Binance briefly stopped withdrawals of stablecoin USDC as financial backer worries mount after FTX breakdo

Central issues

Binance, the world's biggest cryptographic money trade, stopped withdrawals of the stablecoin USDC on Tuesday while it did a "token trade."

USDC withdrawals were continued around 8 hours after Binance originally reported the stopping of withdrawals.

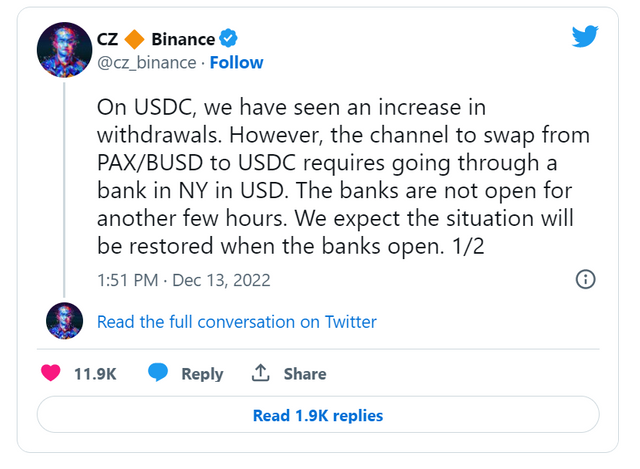

Changpeng Zhao, Chief of Binance, tweeted on Tuesday that the trade is seeing an expansion in withdrawals of USDC.

The move comes as financial backer worries develop about Binance's solidness following the breakdown of opponent trade FTX as well as a report of a likely criminal examination from the U.S. government.

Binance briefly stops USDC withdrawalsWATCH NOW

VIDEO02:42

Binance briefly stops USDC withdrawals

Binance, the world's biggest cryptographic money trade, stopped withdrawals of the stablecoin USDC

on Tuesday while it did a "token trade."

USDC withdrawals were continued around 8 hours after Binance originally reported the stopping of withdrawals.

The move came as financial backer worries develop about Binance's dependability following the breakdown of opponent trade FTX as well as a report of an expected criminal examination from the U.S. government.

Binance expressed before on Tuesday it had "briefly stopped" USDC withdrawals while it does a "token trade." This includes trading one digital money for one more without the requirement for government issued money.

Changpeng Zhao, Chief of Binance, tweeted that the trade is seeing an expansion in withdrawals of USDC, a digital money known as a stablecoin in light of the fact that it is fixed coordinated with the U.S. dollar

.

USDC is utilized by financial backers to exchange and out of various digital currencies without the need to move cash once again into U.S. dollars. On the off chance that dealers are pulling out USDC from Binance, it very well may be to move it onto another stage.

Zhao said that any exchanges into USDC from the stablecoin known as PAX, as well as Binance's own token BUSD, require steering through a bank situated in New York which isn't yet open. The idea from Zhao is that clients are hoping to change over their PAX and BUSD into USDC to pull out their assets from Binance.

A symbolic trade could be a way for Binance to get more USDC rapidly while the banks are shut to continue withdrawals for clients.

Zhao said clients might in any case pull out other stablecoins including BUSD and tie. Stores are not impacted, he said.

Binance's own token called BNB

was exchanging down around 5% on Tuesday morning, as per information from CoinGecko.

It's not ordinarily uplifting news when a crypto firm needs to stop withdrawals. In the late spring, crypto firms including moneylender Celsius needed to stop withdrawals before eventually seeking financial protection. There is no sign of any such difficulty for Binance.

In the beyond 24 hours, Binance has seen $1.6 billion of outpourings from its foundation, as per a tweet from crypto information organization Nansen distributed early Tuesday. Binance has more than $60 billion of resources on its foundation, Nansen said.

Financial backers jumpy

The breakdown of FTX and capture of its previous President Sam Bankman-Broiled has crypto financial backers nervous with fears of additional virus across the business.

Binance has been at the center of attention since its choice to sell its stake in FTX's self-gave FTT advanced tokens, which went before the disappointment of the opponent trade.

Financial backers have called for additional straightforwardness from Binance's business. Last month, the organization gave a proof of save where it professes to have a hold proportion of 101%. That implies it has an adequate number of resources for cover client stores.

However, pundits have said that the confirmation of stores have not gone far to the point of giving affirmations of Binance's guarantee. Mazars, the examining firm Binance utilized for its evidence of stores, said in its five-page report that the organization does "not offer a viewpoint or a confirmation end."

Financial backers are likewise monitoring a report from Reuters that U.S. Division of Equity examiners are postponing the determination of a criminal examination concerning Binance. Reuters, refering to four individuals acquainted with the matter, announced that the examination is centered around Binance's consistence with hostile to tax evasion regulations. Binance answered saying: "Reuters fails entirely to understand the situation once more."

"We have no understanding into the internal operations of the US Equity Division, nor would it be suitable as far as we're concerned to remark on the off chance that we did," the organization said in a tweet on Monday.