Trading the Forex Market Successfully

Anatomy of a Winning Trade

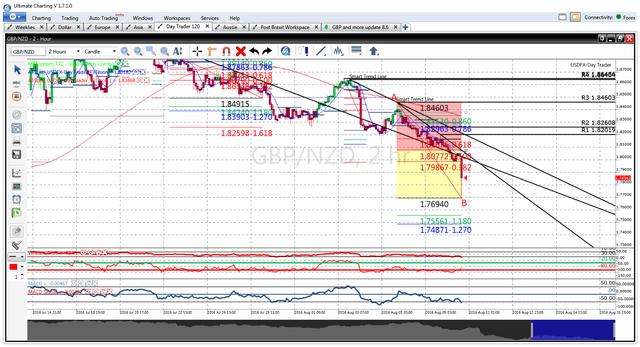

A couple of days ago, I posted my first article on the Forex Market, which you can see here. In it, I presented the chart below and stated that based on my technical analysis I had sold it earlier and was already profitable by a couple of hundred pips. I also noted that I would stay in that trade, instead of cashing out, as I expected it to drop further. That article is timestamped, so in case you did not read it when I posted, you can verify the prediction was not modified to fit the facts. Some of you did read it, though, and can vouch for it directly.

This pair is the GBPNZD, the British Pound against the New Zealand Dollar. For those who read charts, you can see that it was already in a downward trend since somewhere around July 20th, with normal ups and downs along its way down. Additionally, a few minutes ago the Reserve Bank of New Zealand announced its interest rate decision, an event we call a Fundamental Announcement, given that it has the potential to drastically move a currency pair in one direction or another. Due to the weakness of the British Pound after Brexit, and the market's expectation of lower rates, I decided it was a reasonable risk to stay in the trade. Not based on any one of the above criteria, but a combination of all of them. At 5pm ET today, when the decision was announced, this is what happened:

You can see the sharp drop from above 1.8000, down past 1.7700. That was an additional 300+ pips over what I had already captured on the trade, and at that point I took my profit. Good thing I did, too, as it has now retraced a few hundred pips. That is also a normal occurrence, as the market tends to overreact, and then correct itself, when cooler heads prevail. All in all, this trade I was in for all of 3 days netted me over 700 pips, or US$7,000. Can you really afford not to learn this, especially when I am sharing the knowledge for free?

More in this series:

Trading the Forex Market - Part 1

Trading the Forex Market - Part 2