AI in Fintech Market Growth, Size, and Trends Forecast 2024-2032

Global AI in Fintech Market Statistics: USD 87.7 Billion Value by 2032

AI in Fintech Industry

Summary:

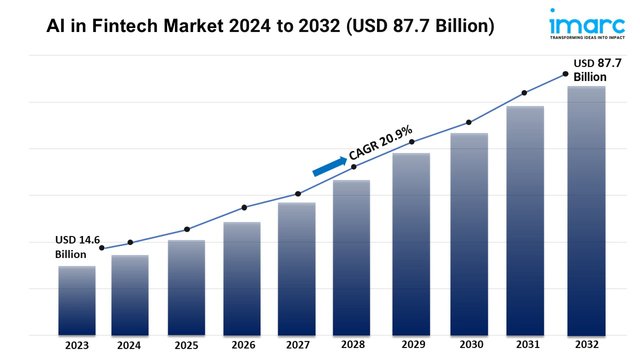

- The global AI in fintech market size reached USD 14.6 Billion in 2023.

- The market is expected to reach USD 87.7 Billion by 2032, exhibiting a growth rate (CAGR) of 20.9% during 2024-2032.

- North America leads the market, accounting for the largest AI in fintech market share.

- Solutions hold the largest share in the AI in fintech industry.

- Cloud-based represents the leading deployment mode segment.

- Based on the application, the market has been divided into virtual assistant (chatbots), credit scoring, quantitative and asset management, fraud detection, and others.

- Enhanced fraud detection and risk management is a primary driver of the AI in fintech market.

- The increasing demand for personalized financial services and rising focus on operational efficiency and cost reduction are reshaping the AI in fintech market.

Request for a sample copy of this report: https://www.imarcgroup.com/ai-in-fintech-market/requestsample

Industry Trends and Drivers:

- Enhanced fraud detection and risk management:

With the capability to process massive datasets in real-time, artificial intelligence (AI) algorithms can analyze transactions, user behaviors, and financial activities to detect fraudulent patterns much faster than traditional methods. These systems continuously learn and adapt, making them more effective at identifying new, evolving forms of fraud, such as synthetic identities and advanced phishing schemes. This ability to sift through enormous amounts of data quickly and accurately minimizes false positives, enabling financial institutions to focus on genuine threats while avoiding unnecessary disruptions. Additionally, AI enhances the prediction of potential risks by analyzing factors like market volatility and economic trends, improving the overall financial risk management framework.

- Personalized financial services:

AI is improving the delivery of personalized financial services, offering clients more customized, relevant products and experiences. By leveraging machine learning algorithms, fintech companies can analyze vast amounts of user data, including spending habits, transaction histories, and even social media behavior, to offer tailored recommendations for savings plans, credit options, and investments. This level of personalization goes beyond what traditional financial institutions could offer, as AI can predict user needs and preferences with high precision. Additionally, AI-powered chatbots and virtual assistants offer users instant, tailored responses to their financial inquiries, enhancing individual satisfaction. Individuals are demanding more personalized, responsive financial services, which is leading to the adoption of AI to meet these expectations.

- Operational efficiency and cost reduction:

AI allows financial companies to streamline operations and reduce manual labor by automating routine tasks, such as transaction processing, compliance checks, and user support. AI-powered chatbots can handle client inquiries around the clock, providing instant answers to common questions and freeing up human staff for more complex issues. Machine learning (ML) models are also used to automate back-end processes like loan approval, fraud detection, and risk assessments, enabling faster and more accurate decision-making. Additionally, AI enhances data management by processing and analyzing large volumes of information more efficiently, reducing errors, and improving the accuracy of financial reporting. These improvements in efficiency not only lower operational costs but also allow fintech companies to scale their services more effectively.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging AI in fintech market trends.

AI in Fintech Market Report Segmentation:

Breakup By Type:

- Solutions

- Services

Solutions exhibit a clear dominance in the market attributed to the increasing adoption of AI-driven software and platforms that enhance the efficiency and effectiveness of financial services.

Breakup By Deployment Mode:

- Cloud-based

- On-premises

Cloud-based represents the largest segment owing to its scalability, flexibility, and lower costs.

Breakup By Application:

- Virtual Assistant (Chatbots)

- Credit Scoring

- Quantitative and Asset Management

- Fraud Detection

- Others

Based on the application, the market has been divided into virtual assistant (chatbots), credit scoring, quantitative and asset management, fraud detection, and others.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market due to its advanced technological infrastructure, rising investments in AI innovation, and the presence of major fintech companies.

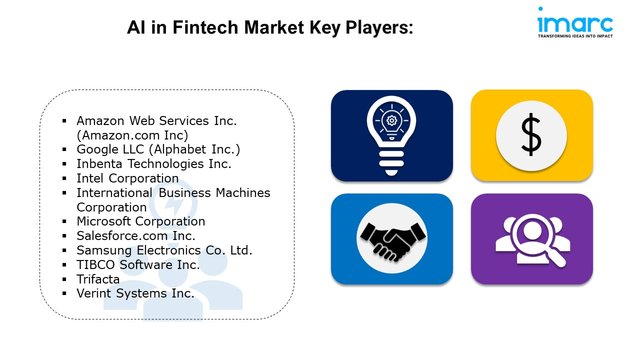

Top AI in Fintech Market Leaders:

The AI in fintech market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Amazon Web Services Inc. (Amazon.com Inc)

- Google LLC (Alphabet Inc.)

- Inbenta Technologies Inc.

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- Salesforce.com Inc.

- Samsung Electronics Co. Ltd.

- TIBCO Software Inc.

- Trifacta

- Verint Systems Inc.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163