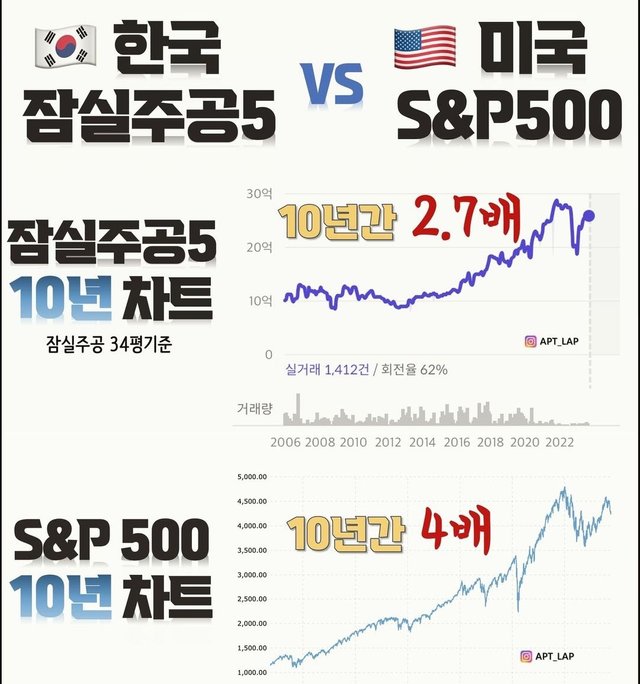

🇺🇸 S&P 500 is better than Korean real estates.

@APT_LAP on InstagramThe price of one of Korean real estates representatives has increased 2.7 times during the last decade. However, the S&P 500 is better with respect to the profit ratio.

Anyways, those assets have been good assets against the inflation. Cause, more than 270% profit for 10 years is really great.

By the way, the Bitcoin(BTC) profit ratio for 10 years is much better than S&P 500. It's been proving one of best assets against the inflation.

Take a look at the above picture. Time goes by, it seems that you have to pay it less in BTC.

After 7 years, if the market capitalization of the BTC surpasses the Gold, the price will be more than $600k, and $2k(reflecting the inflation) for a new series of iPhone will be 0.0033 BTC. Someday, 1 BTC would be able to exchange real states.

Upvoted! Thank you for supporting witness @jswit.