Simple emini Trading System

By Steve Wheeler

Founder and CEO of NaviTrader.com (www.navitrader.com)

Professional Trader and System Designer/Developer

www.navitrader.com

How To Build A System With Positive Expectancy

Introduction

Let me start by introducing myself. I am a full time trader and trainer in the futures markets. I run a real time trading room two hours each trading day. I have traded for over 20 years, and concentrate primarily on the currency (FOREX), crude oil, gold, and stock index futures markets, such as the S & P E-mini. In a previous career, I was a practicing C.P.A . in the state of Florida.

I have developed a full suite of charts and indicators known as the Trendicators™ and a market analyzer known as the TradeFinder™, as well as a number of automated trading systems and automated buy, sell, and trade management systems.

What follows are the fundamental elements you need to be consistently profitable in the futures markets. I have also included information below that is crucial to your overall success and in managing your risk.

Preparation for trading profitably consists of market observation over a period of time so that the trader can build confidence in knowing what usually happens in the market, and how to profit from the recurring market behavior that repeats itself every day. To take advantage of cycles in the markets, observe the typical move that a market moves after it moves up or down out of a range contraction pattern.

The real objective is to build a knowledge of probabilities of market behavior so as to take consistent profits out of specific trading instruments. The following are observations of market behavior that will help to put the probabilities in your favor

How To Build A System Into Your Charts

To put the probabilities in your favor, you must have an objective method or system for your trading. Patterns repeat themselves over and over in all markets, so knowing these patterns can help to put the probabilities in your favor. The more you can automate your trading signals, the more objective you will be in your trade selection. You need to determine a set of technical conditions for which you would take a long or short position in any market. You can use technical indicators that are widely available, or you can develop your own indicators. Once you have chosen the indicators you want to use, test them for validity in your trading. As in any testing, the more data the more reliable the results will be.

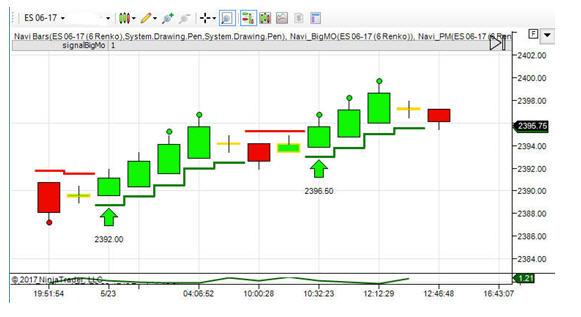

Below is an example of a chart where I have developed a system to determine price bar direction and have coded them green on an up bar and red on a down bar. This will provide the technical indicators that need to match up for a long or short position. You can see the automated buy signals which are the green arrows. You can use simple rules such as a buy above the signal bar and exiting either on a trailing stop or a profit target. Whatever system you use, be sure to test it on a sufficient sample size to test for a positive expectancy.

Making money in the market is a matter of being on the right side of the market. Specific to the futures markets, there are both up and down moves each day that provide many trading opportunities. One approach to the markets is to look for evidence of major support and resistance levels based on chart history. Many people ask me which time frame that I look at for my trading, and by best answer is that I look at all of them. A good analogy would be that if you were going to buy or short a stock, you would most likely start by looking at a weekly or daily chart. Why would you approach the futures markets any differently? To put the odds in your favor, you must find things that occur over and over and trade with this information.

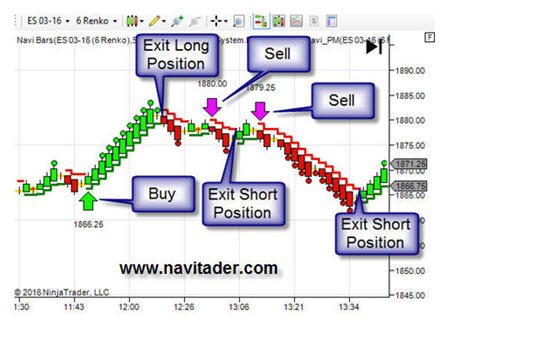

Below you will see an example of a 6 (Brick Size) Navi_Renko chart of the S & P Futures E-mini chart. This chart has buy and sell signals. The buy signals are the Green arrows pointing up and the sell signals are the magenta arrows pointing down as noted on the chart below.

The above chart and the system displayed by the chart is an example of a signal that will enable you to objectively test a signal on any chart time frame or data series that you would like to test. Other examples would be using indicators such as moving averages for buy and sell signals One method of testing is to use a trade simulator such as the Market Repay function of the Ninjatrader® platform. You can download market replay data and test based on historical data taking trades based on your entry and exit criteria. You will be able to test various stop and profit target levels over a series of trades. I would suggest that you test during the time periods in which you plan to trade. An example would be to test the S & P futures from 9:45 AM Eastern time through 11:00 AM Eastern time if that is the part of the day that you intend to trade.

How To Develop a System with a Positive Expectancy

To develop a plan that has a probability of success, you must test a sufficient amount of data to get a statistically significant sample of trades. I suggest testing at least 75 trades during the time period in which you plan to trade, taking the trades based on your plan and managing the open positions according to your plan. This process will enable you to gather data on your average winning trade, and your average losing trade in dollar terms. You will also know the percentage of winners versus the percentage of losing trades.

From that data, perform a calculation as follows:

Probability of winning trade X Average Winning trade in dollars minus the probability of a losing trade X the Average Losing trade.

Example:

( .7 x 200 ) - ( .3 x 100 ) = 110 When we have a positive value from this calculation this means that you have a positive expectancy based on your data. In other words, you have a system that has put the probabilities in your favor of being profitable.

Probabilities favor the continuation of a trend, therefore you want to trade or invest in the direction of the major trend. For purposes of intra day trading or even investing, a daily chart is a very good place to start to analyze the major trend. To put the odds even further in your favor, I recommend that you analyze whatever you want to trade to find out the consistency of the trend. This can be done by measuring the trend in various time frames all the way from short term trends such as a five minute chart all the way to daily or even weekly charts.

Risk Management

A primary downfall of beginning traders lies in not knowing how to manage risk. The use of protective stop losses (known as stops); is one important tool in trading futures. An even more important tool is known as position sizing. Position sizing answers the question of how many contracts I should trade in the futures markets, and how many shares should I should buy or short in the stock market.

We know that trading is all about how to react to your successes as well as trades that don’t go your way. No discussion of trading would be complete without a discussion of risk management. For futures trading, risk management is established with a combination of the use of stop orders combined with position sizing. You need to pair a proven strategy along with risk management. Risk management is accomplished in general by never taking a “big” loss on any one trade. I suggest that you start by making sure that on any one trade, you do not risk any more than one percent of your trading account. You will need to calculate before you enter a trade whether you would be risking more than one percent of your trading account.

To calculate position size you need to know some basic information such as the following:

Account Size

• Risk Percentage that you are assuming

• Tick value of contract you are trading

• Number of ticks of your initial stop loss order

A Risk Management calculation example for the e-mini would be as follows:

a. Entry price = 1438.25

b. Initial Stop level = 1436.25 = 8 ticks on the S & P E-mini

c. 8 ticks x tick value of $12.50 = $100 $100 x 1 contract = $100 risk on this trade.

d. Account Size = $10,000

In this example, you would be able to trade 1 contract $10,000 x 1% = $100 maximum risk

Like any profession, you need to be prepared to take on the markets in a structured and methodical manner. If you study the above principles, you will better understand overall market behavior and you will be equipped to begin to consistently benefit from the great opportunities that exist each day in the markets.

Platform:

As you develop your trading skills, I suggest that you use a professional trading platform that will allow you to trade directly from the charts and will allow you to trade in simulation mode as well as to execute trades in your live futures account. As with any skill, the more that you practice, the better you get at it. It is important to develop your skills regarding the proper use of your trading platform while in simulation mode so as to minimize trading errors after you are trading your actual trading account.

Trading in simulation mode will help you to develop your confidence and an overall methodology that fits your personality.

Developing a Belief in Your Approach and Overcoming Fear:

Most traders will develop fear as they trade due to a history of losses. Like any fear, the way to overcome it is to face fear head on and continue to do what you fear the most. An advantage of having a trading platform that provides for simulation is that you will be able to trade in simulation mode, as in our example above to build a plan with a positive expectancy and thereby develop greater confidence in your approach to trading. As you trade in simulation mode, develop a set of notes that will act as the beginning of your trading plan. Trade in simulation mode until you have mastered the use of the trading platform you have chosen. As you trade in simulation mode, practice developing the discipline needed to execute your trading plan. Through repetition, you will begin to develop into a polished and profitable trader.

Please let us know if you need any help in developing your approach to profitable trading. Send an e-mail to [email protected] with any questions and visit our website at www.navitrader.com

Above charts use the Trendicator© Charts running in the NinjaTrader platform.

If you have any questions on the material in this publication, please send an e-mail to [email protected] www.navitrader.com

Contact Information:

Steve Wheeler

[email protected]

www.navitrader.com

800 987 6269

Skype navitrader.steve

Congratulations @navitrader! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @navitrader! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @navitrader! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!