Could the price of gold increased by 500% replicating the seventies?

The price of an asset such as gold- could increase 500% is something highly speculative. However, in the history of the gold market, there have been times when the price of gold rose sharply, as in the 70s of last century. In 1971 the gold price was fixed by the International Monetary System Bretton Woods and stood at $ 35 per ounce. At the end of that decade the price of gold ended a record $ 850 per ounce. That's an increase of 2,300% in just 10 years. For stock market investors' 70s were a lost decade, with a lot of volatility and flat returns.

The world did not end in the 70s but double-digit inflation, the crisis in oil prices, a weak dollar and political instability created a lot of tension in the markets. With the increase of fear and uncertainty, investors bought more gold and in the late 70s were falling apart positions. Recent years have created similar to the 70s to the gold market environment:

The crisis of confidence in the 70s and the current crisis

Specific economic problems in the 70s West of inflation, recession and oil are different to the Current Problems crisis. But there are similarities between those years and today. In 1979 US President Jimmy Carter, spoke of a "crisis of confidence" in the government and in the future. That crisis Confidence Transfer to president, partly because of the Iran crisis, Losing Presidential Elections in 1980 against Ronald Reagan.

The campaign slogan Regan was: "Make America great again", the same slogan USING Donald Trump to channel popular dissatisfaction and anxiety. The global crisis of confidence is real and one from Washington Extends London, Berlin or Beijing. The crisis of confidence came a UN 70 Maximum Point in 1979 which coincided with gold prices at record highs. In the news we could find In a similar Future para environment.

The failure of the monetary policies of central banks

When US unilaterally decided to break the system of Bretton Woods gold standard in August 1971, the Federal-Fed Reserve, the US central bank, assumed a more prominent role to manage the US economy The Fed followed a line of Keynesian economic thought, named after the British economist John Maynard Keynes, who argued that increased money supply would increase employment and economic growth.

When unemployment accelerated in the 70s, the Fed and other central banks reponded increasing the supply of money, but it did not work. The world fell into a "stagflation", ie, a combination of a stagnant economy with rising inflation. So, to control inflation, the central bank increased interest rates. In 1971 the benchmark interest rate the Fed, the Fed fund rate was below 4%. A late stood at 13%.

Currently we have spent seven years under an experiment by central banks does not seem to give real fruits for the population, besides making richer the richest. The world suffers from a lack of economic growth, not inflation being a problem yet, but rather the fall in prices is known as deflation. To combat deflation central bankers have increased the money supply aggressively and have fallen to historic lows in interest rates, helping the economies of indebted governments.

Some countries even have a policy of negative interest rates (NIRP - negative interest rate policy), "paying" negative rates for deposits of commercial banks in their countries, and extend these negative rates for public debt of government issuers.

In this environment, with a bonus that generates negative rates it achieved that possession of physical gold is much more attractive although not of interest.

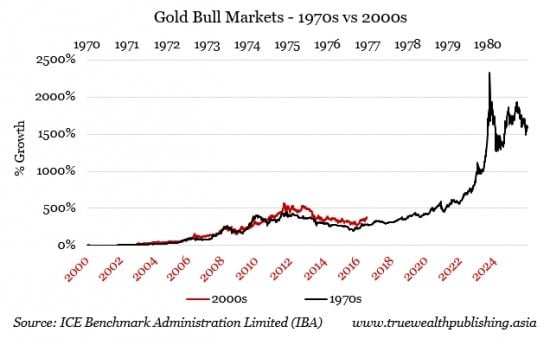

Similar patterns for gold price

All financial markets are dynamic ups and downs that are usually repeated in patterns over many years.

In the 70s the price of gold rose from $ 35 per ounce in 1971 to highs of $ 180 in late 1974. Since then the price of gold fell almost 40% to $ 110 in August 1976. From this point the price of gold reached its previous peak in June 1978 and, from there, made an almost parabolic rise, up to $ 850 in January 1980.

The current price of gold could be compared to this same pattern 70s.

1970s: From $ 35 to $ 180 in 1971 in 1974 (414% increase)

Today: $ 280 in 2000 to 1,888 in August 2011 (574% increase)

1970s: Correction 1974-76 of $ 197 to $ 110 (44% drop)

Today: Correction 2011-15 of $ 1,888 to $ 1,056 (44% drop)

The gold price is currently 26% above the lowest price of 2015. This is equivalent to the price of gold November 1976 with $ 132. If the price of gold repeats the pattern 70 could reach $ 6,800 in the next three to four years.

Comparison gold price 70s and 2000

In today's market , the price of gold reached $ 1,188 in August 2011 but fell to $ 1,056 in November 2015. Is it possible that the price of November 2015 has been the ground for gold price correction that observed since 2011 ?

For gold price rise as in the 70s it should enter a phase similar to the famous tulip mania of the seventeenth century warming, Internet stocks in 2000 and Chinese stocks last year.

In 1979 , a second crisis in oil prices , after years of inflation in energy prices , combined with political instability, pushed investors to a final climb panic that led to the maximum gold prices January 1980 .

Is it likely that this scenario be repeated ? Probably not, but the environment is favorable.

Your error is you are looking at the price of gold as fluctuating, and the dollar as being stable. That's nonsense, an ounce of gold buys about the same now as in 1900 - a good suit. Homes similarly cost about 200 ounces of gold (more in high demand places).

While we were on the gold standard (even nominally) the price of gold was artificially low (or, rather, the cost of dallars artificially high). So, when that constraint was removed, the dollar found it's true market value (Carter's "stagflation").

Since the dollar has again been wildly inflated with price manipulation of the gold market, that inflation will sometime show as a decrease in purchasing power of the dolar, while gold retains value.

You are right at some point, but I think gold will increase its relative value because of their scarcity and global population growth.

I'm saying that an ounce of gold will buy 10 good suits.

Thank you for your comment.

If you measure the dow Jones in gold, the market has crashed already. The problem with the fiat values is that everyone is crashing, so they look stable relative to each other. I don't think for long though. Upvoted and following.

Great post. It will be interesting to see what happens in the coming months. Typically, gold has been a reliable commodity to hold. Now, with @dollarvigilante predicting a huge economic crash, it would make sense that more and more people will rush to buy gold, driving up the cost.

This situation was been predicted since many years.

One day will became real, because reality will surpass Dollar's fiction, but I don't know when.

Thank you for your upvote.

That scenario could play out, but the more likely cause is high inflation in a foreign country. I was watching the gold market off and on before the financial crisis, and closely from 2009 to 2011. Unlike some other goldbugs, I took the U.S. inflation figures more-or-less at face value; the food I bought didn't go up in price all that much. That posed a conundrum: why would gold be shooting up (as it was from the start of '09 until it topped in '11) even though inflation was minimal?

The answer was China and India. In China, the new prosperity dovetailed with an old tradition of buying gold to save. Also, the Chinese central bank was buying a lot. And India, another nation with a strong tradition of gold-buying, did suffer high inflation at the time gold was climbing!

Whether or not gold goes up to that magic $5,000, now is a good time to buy it. It was in the doldrums for more than two years and is now waking up. Anyone buying and holding right now is likely to get a profit.