Cryptonation: Swiss FINMA confirms stance as Crypto Incubator!

Today the FINMA (Swiss Financial Markets Supervisory Authority) released the result of its last roundtable on the subject.

I will make an overview of it and leave a link so you can also download the document. Maybe one of you dear readers is involved in the Cryptospace as an entrepreneur and is considering Switzerland as a location for your new endeavor.

Switzerland was and still is somehow one of the biggest and most reputed financial markets worldwide. Swiss Banking is famous for its Chocolate, Cheeses and Mountains and their ski-resorts. The first industry is suffering a substantial hit after U.S. enforced almost unilaterally the new FATCA tax rules, which triggered world transparency and anti-tax-haven worldwide movement. Switzerland lost a considerable amount of Market and is now seizing opportunities in the fintech sector, and most recently in the Blockchain one.

The FINMA set some strategic goals a few years ago in preparation for a disruptive market.

Goal 5

-No unnecessary obstacles to innovative business models

-Principle-based, technology-neutral and competition-neutral regulation and supervision

-Transparent and legal clarity

-Zero tolerance of criminal behaviour

As you can see, that is quite a difference with other developed countries. The FINMA is not alone in this path, and it is actively participating in the 2018 Federal Working Group on innovative technologies, it is expected that the Federal govt. will pass some law to promote the sector sometime this year.

As seen in a previous post of mine the FINMA is the one responsible for releasing the Token type qualification. To quote the report;

Token categories

– Payment tokens: (cryptocurrencies) give rise to no claims on their issuer. They are

intended to be used, now or in the future, as a means of payment for acquiring

goods or services or as a means of money or value transfer.

– Asset tokens: represent assets such as a debt, equity or other claim on the issuer,

e.g. a share in future company earnings or capital flows. In terms of their economic

function, these tokens are analogous to equities, bonds or derivatives. Tokens

which enable physical assets to be traded on the blockchain also fall into this

category.

– Utility tokens: provide access digitally to an application or service by means of a

blockchain-based infrastructure at the point of issue.

(Author bold highlight)

Starting from there is much more comfortable for an ICO start-up to decide which option to adopt, and moreover what kind of regulation will impact the tokens and future users and investors. As expected, when qualifying as Securities, the harder the controls and regulations will be.

The innovative take comes, when referring to Securities Tokens, states that they can be uncertificated and the only requisite is for the issuer to keep a ledger on the amount and type of these, and adds;

"There are no requirements as to the form of the uncertificated securities ledger. It can be kept on a

blockchain."

As far as I know, this opens a new field for Tokens as securities, since one of the biggest fears in the market is to be considered a Security and therefore complying with the strict securities laws. One of the worst issues is to keep track of the holders and the need to operate through the centralized ledger and safe-keeping intermediaries, also known as "stock exchanges".

The last would mean an impossible for such small companies and start-ups and would've meant an early killer for the system.

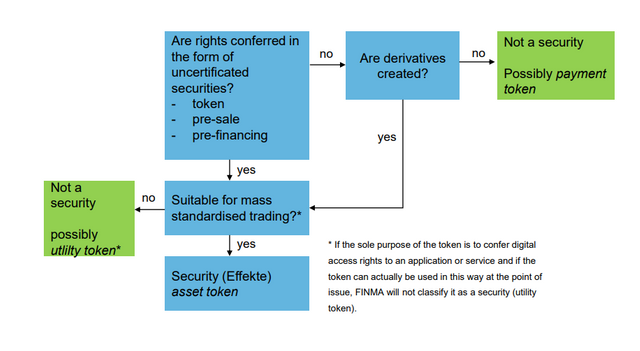

A practical graphic has been created by the FINMA to follow and decide what kind of Token is being built;

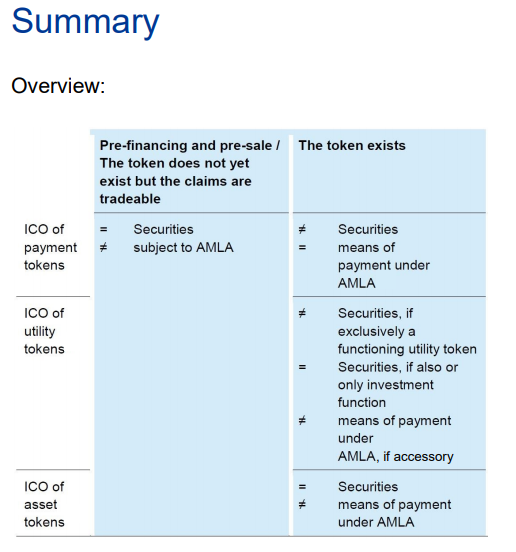

The presentation has much more information on other topics related to the regulation as financial instruments, this touches AML, KYC rules, Exchanges, SRO (Self-regulated organizations), Collective Schemes Act, etc. I recommend you to read the whole material if you are interested in the subject or are thinking of investing in Switzerland.

To provide more information would be to repeat the work done by FINMA and that is not the idea. Also, to be honest, is a little annoying.

The link is here and is open to the public. Credits to my friends from the Swiss Crypto Valley Association for uploading it to their website.

Snaps belong to the report and are made by FINMA

@Santana33 @Santana33 | ||

|---|---|---|

| ||

| ||

|

The Swiss are moving fast when it comes to crypto and ICOs, while the rest of the world is falling behind with their idiotic rules and inefficient bureaucracies.

You can even buy bitcoin at Swiss train station ticketing machines today! What other country has that?

Thenk you @santana33 for the post. Let's hope more governments will adopt crypto - friendly regulations. With years passing by, as crypto becomes a few trillion dollar industry, governments will try to attract crypto tax payers, right?

Is forex is better than cryptocurrencies?

Any suggestion please ?

Anyone opinion would be awesome.

Forex gains $5,580 in 3 days.

https://steemit.com/forex/@salahuddin2004/forex-prediction-2-usdjpy-successful-total-profit-usd5-858

I believe so, blockchain will be in the long run an automatic system to measure payable taxes for individuals and companies. Transparent and trustless, future is around the corner.

Outsiders complain that bitcoin facilitates tax evasion but with a permanent immutable ledger of all transactions ever it has to be a tax mans dream. I agree it should aid in auto calculations and deducting taxes in the future.

Indeed, that is the key part, the problem now is that most other regimes want to be full in control of the people before developing something for themselves, that is why the Swiss example is a different thing.

This is an endorsement for the digital currency industry. May FINMA be blessed and thank you for this mood improving post. This is one among the many thing you wrote that caught my interest most "As far as I know, this opens a new field for Tokens as securities, since one of the biggest fears in the market is to be considered a Security and therefore complying with the strict securities laws. One of the worst issues is to keep track of the holders and the need to operate through the centralized ledger and safe-keeping intermediaries, also known as "stock exchanges". 👍

Thank you for sharing, good post..

Nice post

nice post sir. restemeed and upvote!! :)

Great article , keep the good work

Congratulations @santana33, this post is the tenth most rewarded post (based on pending payouts) in the last 12 hours written by a Superuser account holder (accounts that hold between 1 and 10 Mega Vests). The total number of posts by Superuser account holders during this period was 1294 and the total pending payments to posts in this category was $6405.63. To see the full list of highest paid posts across all accounts categories, click here.

If you do not wish to receive these messages in future, please reply stop to this comment.

Congrats @santana33

Thank you but i want to ask you please

ask me