How to Earn Passive Income on Gold using Cryptocurrency

Alright, let's be honest. You've probably seen the headlines. Gold is doing that thing again --- surging. Pushing prices higher, making everyone wonder if it's finally having its big moment. It's enough to make you pause and think, "Okay, is now the time to finally jump in?"

For forever, it feels like, gold has been that reliable, slightly boring uncle in the investment family. The guy you turn to when things look shaky, the classic "store of value." But actually owning gold? That always sounded like a bit of a hassle. We're talking heavy bars, secure storage (and the cost that comes with it), worrying about authenticity, and trying to sell a chunk if you need cash. Paper gold (ETFs) made it easier, sure, but it still felt... passive. Just watching a number on a screen, hoping it goes up.

But lately, as gold has climbed, I started looking again. And I stumbled down a rabbit hole I didn't expect: gold, but make it crypto.

Wait, Gold on the Blockchain? Seriously?

Yeah, seriously. It sounds a bit wild at first, right? Taking something as ancient and physical as gold and turning it into a digital token. But the more I looked, the more it started to make sense.

The idea is pretty cool: you have these tokens, like PAX Gold (PAXG), where each token is actually backed by a physical ounce of real, audited gold stored safely in vaults. It's like owning a tiny, instantly transferable, digitally verifiable piece of a gold bar, without needing a vault key or an armed guard.

Think about the traditional pain points:

- Storage: Solved. It's on the blockchain (and the physical gold is securely stored by the issuer).

- Divisibility: Solved. You don't have to buy a whole bar or coin. You can buy 0.1 PAXG, or 0.005 PAXG. Try doing that with a physical coin!

- Transfer: Solved. Want to move your gold? Send the token. It takes minutes, not days or weeks (or requiring a security detail).

- Accessibility: Solved. You can buy and trade these tokens on crypto exchanges pretty much anytime.

Okay, so tokenized gold seems like a neat upgrade for ownership convenience. But here's what really grabbed my attention, and honestly, felt a bit revolutionary.

An Introduction To PAXG

PAX Gold (PAXG) is a digital asset backed by physical gold, issued by Paxos Trust Company. Each PAXG token represents one fine troy ounce of a London Good Delivery gold bar, stored securely in professional vault facilities. By combining the stability and tangible value of gold with the speed and flexibility of blockchain technology, PAXG enables investors to own and trade real gold without the complexities of physical storage or transportation. It offers a regulated, transparent, and easily accessible way to gain exposure to gold via the Ethereum blockchain.

Making Your Gold Pull Its Weight

With physical gold, your best-case scenario, price-wise, is appreciation. While it sits there being valuable, it doesn't actively do anything for you. In fact, it usually costs you money for storage or insurance.

This is where platforms mixing crypto and yield come into the picture. I've been holding some PAXG on Nexo, and the experience has been eye-opening. Not only am I exposed to the potential upside if gold prices continue to climb (the traditional gain), but the platform also offers interest on those PAXG holdings.

Think about that for a second. Your gold isn't just sitting there, hoping the price goes up. It can potentially be earning you passive income at the same time. You get the potential appreciation from the gold's value plus the interest paid out by the platform, at interest rates of up to 6% annually. It felt like unlocking a new dimension for an asset that's been around for millennia. It's turning a traditional cost center (storage) into a potential profit center (yield).

It's a powerful combination, marrying the tangible value of gold with the dynamic possibilities of digital finance.

Is Nexo Safe?

Being a CeFi (centralized finance), Nexo holds your digital assets in their vaults while giving you the opportunity to earn passive income with up to 14% annual interest on your cryptocurrencies. As compound interest is indeed the 8th wonder of the world, this paves the way for an effortless stream of passive income by leveraging the capital appreciation of the held asset (gold in the form of PAXG in this example), as well as earning from compounding interests by simply holding said asset. Established since 2018, Nexo has been a notable contender in the digital space, surviving the downfall of the bear markets and standing the test of time. That said, nonetheless, no investment is without risk --- especially with CeFi where you entrust your money to a 3rd party --- hence the need to do your homework properly. It is true that Nexo has had its own shares of controversy over the years --- nonetheless, to date, it is still one of my favorite and most trusted passive income platforms, apart from Binance.

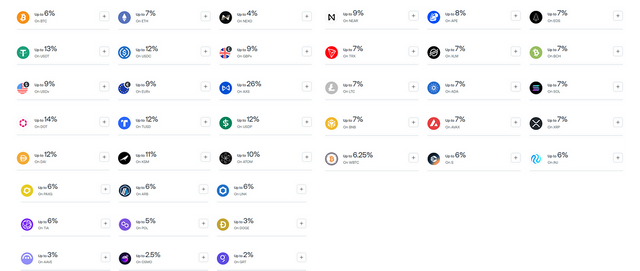

Nexo offers interest rates on various types of cryptocurrencies, including PAXG

Are There Any Caveats?

PAXG is one of the most reputable gold tokens out there, primarily because it's issued by a regulated entity (Paxos) and they have regular audits showing the gold is actually there. But yes, other tokens exist (like XAUT), and the landscape is evolving. It's definitely not just PAXG, but they seem to be leading the pack in terms of adoption and trust... relative to this still-new space, anyway.

Now, let's get real. This isn't a fairy tale. Mixing gold and crypto introduces new wrinkles and risks you absolutely need to understand.

- Platform Risk: If you hold your PAXG on a platform like Nexo (or any exchange/lender), you're trusting that platform. If it gets hacked or goes bust (we've seen enough of that in crypto), your assets are at risk. Not the gold itself, but your access to it via the platform.

- Token/Smart Contract Risk: The token itself relies on blockchain technology and smart contracts. While generally robust, nothing is 100% foolproof.

- Counterparty Risk (Is the Gold REALLY There?): You have to trust the issuer's audits. While Paxos is regulated and audited, it's still a layer of trust required compared to holding physical gold yourself.

- Crypto Market Weirdness: While PAXG tracks gold, it trades on crypto exchanges. Extreme crypto volatility or exchange-specific issues could impact its liquidity or price in the short term, even if the underlying gold value is stable.

- Variable Yield: The interest rates on platforms aren't fixed forever. They can go down (or up!) depending on market demand and platform decisions.

So, Back to the Big Question: Buy Gold Now?

Look, I can't tell you if the current surge means you should buy. Nobody can predict the future. Gold could keep climbing due to global uncertainty, or it could pull back. That part of the investment decision is the same as it ever was, driven by macroeconomic factors and your personal outlook.

But what is different now are the ways you can choose to get exposure. If you do decide gold fits into your portfolio, options like tokenized gold, and the potential to earn yield on it through platforms, offer a fascinating, modern alternative to the old methods.

It's less about replacing traditional gold entirely and more about having a new, potentially more dynamic tool in the toolkit. It's about exploring how an ancient store of value can participate in the digital financial world and maybe, just maybe, start earning its keep.

It's definitely got me thinking differently about that shiny, yellow metal. Worth a look, with eyes wide open to the new kinds of risks, of course.