Vertical (common-size) analysis of financial statements

Vertical analysis (also known as common-size analysis) is a popular method of financial statement analysis that shows each item on a statement as a percentage of a base figure within the statement.

To conduct a vertical analysis of balance sheet, the total of assets and the total of liabilities and stockholders’ equity are generally used as base figures. All individual assets (or groups of assets if condensed form balance sheet is used) are shown as a percentage of total assets. The current liabilities, long term debts and equities are shown as a percentage of the total liabilities and stockholders’ equity.

To conduct a vertical analysis of income statement, sales figure is generally used as the base and all other components of income statement like cost of sales, gross profit, operating expenses, income tax, and net income etc. are shown as a percentage of sales. In a vertical analysis the percentage is computed by using the following formula:

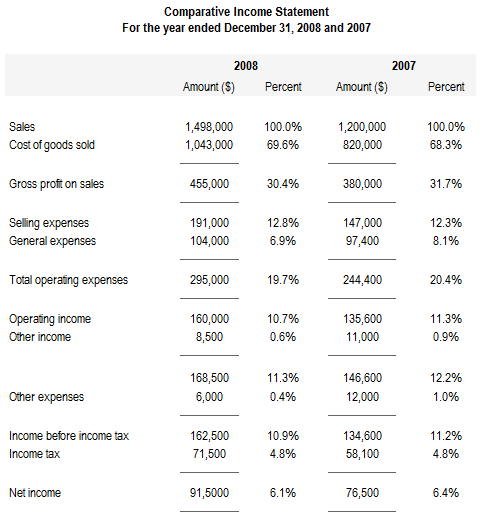

A basic vertical analysis needs an individual statement for a reporting period but comparative statements may be prepared to increase the usefulness of the analysis.

Example:

Current assets:2008: (550,000 / 1,139,500) × 100 = 48.3%

2007: (530,000 / 1,230,500) × 100 = 43.3%

Cost of goods sold:2008: (1,043,000/1,498,000) × 100 = 69.6%

2007: (820,000/1200,000) × 100 = 68.3%

Vertical analysis states financial statements in a comparable common-size format (percentage form). One of the advantages of common-size analysis is that it can be used for inter-company comparison of enterprises with different sizes because all items are expressed as a percentage of some common number. For example, suppose company A and company B belong to same industry. A is a small company and B is a large company. Company A’s sales and gross profit are $100,000 and $30,000 respectively whereas company B’s sales and gross profit are $1,000,000 and $300,000 respectively. If vertical analysis is conducted and sales figure is used as base, it would show a gross profit percentage of 30% for both the companies.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.accountingformanagement.org/vertical-analysis-of-financial-statements/