What if the U.S. SEC approves the rule change of staking for 2 Grayscale's spot ETH ETFs? 🤔

As I wrote below 3 days ago,

The NYSE(New York Stock Exchange) filed a rule change for changing staking 2 Grayscale's spot ETH ETFs on behalf of Grayscale.

Unfortunately, the decision has been postponed until June 1. But, the deadline is this October.

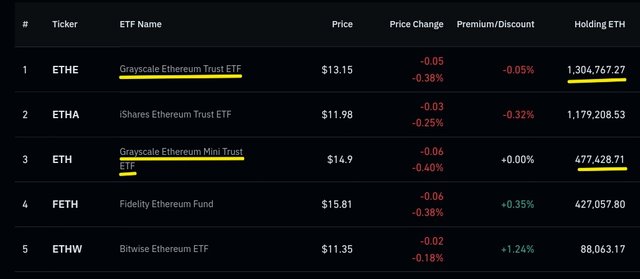

Grayscale is holding 1.78m ETH(Ethereum).

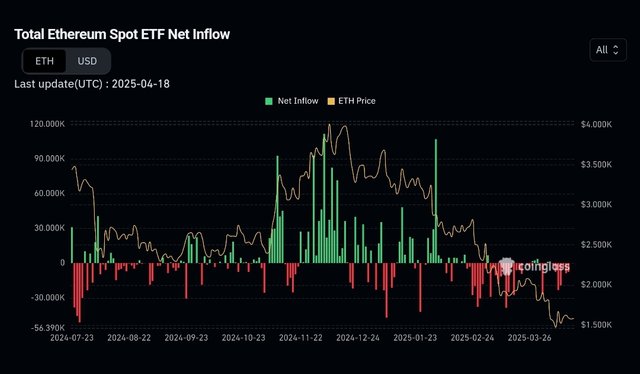

Net inflows have been poor since this February. If the U.S. SEC approves it, net inflows will be improved.

As you know, Ethereum staking APR is around 3%. If 2 major spot ETH ETFs start validating Ethereum main network, Grayscale, the asset manager, might be able to stack and distribute staking rewards to ETF holders, such as dividends stocks.

If the SEC allows Grayscale’s spot ETH ETFs to stake, it may seem appealing to investors, but it could bring systemic risks. Issues like centralization, liquidity strain, and tax confusion may arise. In pursuit of yield, Ethereum’s spirit shouldn’t be compromised. Every gain carries an unseen cost.