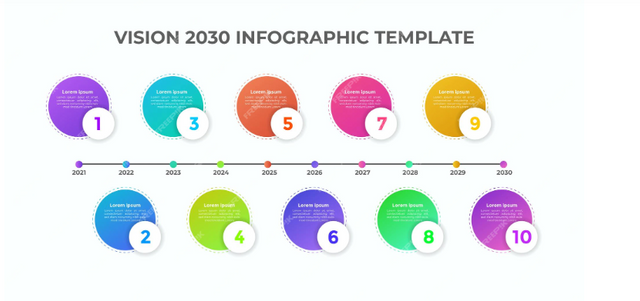

10 Steps Towards Achieving Financial Freedom

The Top

10 Steps Towards Achieving Financial Freedom

Introduction to financial freedom

Financial freedom is a goal that many individuals aspire to achieve. It is the ability to live a life free from financial stress, where one has enough resources to support their desired lifestyle without relying on a paycheck. However, attaining financial freedom requires careful planning, discipline, and commitment. In this article, we will explore the top 10 steps towards achieving financial freedom and how each step can contribute to your journey.

Claim your Free Copy of Tony Robbins’ “Money: Master the Game” https://amzn.to/48ilH5v.

Understanding the concept of financial freedom

Before diving into the steps, it is essential to understand what financial freedom truly means. Financial freedom goes beyond having a high income or being debt-free. It is about having control over your finances and being able to make choices that align with your values and goals. Financial freedom allows you to pursue your passions, take risks, and have peace of mind knowing that you have the financial stability to weather any storm.

Step 1: Set clear financial goals

The first step towards achieving financial freedom is to set clear and specific financial goals. Without a clear vision of what you want to achieve, it is challenging to create a plan to get there. Start by identifying both short-term and long-term goals. Short-term goals could include saving for a down payment on a house or paying off credit card debt. Long-term goals could involve retiring at a certain age or starting your own business. By setting goals, you give yourself something to strive for and a roadmap to follow.

Claim your Free Copy of Tony Robbins’ “Money: Master the Game”https://amzn.to/48ilH5v

Step 2: Create a budget and stick to it

Creating a budget is crucial for managing your finances effectively. A budget allows you to track your income and expenses, ensuring that you are living within your means. Start by listing all your sources of income and categorizing your expenses. Be mindful of your spending habits and identify areas where you can cut back. Set aside a portion of your income for savings and investments. It is essential to review and revise your budget regularly to adapt to changing circumstances and ensure that you are on track to achieving your financial goals.

Step 3: Save and invest wisely

Saving and investing are key components of achieving financial freedom. Saving allows you to build an emergency fund and have a safety net for unexpected expenses. Aim to save at least six months' worth of living expenses to provide financial security. In addition to saving, investing your money can help it grow over time. Explore different investment options such as stocks, bonds, mutual funds, or real estate. Consider seeking professional advice to make informed investment decisions based on your risk tolerance and financial goals.

Step 4: Eliminate debt

Debt can be a significant obstacle on your journey to financial freedom. High-interest debt, such as credit cards or personal loans, can quickly accumulate and hinder your progress. Start by paying off your high-interest debts first, while making minimum payments on other debts. Consider strategies such as the debt snowball or debt avalanche method to tackle your debts systematically. As you eliminate debt, you free up more of your income to save, invest, and work towards your financial goals.

Claim your Free Copy of Tony Robbins’ “Money: Master the Game” https://amzn.to/48ilH5v

Step 5: Build multiple streams of income

Relying solely on a single income source can be risky. Building multiple streams of income can provide you with additional financial security and accelerate your path to financial freedom. Explore opportunities to generate passive income, such as rental properties, dividends from investments, or creating an online business. Diversifying your income streams can help protect you from unexpected events and give you more flexibility in achieving your financial goals.

Step 6: Protect your assets with insurance

Protecting your assets is essential to safeguard your financial future. Insurance plays a vital role in mitigating risks and providing financial protection in case of unforeseen circumstances. Ensure that you have appropriate coverage for your health, home, car, and other valuable assets. Consult with an insurance professional to assess your needs and find the right policies for your situation. By having the necessary insurance coverage, you can have peace of mind knowing that you are financially protected against potential risks.

Claim your Free Copy of Tony Robbins’ “Money: Master the Game” https://amzn.to/48ilH5v

Step 7: Continuously educate yourself about personal finance

Financial literacy is a lifelong journey. Take the time to educate yourself about personal finance and investment strategies. Read books, attend seminars, or enroll in online courses to expand your knowledge. Understand the principles of budgeting, investing, and saving. Stay up-to-date with current trends and changes in the financial world. By continuously educating yourself, you empower yourself to make informed financial decisions that align with your goals.

Claim your Free Copy of Tony Robbins’ “Money: Master the Game” Here https://amzn.to/48ilH5v

Step 8: Practice frugality and live below your means

Living below your means is a fundamental principle of financial freedom. It means spending less than you earn and avoiding unnecessary expenses. Practice frugality by distinguishing between wants and needs. Prioritize your spending on essential items and experiences that bring you genuine joy and fulfillment. Avoid lifestyle inflation and the temptation to keep up with others. By adopting a frugal mindset, you can save more, invest wisely, and accelerate your journey towards financial freedom.

Claim your Free Copy of Tony Robbins’ “Money: Master the Game” https://amzn.to/48ilH5v

Step 9: Plan for retirement

Planning for retirement is crucial to ensure a comfortable and secure future. Start saving for retirement as early as possible to take advantage of compound interest and allow your money to grow over time. Contribute to retirement accounts such as a 401(k) or an Individual Retirement Account (IRA). Consider consulting with a financial advisor to determine the best retirement savings strategy for your needs. Regularly review and adjust your retirement plan as your circumstances change to stay on track towards your retirement goals.

Step 10: Enjoy the journey to financial freedom

While working towards financial freedom requires discipline and commitment, it is essential to enjoy the journey. Celebrate milestones along the way and reward yourself for your progress. Take time to appreciate the financial security and freedom you have achieved. Remember that financial freedom is not solely about reaching a specific monetary goal, but also about living a life aligned with your values and passions. Find balance in your finances and personal life, and enjoy the fruits of your hard work and dedication.

Conclusion

Achieving financial freedom is a goal within reach for anyone willing to commit to the necessary steps. By setting clear financial goals, creating a budget, saving, investing wisely, eliminating debt, building multiple income streams, protecting assets, continuously educating yourself, practicing frugality, planning for retirement, and enjoying the journey, you can pave the way towards a future free from financial stress. Embrace the steps outlined in this article, and take control of your financial destiny. Start today and embark on the path to financial freedom.

Claim your Free Copy of Tony Robbins’ “Money: Master the Game”https://amzn.to/48ilH5v**