doing well and enjoying life with the blessings of Allah Almighty. I am happy to take part in the exciting challenge hosted by SteemitCryptoAcademy community . So, without any further delay, let's dive right in! Shall we ? ........, Okay , Okay😊! .

A few weeks ago, I was chatting with my cousin about Steemit. The topic? Well, it was about the Steem price going down. I agreed and jokingly said, “At least Steemit should give us more SBD!” We laughed it off, of course.

But jokes aside, we all understand the market conditions and their ups and downs.

My point is, SBD isn’t always a less-tending topic . It’s essential, and who knows? It could trend big again someday! Stay positive, folks!

Question 1: Understanding the Role of SBD as a Stablecoin |

|---|

As we know, SBD (Steem Backed Dollar) plays a peculiar role within the Steem ecosystem. Unlike most other stablecoins, pegged strictly to fiat currencies, it aims at stability under very deep integration to the Steemit platform.

I find it pretty cool about its functions right in the center of rewarding content creators and giving a fairly fixed value for transactions. Imagine receiving a salary in a currency which doesn't get you worrying every moment about some sudden value crashes. That's SBD for you—mostly.

No, not really. At times the adjustor to 1$ is more likely a guideline than a value. Still, a pretty fair effort on the part of the crypto world, where volatility is as normal as memes. Sure, SBD secures the earnings slightly for the users, even if the market tries their patience sometimes.

I guess it is attractive, as it is entirely accessible: one need not be a finance specialist to understand its role within the ecosystem. SBD might, however benefit from further innovation to increase utility and assure greater stability as the recent exchange restrictions have shown.

Indeed, no one wants to feel like a silent partner in what they think will be a reasonably predictable asset while enjoying the feeling of receiving a reward!

SBD SBD |

|---|

SBD or Steem Backed Dollar has a different profile than many popular cryptocurrencies. It is usually not the attention leader like USDT (Tether) or DAI. It is already amazing—definitely in the Steem ecosystem. Its pros and cons are discussed here in an interesting way.

First, let's talk about the benefits. One thing I really admire about SBD is that it is closely linked to the Steemit platform. Unlike USDT or DAI, SBD feels like a very feminine currency for Steemians. You create the content. Get involved with the community and grow—you're rewarded with SBD. It's a digital slap on the page with real-world capabilities. In fact, it's designed to support nearly $1, making it a reasonably solid model to hold. Rewards without fear of the market falling all the time...

Now let's not forget how SBD makes things easier. With USDT or DAI, you generally need to work with an external wallet. exchange or additional products to take full advantage of, but SBD is well integrated into the Steem ecosystem, so it's easy to use for transactions, tips, or just to hold on. No additional hassle. No confusing terms—just simplicity.

But yes, every coin has its flip side, unlike USDT or DAI, you have to accept the limitations of SBD. One big negative is its liquidity. Compared to USDT and DAI, which are generally accepted globally in the world of cryptocurrencies, SBD operates in a much more limited sphere of influence. To be honest, trying to explain SBD to a non-Steemite might come across as overbearing. That's confusing. On the other hand, USDT and DAI are like the common language of the crypto world, understood by everyone.

Another challenge to consider is price stability. USDT aims to be backed by fiat currencies on a one-to-one basis, while DAI uses collateralized smart contracts to support the peg. In contrast, SBD relies on an algorithmic framework. which sometimes finds it difficult to maintain a consistent peg at $1. If you have been following SBD's drastic price changes, you know what I'm talking about.

Then there's the matter of real-world applications. USDT and DAI have shown themselves to be extremely useful outside of cryptocurrency exchanges. It can be used for trading, payments, and even savings. SBD appears to be a bit more of a Steem-focused currency.

Finally, I believe SBD has a lot of potential for those investing heavily in Steemit. However, in order to compete with heavyweights like USDT or DAI, SBD needs to improve its stability, liquidity, and real-world adoption. That said, SBD remains a valuable but relatively niche player in the stablecoin space.

Question 2: Addressing SBD’s Stability Challenges |

|---|

It can be clearly noted that SBD or Steem Backed Dollar has faced severe issues in maintaining stability, especially compared to other stablecoins like USDT and DAI. The halting of SBD deposits on Upbit highlighted some of these problems, particularly in relation to its use, utility, transaction status, and usage. These weaknesses raised issues over its viability and usage within the Steemit platform and its ability to sustain stability within a volatile market.

Upbit Announcement regarding sbd depositing suspending Upbit Announcement regarding sbd depositing suspending |

|---|

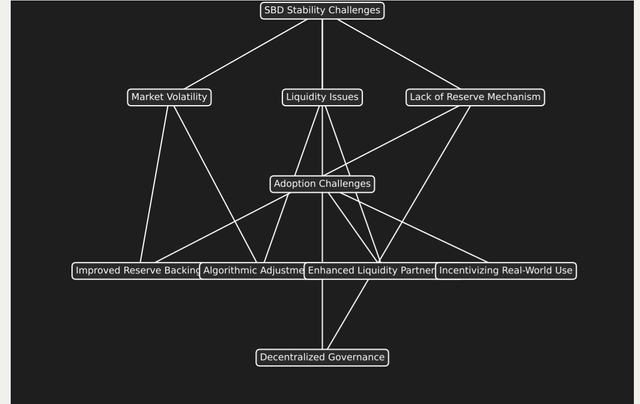

Challenges:

Market Volatility: While SBD is supposed to hold a price of $1, it fluctuates most of the time, primarily because of general volatility in the cryptocurrency market. This unpredictability creates uncertainty for users who rely on it for transactions or as a form of value storage.

Liquidity Problem: SBD has a relatively restricted liquidity when compared to the top stablecoins like USDT. It is mainly used in the Steemit network, and its usage outside this particular platform is relatively limited. This is a problem since it cannot easily maintain a stable market price.

Weak Reserve Mechanism: While USDT and DAI have a well-established reserve mechanism to back their value, SBD relies on algorithmic stabilization. The system can be less reliable in times of market stress, which can lead to price instability.

Adoption Challenges: According to Upbit, one of the significant challenges is the adoption of SBD beyond the Steemit ecosystem. Many exchanges or services outside the Steemit ecosystem do not have support or implement SBD, which would reduce its utility in the wider cryptocurrency economy.

Proposed Solutions to Strengthen SBD's Peg:

Stronger Reserve Backing: For higher stability, SBD could be enhanced through a more robust reserve backing in the same manner as USDT fiat reserves or DAI collateralized assets. This would put into reserve diversified assets through both traditional assets and digital currencies so that during times of market fluctuation, there would be greater reliability.

Algorithmic Reforms: The algorithmic stabilization of SBD could be made more responsive to market changes in order to keep the peg closer to $1 even when volatility is extreme. Increased transparency and predictability of this system would probably build user confidence as well.

Partnership With More Exchanges to Enhance Liquidity: The Steemit platform may increase liquidity by making partnerships with more exchanges or other platforms already proposed by kouba01 My Personal Reflection on the Delisting of SBD by Upbit . In this way, SBD will gain adoption beyond the Steemit community. The more exchanges supporting SBD, the better access it will have to a global user base, making its market stability better.

Promoting Real World Usage: While it serves as a reward token on the Steemit network, SBD would benefit from more real-world usage. For example, incentivizing businesses or service companies to accept SBD as a mode of payment would add more value in real-world terms. Expanded functionality beyond Steemit may help solidify its position in the stablecoin space.

Decentralized Governance: Adoption of the decentralized governance framework may alleviate certain concerns about its long-term stability. By allowing the community to propose and vote on updates to the system, Steemit users would have more control over the development of SBD, thus ensuring that it keeps pace with changes in market demand and user's demands.

SBD Stabality challenges SBD Stabality challenges |

|---|

Given the issues stated by Upbit, it's clear that some form of innovation is necessary regarding the SBD operational mechanics. Addressing the issues faced with liquidity, market volatility, and user adoption by incorporating some of the solutions described above could give SBD more strength in the peg and further position it as a reliable stablecoin in the cryptocurrency space.

Question 3: Expanding SBD’s Utility |

|---|

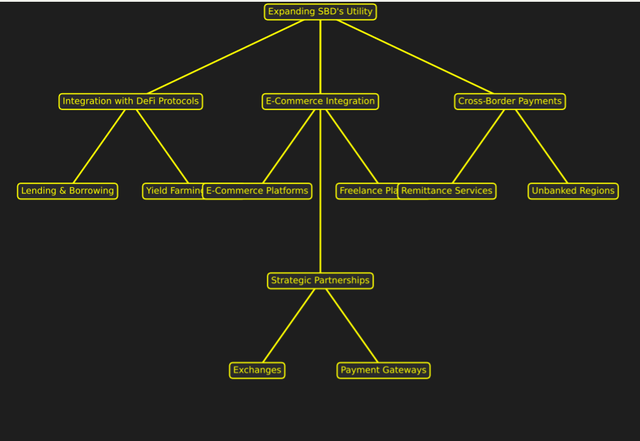

In order for SBD (Steem Backed Dollar) to truly unleash its potential, it must transcend the boundaries of the Steemit platform. The following are novel ways in which it can expand its utility and adoption in DeFi, e-commerce, and cross-border payments.

Expanding Sbd's utility flow chart Expanding Sbd's utility flow chart |

|---|

1. Integration with DeFi Protocols

The best way that SBD can be used to expand its utility is through integration into Decentralized Finance (DeFi) protocols, which are among the fastest-growing subsectors. In this regard, SBD can find its way into lending, borrowing, and yield farming. This means that SBD could potentially be used as collateral on some lending platforms like Aave or Compound, allowing the user to borrow some other assets or earn interest in SBD through staking it in liquidity pools. Moreover, SBD will be integrated into decentralized exchanges—DEXs—that will trade and lend liquidity to its value. By doing so, it would also increase demand for the token, thus becoming a very important component of the DeFi ecosystem.

2. E-Commerce Integration

Another strategic move will be integrating SBD into the top e-commerce platforms. Then, by partnering with popular marketplaces like Shopify, Magento, or WooCommerce, SBD could be implemented as a payment option for buying goods and services. This will make it possible for users to spend their SBD rewards just like ordinary currencies, hence increasing real-world applications. Fiverr, Upwork, and alike freelance platforms can also offer SBD as an option to pay for services; hence, freelancers may be paid not only by traditional means but in stable cryptocurrency as well.

3. Cross-Border Payments

SBD may become a strong instrument for cross-border payments. By establishing partnerships with remittances services or blockchain-based payment providers, SBD could be used for low-cost, fast, and efficient international money transfers. More specifically, regions with restricted access to traditional banking services will greatly benefit from this. Stability makes SBD the most reliable option to send money across borders while avoiding high fees and slow transaction times related to traditional services.

4. Strategic Partnerships

Finally, SBD can derive further utility by forging partnerships with cryptocurrency exchanges and payment processors. The listing of SBD on more exchanges and integration with popular online payment gateways like CoinGate and BitPay will increase its liquidity and visibility. Such strategic moves will help SBD become one of the trusted and widely used stablecoins in the larger ecosystem of cryptos.

By exploring these avenues, SBD will transform into a widely held digital asset, benefiting individuals and businesses around the globe.

Question 4: Adapting to Exchange Suspension of deposits. |

|---|

The Future of SBD: Adapting to a Changing Crypto Landscape.

With the increasing competition against SBD (Steem Backed Dollar) by more established stablecoins like USDT and DAI, the Steemit community has to redefine its meaning in the greater cryptocurrency ecosystem. To remain relevant and continue growing, SBD must move beyond its traditional use case within the Steemit platform.

Expanding Beyond Steemit

Currently, SBD is mostly used for rewards and transactions on Steemit. In order to remain competitive, it needs to be integrated into DeFi (Decentralized Finance) protocols, e-commerce, and cross-border payments. The more it can be integrated, like becoming a payment option on e-commerce platforms such as Shopify or integrating into DeFi lending platforms, the more utility SBD would gain and the greater the potential user base. Those integrations would mean SBD is not just an asset on Steemit but has a broader appeal across industries.

Enhancing Stability

Maintaining the peg to $1, especially during market fluctuations, is a fundamental challenge for SBD. Unlike USDT or DAI, which are fiat-backed or collateralized respectively, SBD's algorithmic approach puts it at risk from price volatility. In improving the latter, SBD would also need to think of collateralized reserves or even hybrid models combining the best of both: algorithmic control with asset backing, like the MakerDAO system used by DAI. This helps hold the value during downturns, giving users greater confidence in their holdings.

Community and Adoption

The Steemit community is core to SBD's future. In order for the community to grow, it needs to spread its wings and appeal to new crypto users. Introducing incentives for DeFi participation, luring in content creators from other platforms, and integrating with crypto payment processors can help bring in a larger audience. As the community adopts SBD for real-world use, its adoption will grow.

Conclusion

In order for SBD to succeed in this changing crypto space, the Steemit community has to concentrate its efforts on expanding utility, improving stability, and building partnerships. Only by adapting to the needs of the greater crypto world can SBD remain relevant and secure a place in the future of stablecoins.

Question 5: Future Prospects for SBD |

|---|

As the cryptocurrency landscape continues to evolve, SBD (Steem Backed Dollar) is under increasing pressure from other established stablecoins from the prominent one's USDT and DAI. However, SBD is in a unique position in its own place, inextricably linked with the Steemit ecosystem. In order for it to be relevant and to grow, the Steem community has to evolve, innovate, and explore new opportunities beyond the platform. Here is a look at the strategies to strengthen SBD's position in the crypto world.

Embracing the DeFi Revolution

Integration with the DeFi ecosystem would allow SBD to stay relevant in a rapidly changing space. The DeFi protocols are changing the face of finance, & by being incorporated into these platforms, whether it be for lending, borrowing, or staking, SBD will gain more utility & exposure then ever did they. By allowing people to stake SBD or use it as collateral on Compound, for instance, SBD is exposed to an even wider audience. This helps position SBD as more than just a token for Steemit but makes it a staple in the larger DeFi movement.

Beyond Steemit: Real-World Use Cases

Even though Steemit has been the home for SBD we know well, however taking its usage beyond Steemit is very important. Accepting SBD as a payment method on e-commerce sites or freelance platforms like Fiverr or Upwork would bring it real-world use cases, increasing its value however its seems to impossible . Online marketplaces and service providers will help establish SBD as a viable alternative to traditional payment methods by increasing its adoption & utility through partnerships.

Moreover, by expanding in the area of cross-border payments, SBD would allow users to send money anywhere around the world with low fees and fast transactions, thereby further solidifying its global appeal.

Strengthening Stability and Reserve Mechanisms

The major test for SBD is its peg to $1, time and again discussed not only by me but few other participants of ** week 4**, and particularly during periods of market volatility. Unlike such stablecoins as USDT and DAI, which have very strong backing mechanisms, the algorithmic approach used by SBD can sometimes give way to its instability. Here, the Steemit community can introduce stronger reserve backing, similar to fiat-backed or collateral-backed stablecoins, therefore helping to keep the value of SBD and making it more reliable under market volatility.

Implementing a decentralized governance model would highly empower the community landscape to propose and vote on changes to the SBD mechanism, ensuring its continued adaptability to market conditions and the needs of its users.

Fostering Community Engagement

Success will come to SBD only and only when through its tightly linked community—Steemit. Maintaining a proper engagement of the community is imperative to long-term success. Providing incentives through incentive programs and rewards will encourage users to hold, use, & stake SBD, which will help build demand and liquidity. The more people that use SBD, the more valuable it will become.

A very crucial way to spread its appeal beyond Steemit is education. Do you know why ? The creation of awareness campaigns is important in focusing on the features of SBD, including its stability, rewarding system, & potential in leading sectors, as this can allow the community to attract new users to it and thus extend trust. This crypto world could no doubt adopt SBD's unique features and real-world applications if educated well on these subjects.

Strategic Partnerships for Broader Adoption

Last but not least, a strategic partnerships are the main key to SBD's growth. By partnering with payment processors various exchanges, and blockchain platforms, it can increase the exposure of SBD to a wider community of Steemit. For instance, integration with crypto payment gateways like CoinGate or BitPay etc would allow SBD to become an accepted means of payment for merchants. Listing SBD on major exchanges like already mentioned by me and also Kouba01 about a week ago, creating trading pairs would give it more liquidity and attract investors of all kinds.

Conclusion: A Bright Future for SBD

Ai i said future of SBD highly depends on its ability to evolve and expand beyond Steemit. Tapping into DeFi protocols, building real-world utility, increasing stability, and also fostering community engagement, SBD could carve out a strong position in the competitive stablecoin market. With the right strategies and innovations way, the Steemit community has the potential to make SBD a globally recognized and reliable stablecoin for the future.

kind Regards

@artist1111

Adieu, folks!

May the winds of fortune

carry you to greatness!

May the winds of fortune

carry you to greatness!