Steem/USDT Scalping – Mastering Short-Term Trading Strategies

AssalamuAlaikum & Greetings Everyone!

AssalamuAlaikum & Greetings Everyone!

It's me @amjadsharif

From #pakistan

From #pakistan

Steemains and traders hope all of you will be fine. The scalping is the path that can make a profit within minutes. With proper risk management trader can earn profit very shortly. Let's now go to our homework.

<center]

| Q.1 - Understand scalping in Steem/USDT |

|---|

Scalping is a short -term trading strategy in which traders do numerous trades within a few seconds or minutes to take advantage of small changes in the price. The main purpose of this strategy is to make less profit in each trade but to earn overall earning through more trades. Scalping usually succeeds in more liquidity and low spread markets, where orders can be completed immediately.

Features of scalping

Short -term trades: A trade lasts for a few seconds or minutes.

More trading frequency: dozens or hundreds of trades are done throughout the day.

Low spread: Low spread pair is chosen to make profit.

More liquidity: More liquidity markets are suitable for scalping.

Depending on technical analysis: Indicators such as chart patterns, RSI, MACD and moving average are used in scalping.

Compare scalping and other strategies

Scalping vs Day Trading

Duration: Trade in scalping lasts for a few seconds or minutes, while day trading can last for several hours.

Risk and Profit: Scalping is low but frequent profit, while day trading targets more profit by making low trades.

SCALPING vs Swing Trading

Trade duration: Scalping is traded for a very short time, while a position in swing trading is placed for several days or weeks.

Benefits of fluctuations: Scalping takes advantage of small fluctuations, while swing trading is focused on major trends.

SCALPING Ability to Steem/USDT

Correct Factors

More liquidity: Scalping can be effective if Steem/USDT has more liquidity.

Low spread: Low spread improves profits in scalping.

Volatility: More volatility can increase scalping opportunities.

Challenges and Dangers

Low liquidity: In case of low liquidity, orders may be delayed, which is harmful to scalping.

More spread: Scalping becomes less effective if the spread is high.

Exchange fee: Repeated trade causes more fees, which can reduce profit.

Scalping strategy

Price Action and Support/Resistance Trading - Trading at Short Test Support and Resistance Levels.

Moving Average Strategy - Short Term Moving Average Cross Over Use.

RSI and MACD indicators - searching and selling signals.

| Q.2 - Best Technical Indicators for Scalping - Steem/USDT |

|---|

Scalping is a high -speed trading strategy that earns small profits within a short time. Various technical indicators can be used for Steem/USDT scalloping, including RSI, MACD, Bowling Bands, and Moving Average. These indicators help traders estimate the short -term pricing direction, Momentum, and potential entry or exit points.

RSI

RSI is a Momentum Indicator that shows the market overbought and over -sales situation. It has a range of 0 to 100, and is generally considered over 70 over and below 30.

RSI Over-bought, Over-sold Indication

RSI Over-bought, Over-sold Indication Used in scalping

If RSI is close to 30, it shows that the market is over -sale and the price can go up, which may be a purchase opportunity.

If RSI is close to 70, it shows that the price has been purchased and can go down, which can mean sale.

In Steem/USDT, if RSI comes down to 30 on the chart of 5 or15 minutes and starts to go up again, immediately scalping can be made.

MACD (Moving Average Convergence Divergance) - Trend and Momentum Indications

The MACD displays the difference between two moving average and provides purchase and sale signals based on their relationship with the signal line.

Macd cross-over signal Indication

Macd cross-over signal Indication Used in scalping

When the MACD line cuts the signal from the bottom, it gives the purchase signal.

When the MACD line cuts the signal from the top, it gives the sales signal.

On a 5 or 15 -minute chart, if MACD gives a sharp signal, a small trade can be taken by taking instant trade.

Bollinger Bands

Bollinger bands consist of three lines.

Upper band (higher price range).

Middle band (20-Perod Moong Average).

The lower band (low -cost limit).

Indicate the price touches uper band for selling and lower band for buying

Indicate the price touches uper band for selling and lower band for buying Used in scalping

When the price is near the lower band and starts going up, it may be an opportunity to buy.

When the price touches the upper band and starts coming down, it may be a chance to sell.

In Steem/USDT's scalloping, a short term can be purchased if the price begins to return from the bottom of the Bollinger band.

Moving Averages - indicating the direction of the trend

Moving Average is used to display the general trend of the market. Usually 9-EMA (Exponential Moving Average) and 21-EMA are suitable for scalloping.

generated signal when crossover established

generated signal when crossover established Used in scalping

If 9-EMA crosses the 21-MA from the bottom, this is a sign of buying.

If 9-EMA crosses the 21-MA from above, this is a sign of sales.

Instant scalloping is possible based on these signals on a 5 or 15 -minute chart.

| Q.3 - Developing a Scalping Strategy for Steem/USDT |

|---|

Scalping is a short -term trading strategy in which traders open and close positions rapidly to make small but continuous profits. In this article, I will present a detailed strategy for steem/USDT's scalping, which will include entry and exit points, position sizing, and stop loss set.

Trading framework and analysis of market situation

|  |

|---|

- Time Frame Choosing

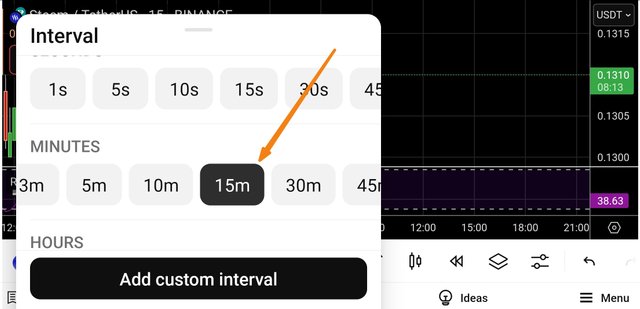

Time Frame

Time Frame Since scalping has to make immediate decisions, there are 1 minute (M1), 5 minutes (M5) or 15 minutes (M15) charts suitable.

- Market conditions

Choose the high Volatility time, such as the beginning of the European or American session.

Review the 24 -hour liquidity and volume of the steem to find out if the price is good or not.

Identification of entry point

|  |

|---|

Main trading indicators

We will use the following indicators to determine the best entry points:

- EMA (Exponential Moving Average)

Use 9 EMA and 21 EMA.

When 9 EMA, 21 EMA crosses from bottom to bottom, the purchase will be indicated.

When 9 EMA, 21 EMA crosses from top to bottom, will be a sign of short entry.

- MACD (Moving Average Convergence Divergance)

If the MACD line crosses the signal line from the bottom, the purchase will indicate.

If the MACD line crosses the line from top to bottom, there will be an indication of selling.

- RSI (Relative Strength Index)

RSI If you are close to 30 and start up, buying is a signal.

RSI If it is close to 70 and starts down, there is an indication of selling.

Looking of Exit Points and Profit

Since the purpose of scalping is to make small profits, adopt the following ways:

|  |

|---|

- Take Profit (TP):

Keep the target above 0.5% to 1% after buying.

Keep the target down from 0.5% to 1% after selling.

- Trailing Stop:

As soon as the price goes to profit, adjust the stop las up/down to save the profit.

Setting of Stop Loss (Stop-Loss)

Set the stop loss from 0.3% to 0.5% loss to prevent major loss.

If the market suddenly goes in the opposite direction, close the position quickly and avoid more damage.

Position Sizing and Risk Management

Put 1-2% of the account in a trade.

If your account is $ 1000, allow a maximum of $ 10 to $ 20 in each trade.

Be careful when using leverage, because excessive leverage means more risk.

Strategy Executed

- Trading plan:

Analyze the market.

Wait for trading signals (EMA, MACD, RSI).

Open the trade and set a stop las and tech proof.

Monitor the trade, and save profits through the trailer stop.

If the market is not favorable, then immediately accept the loss.

Review of the performance of trades

Keep a trading record every day.

Compare the losses and profits and improve the strategy.

This scalping strategy is designed to make several small profits in the short term. With accurate risk management and technical analysis, successful scalping in Steme/USDT is possible. Always trade with discipline and avoid unnecessary risks.

| Q.4 - Risk Management in Scalping: Guide to Steme/USDT Traders |

|---|

Scalping is a high -speed trading strategy that tries to make a profit by making small trades in a short time. Although this method may be profitable, it also includes a significant risk, especially when trading unstable crypto joints such as Steam/USDT. For success, traders must understand these risks and adopt effective risk management techniques.

The dangers connected to the scalping

- A. More Market Volatility

Scalping depends on the price of price, but more volatility can cause sudden losses. If the market moves faster in any direction, traders using more leverage can suffer severe damage.

- B. More Trading Fees

Since scalers do many trades daily, the costs like spreads, commissions, and slippage increase, which can reduce profits.

- C. Emotional Trading and Tired

Scalping has to make immediate decisions, which can lead to stress. If the trader cannot control his emotional quality, he can make wrong decisions in overdrading or panic.

- D The Dangers of Leverage

Many scales use more leverage to make less profit in low capital, but it also increases the risk of liquidation, that is, if the price goes below a certain range, the position can be automatically closed.

- E. The Risk of System Dis-orders

Since scalping is imposed in rapid orders, internet malfunction, exchange closure, or technical issues can cause damage to traders.

Ways to reduce damage in scalping

- A. The use of a stop las (Stop-Loss)

Stop las is an order that automatically closes the position when the price reaches a certain extent, so that there is no harm. Steme/USDT trading is better to keep a tight stop ranging from 0.5% to 1% so that there is no major loss.

- B. The choice of appropriate leverage

It is better to use low leverage (eg 3X or 5X), as even more leverage can be levied on small shocks in the market.

- C. Capital Management

Use only 1% to 2% of the total investment in each trade so that the overall account is protected even in case of continuous loss.

- D. To overcome emotions

Trading can cause fear, greed, and more self -esteem. Follow the trading plan and if the market goes against expectations, do not increase the damage by opening the trade.

- E. Choosing appropriate entry and exit points

Scalers should understand the right entry and exit points by understanding support and resistance levels to avoid unnecessary fluctuations in the market.

- H. Use of fast internet and stable exchange platform

Since scalping has seconds games, choose a sharp Internet and low -fee exchange platform so that orders are complete without delay.

| Q.5 - Real-World Scalping Case Study Steem/ usdt |

|---|

Scalping is a short -term trading strategy in which the trader tries to make small but constant profits in a short time. In this case study, we will analyze the scalping trades made on a trader's stem/USDT couple, where it adjusts its strategy according to market conditions.

Trading setup and preliminary analysis

The trader was trading at a short time intervals (5 minutes and 15 minutes charts) in the steam/USDT market. He focused on the following trading signals:

Trading volume: Suddenly growing volume was used for entry point.

Support and Resistance Levels: Purchase and sales strategy on resistance at nearby support zones.

Moving Average Cross Over: 9-EMA and 21-EMA's cross-overs were used for immediate entry and exit.

Market adjustment during trading

The trader saw a sudden increase in the price of the stem on a 5 -minute chart, indicating a sharp breakout. It immediately purchased at 0.1825 USDT at a low price, and set the initial target 0.1850 USDT. However, as the price rose to 0.1845 USDT, the volume was seen, which showed the breakout weakness.

On this Occasion the Trader Made two Adjustments

Trailing Stop Loss: He moved his stop at Loss Entry Point to avoid losses.

Parial Profession Tiking: 50% position was closed at 0.1845, while the remaining position was left on the brake Avon.

Difficulties and Lessons Learned from Them

Understanding of the Sentiment: Although technical signals were positive, the breakout remained weak. It shows that instead of relying on technical analysis, the overall market situation should be viewed.

Sky decision capacity: Delays in scalping can lead to loss, so immediate and right decisions are important.

Risk management: Immediate adjusting the stop las can protect the trader from major damage.

Conclusion

In this trade, the trader initially purchased at 0.1825 and sold 50% position at 0.1845 and earned about 1.1% profit. The remaining 50% of the position closed at the brake, which did not cause any damage.

This case study makes it clear that a scale should not only master the technical analysis but also have immediate decisions and market adjustments. Successful scalping depends on small but permanent benefits, which can be achieved by discipline and risk management.

Wish best for all friends!

I invite @josepha, @chant and @shabbir86,

Thank you

@tipu curate