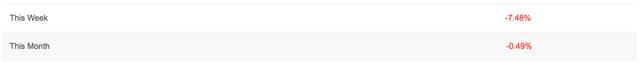

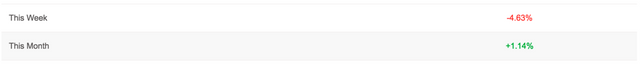

Trading Bot Growth Hack Project, -4.63% Weekly Performance Update

Hello everyone,

Summer trading is upon us and Europe is officially on vacation. Yes, definitely a factor with our trading right now but the trade bot CR is going to do its job. Do not get discouraged.

Coming off of two weeks of expansion it is normal for the markets to consolidate. And this is a trend following system that performs best during expansions. However a week like last means further movement is coming soon.

The question is will the market be on vacation until September too. I do not know. Since we are finalizing tests I will continue trading at least for the next two weeks.

Last week the only change I made was adding adverse risk to reward ratios during their ideal market hours to CR to see if it smooths out the equity curve.

Calculated Returns EA, https://www.myfxbook.com/members/traderjcl/-calculated-returns-ea/2186968

Calculated Returns EA Plus ( normal w/ adverse), https://www.myfxbook.com/members/traderjcl/-calculated-returns-ea-plus/2196565

Analysis

Looks like it could be doing it's job. The main difference this week was a was the 38% win ratio versus the 22%. That equaling a 2.85% difference. It remains to be seen on a positive week for CR to see how CR+ performs. Absolutely worth continuing to forward test and see.

The only other change that will happen at the end of this week - and I expect to the last change for some time will be removing hour 16:00-16:59. It is where roughly 80% of our losses are coming from, a very volatile part of the day and even if over time that hour of the day turned out to be profitable it is not worth the volatility.

Don't get discouraged - we got this!

I am going with the normal version of Calculated Returns (demo) and Calculated Returns Plus (live). At least through mid August.

Possible Tweaks

While reviewing analytics and working over the weekend it got me thinking our long term solution may look something like:

3 orders per trade with the current SL.

- Order 1, TP 0.5 ATR, 0.01 per 1k traded

- Order 2, TP 1.0 ATR, 0.02 per 1k traded

- Order 3, TP 2.0 ATR, 0.01 per 1k traded

Which is basically adding Order 1 with a smaller TP to take a piece of profits off of table quicker and once again smooth out our equity curve a little bit more.

Have a fantastic week!

Cheers,

Jordan

If 80% of the losses are coming from an specific time gap that's excellent news.. you're almost done!

I should had included a screenshot of that pretty important point.

This post received a 3.2% upvote from @randowhale thanks to @jordanlindsey! For more information, click here!

That looks really cool! where can we find more information?