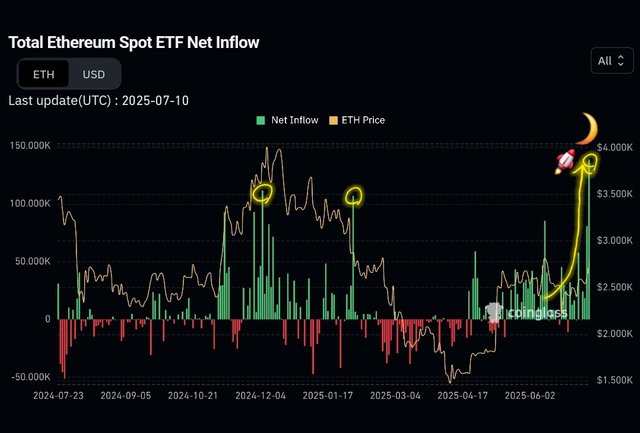

Since the inception of spot ETH ETFs trading, total net inflows recorded a new ATH 🚀🌙🥳🎉🎊

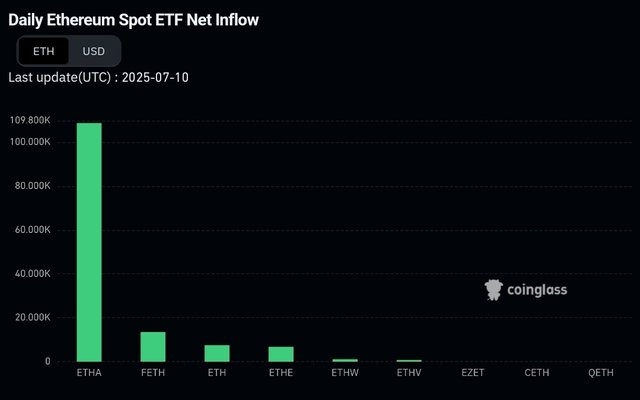

That means retail investors and institutions bought a significant amount of ETH(Ethereum) by purchasing ETHA(iShares Ethereum Trust ETF by BlackRock - the world's largest asset manager).

They bought around 120k ETH. It's around $3.4b.

While ETH ATH(All Time High) price is about $4.8k, total net spot ETH ETFs have been increasing.

So, do they sell ETH which doesn't surpass the ATH, and the bearish market will continuously last for the next 4 years? 🤔 It doesn't make sense 🧐

It's irrational, and considering their ETH holdings, it makes sense that ETH price crosses ATH, then, surges more than $10k. I think It's more reasonable rather than consecutive 4 year bearish market from now on.

"When a giant like BlackRock buys 1.2 lakh ETH via ETHA — should we assume they will sell before the price hits ATH?

A $3.4B investment is no joke.

While ETH has an all-time high of $4.8k, spot net inflows into ETFs are steadily increasing.

So should we still assume the market will remain down for the next 4 years?

Honestly, this logic doesn't fit.

I think, given the positioning of these big players, ETH will first cross ATH — and then go above $10k.

This approach seems more logical and psychologically accurate than a 4-year bearish story."