U.S. Dollar Falls Below Key Support Level & NASDAQ McClellan Oscillator Turns Negative With Massive Divergence. Will The Plunge Protection Team Show Up This Time?

U.S. Dollar Falls Below Key Support Level & NASDAQ McClellan Oscillator Turns Negative With Massive Divergence. Will The Plunge Protection Team Show Up This Time?

"Things are not always what they seem; the first

appearance deceives many; the intelligence of a

few perceives what has been carefully hidden"

-Phaedrus

8/3/2017

The U.S. Dollar Index has just fallen below 93.00 handle falling to fresh 17’ lows, and closing in on three year lows, and its 200 day moving average on the weekly charts as well, threatening to take this to the next level:

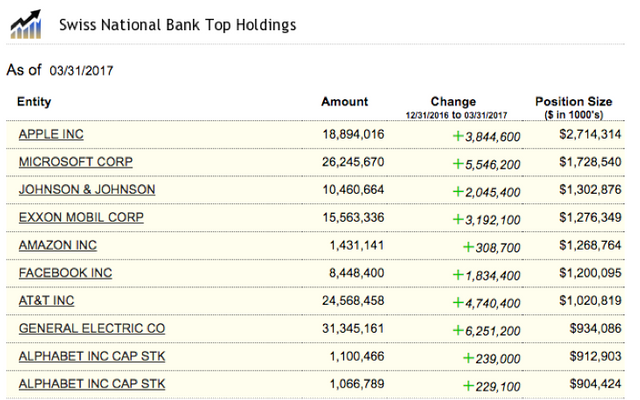

Given the continued loss of control of the Deep State in their Illegal Middle East Wars, the Petro Dollar continues to be shunned by world economies as the Silk Road, and other non Centralized Banking systems backed by real money precious metals gain a foot hold. This begs the question, how has it been possible that the Stock Market has continued to rise in the face of the Dollars weakness? Well by now most of you reading this are well aware of the fact that the Central Bank in the U.S., and Europe, and Japan have been utilizing the fractal-banking scheme to print money (fiat electronic credits) seemingly into infinity and purchasing millions of shares of the major stock market components around the world. Just take a look at the top ten holding of the Swiss Central Bank: (800 bill. In U.S. equities)

What this tells us is that at this point, Markets are not the Free-Markets of past years. I would go so far as to use the Biblical term “dishonest weights, and dishonest measures”. In fact, instead of lending to the public, it has come to light that major U.S. Banks have been reinvesting in their own shares, not lending into the economy as what most people would believe is there mandate. No, they have not been providing money to help new business, finance public projects, etc., they have been reinvesting trillions into their own Bank Shares. Why you ask? Imagine if the trillions of dollars that are kept within private corporations actually were funneled out into the economy? I’ll tell you: Massive inflation. The exchange stabilization fund has hoisted a corrupt system upon which when the public becomes aware, I believe will create an awareness of this system that in the past has been ruthlessly hidden, and anyone that has exposed this has had their careers, lives destroyed. That being said, when I look at the current price action of the Nasdaq it appears to me that as price has recently hit new highs, the strength behind this price momentum has dramatically waned:

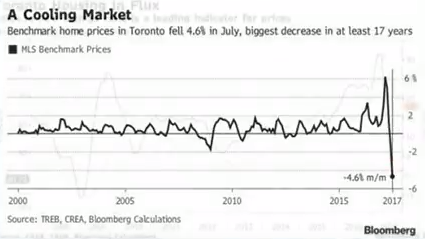

So here we are. Dow 22,000 belies massive Job Losses, retail store closures, bankruptcy, corporate credit default on the rise, and the most recent popping of the Canadian real estate bubble:

I would suspect that the recent about face in the Canadian Housing Market is the canary in the coal mind for our market as well. As Crypto currencies continue to explode to the upside into a Hundred Billion dollar market seemingly overnight highlight the fact that a decentralized alternative to fiat money (the dollar) that has no Central Bank manipulation with paper contracts (swaps) shows evidence that the world is waking up to the disatributes of the Central Banking system and the fact that new systems are being created that will eventually replace it giving power to the people as opposed to more debt enslavement by the elites.

So if you think what goes up can keep going up forever, I would only ask you how well that strategy worked in the wake of 2000, and 2008?

My current recommendations:

SSSQ – Nasdaq 100 inverse ETF

DRV – Inverse on the MSCI Real-estate Index ($RMZ)

FINZ – Inverse to the Financial Services Index

GBTC – Bit coin Investment Trust

ESO – ESO Crypto Currency

JNUG – Junior Minors Gold ETF

ZZZOF – Zinc Mine

YANG – China Bear ETF

TMV – 20 Yr Bond Short ETF

USLV – Silver ETF

VXX – Vix Index ETF

DISCLAIMER: The following article is not meant to be taken as Investment advice. Any and all suggestions, statements, or assertions are solely the opinions of Jay Steele and are provided for informal, educational, and research purposes only. Any actions taken by you, the reader, are entirely your responsibility. You are encouraged to seek professional Investment council with a licensed Investment professional before engaging in any potentially risky behavior.

Congratulations @jaysteele! You have received a personal award!

Click on the badge to view your Board of Honor.

Congratulations @jaysteele! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!