Notary public and hash lock mix

Content

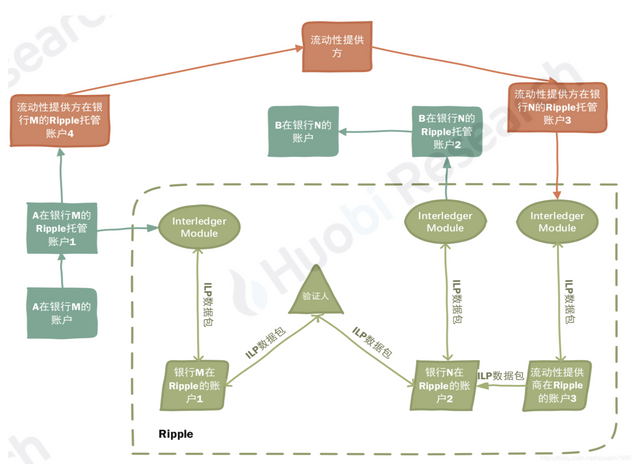

Ripple is a new type of blockchain technology that focuses on solving distributed payment and clearing problems. Ripple defines the Interledger Protocol (ILP, Interledger Transaction Protocol) on the underlying Ripple consensus ledger, which can realize cross-ledger transfer while eliminating counterparty risks in transactions. Technically, it adopts the realization method of notary public and Hash lock.

ILP will establish a two-way anchored relationship between the trader's account and a Ripple local account, realize the synchronous change of the two, and ensure the transparency of the transaction process. At the same time, for the two ledger systems without direct payment channels, multi-hop indirect cross ledger transactions can be realized through ILP.

Insert picture description here

A. First select a liquidity provider with the most suitable exchange rate. Assuming that the exchange rate between RMB and USD is 6:1, then transfer 600 RMB to its escrow account 1 at Bank M, and fill in the remittance information and collection on the Ripple app Address and timeout period, etc.;

This information will be packaged by the Interledger Module and sent to account 1 on Ripple. Ripple account 1 will book the 600 RMB added in escrow account 1 and send the transfer certificate to the validator (Validator, a notary node);

For the payee, company B fills in the remittance address, timeout time and other information on the Ripple application, and broadcasts it on the Ripple network. At this time, the liquidity provider selected by A will advance the transfer to B first, and then use it in Ripple. Transfer 100 USD from account 3 to Ripple account 2, and send the transfer certificate to the verifier (Vadilator);

The validator checks the two transfer certificates; after the verification is passed, the IPL ledger will be liquidated at the same time in accordance with the Hashed Time Lock Agreement atomic transaction agreement;

After the liquidation is completed, Ripple's ledger will synchronize the account changes to its corresponding escrow account through the Interledger Module, and then 600 RMB in escrow account 1 will be remitted to the liquidity provider, and 100 US dollars in escrow account 2 will be remitted to the recipient Account, so as to realize the cross-book transaction between the beneficiary and the remitter.