THE SECRETS TO SAVING MONEY AND WHY YOU SHOULD DO SO

Do you have this desire to save money but you end up not having any?

Or

Do you have a monthly salary coming in but you cannot get to start saving money because you think what you earn every month is never enough?

I have some key answers to that.

You see, it is so easy to loose yourself getting tempted to spend on unnecessary things,..

Especially when you are exhausted at work and you have this feeling that you need to reward yourself at least.

You find it so hard to save money when you are just a generous fellow with a benevolent heart to help out your family and love ones.

I have been to that feeling. And guess what. It only lead me freaking BROKE..

I am not saying to you that you must be selfish to your love ones by being stingy with your money. What I’m telling is you have to set priorities.

Imagine ...

if you have no money left for yourself, how are you going to help them back. If you don’t pay attention to your basic needs first, how can you ever help on their basic needs in return.

You cannot fill another cup with an empty cup. That make sense.

In a nutshell, if you don’t have savings, how can you have a reserved bullet in times of war?

You are the weapon, your savings is your bullet. ..

Before I get down to talking about how to save money effectively, let me just enlighten you why you have to save money not only for yourself.

YOUR JOB IS UNRELIABLE

Are you working on a job you hate?

Do you find yourself easily get into trouble with your workmates or your boss?

Then it’s time for you to establish a safety net once your job itself is going to kick you out suddenly.

Basically, you cannot please anyone, not even your boss, and your clients.

It is inevitable that you may not suffice their expectations of you. Because all people are not perfect, all people are capable of committing minor mistakes at work.

You may be just accustoming yourself or assimilating into the work culture at the moment.

However, there are just circumstances that are beyond your control. Such as sudden laying off of employees because the company had to do it for certain reasons.

You may not see the trouble coming such as feud between you and the company you are working with and colleagues whom you misunderstood with.

They both have the power to make you unemployed in just a snap. Worse will happen if you don’t have saved enough money for you to use to find another job vacancy.

THE WORLD IS UNPREDICTABLE

No matter how secure your job may seem. There are still problems that will compromise your job security.

Even if you have acquired a regular solid position at work, your job still does not guarantee you the the security because you are working paycheck to paycheck.

Just like what happened to the world right now, when people across the world are suffering whose jobs and businesses are affected by the COVID 19 crisis.

The most of the jobs have been forced to stop because the company had to do it for the safety of everyone.

Guess what happened to unemployed folks, their last resort was to beg on the streets in search of food, and going on debt to feed their dependents because they don’t have emergency funds.

While some are not affected by the crisis, most people right now are making their way to selling things online not because of producing benefit to customers but for their own survival.

Whether you like it or not that’s the truth.

The COVID19 may have made us reflect about life in general but there is one thing that gives us reminder. It is teaching us how to save for the rainy days next time we encounter an arduous crisis like this.

OUR GENERAL HEALTH IS UNRELIABLE

Have you ever heard of the term : “RAT RACE?”

In a nutshell , you are on the rat race right now.

You are living pay check to paycheck that means the moment you stop working, you stop earning money.

So if you get sick haphazardly, you have to stop working and so is your income.

If a machine gets worn out as years go by, so is our health.

We are not immortal beings that are incapable of getting sick or capable of defying death.

Overtime, we get older and weaker at the same time. Time will come we get easily ill while at work especially if you had been doing your job for several years.

Therefore, we must have savings to plant wise investments which will benefit us in the future.

————————————-

DISCLAIMER: Now that you have realized the importance of saving, you may be wondering how to start. You can actually search over the web on how to save money, you can even read some books about it. But the following methods I’m gonna show you are the proven effective ways that worked for me and for most people I know.

So here are the life hacks on how to save money effectively:

THE POWER OF HABIT

Some people say thats saving money is so difficult especially if you don’t have that much salary every month, and saving is only for those who have no financial responsibilities.

That is not true.

Wouldn't you know that you can actually save money despite of having a minimum wage?

Th truth is it is not how much money you save every month but it's all about maintaining that saving habit every month.

We are creatures of habit.

If you keep on doing that action over and over again you get accustomed to doing it. That action itself becomes a habit if you keep on repeating that.

The same as saving your money per month. Start allocating at least one peso per month. It may sound ridiculous at first.

“What can you actually benefit by just saving a coin every month?”

When you keep on doing that habit, you’ll get unsatisfied with how small it is so you increase that amount gradually. Until such time, you find yourself saving bigger amounts every month.

You can do this the other way around.

Let's say you are earning a certain amount of salary per month. Allocate a certain percentage of your salary to put on your piggy bank. It all depends on how much you want to put aside as long as you are maintaining that habit.

However, you must habitually do this BEFORE spending.

If you only save after spending, you may lose control of yourself. Thus, it might be too late to realize you’ve got to save!

DELAYED GRATIFICATION

Saving money is nothing more than having self discipline.

It is so easy to get tempted to spend anytime you want and as much as you want but if you are willing to sacrifice your personal pleasure, you will never fail.

One of the secrets to saving money is practicing delayed gratification.

If you know what you are saving money for and how much you badly need it the future, you will beat the spending temptations around you. You must allow yourself to sacrifice a bit , so that you are going to thank your future self and you get to achieve what you want.

Let’s say you wanna buy something expensive while not going on debt. What you need to do is allocate a certain money every month to save up funds that will buy what you want. Be it something you want to have as a reward to yourself.

This method applies also in building up savings for your future. If you are aiming at having a comfortable retirement by the time you get old, might as well you gotta start saving by now and start controlling your unhealthy spending habits.

KNOWING WHAT YOU ARE SAVING FOR

Delaying gratification which is mentioned above boils down to knowing your reasons why you save money.

You have to know what you are saving money for or else you’ll lose yourself in the process.

You might have tried saving some on a piggy back but you ended up breaking it to buy frivolous stuff.

It's because you don’t know the reason behind why you are dong it in the first place.

It is not bad to save money to buy something you like as what I mentioned earlier. But if you don't put label on your savings it is definitely hard to start off.

When you start saving, try putting label on your piggy bank or a savings can.

In that way, you are aware where your money goes. By doing it, you are disciplining yourself to stick on saving habit.

In the real world, if you are heading to financial freedom someday, you gotta have these three savings account:

CALAMITY FUND, EMERGENCY FUND AND RETIREMENT FUND. You can search further about these 3 must-have funds in your life on the web. But let me just unpack these the simplest way:

Calamity Fund is a savings that you will use if unforeseeable problem occurs, such as Natural Disasters, if you are being robbed, to repair a broken down car, sudden hospitalization or sudden death of a family member, etc. It is the amount of money which you can use for the situations that are beyond ur control

Emergency Fund is a savings account which you can use to cover your basic needs for several months. Such as sudden unemployment, if you’ve been fired by your boss, a fund to use to apply for another job, to feed your unemployed love-ones in COVID 19 crisis, and so on.

Retirement Fund is a savings account you can use at your old age or when you choose not to work anymore. This is basically Your Financial Freedom Account.

REWARDING YOURSELF

This may hit you really hard.

Saving money can get extremely boring if you found yourself living like a pauper. The reason why people fail to saving money is that they feel they are sacrificing “way too much”.

They feel they are being too hard for themselves which is why some people will loose themselves by breaking down the piggy bank to suffice pent up desires.

As I mentioned earlier, it doesn't matter how small money you save as long as you are starting off the habit.

Now, what you are going to do is to reward yourself each time you do the saving. You can reward yourself by spending a certain amount of money to buy the food that you want or a small stuff you want to acquire.

You cannot be guilty by doing this as long as it is inexpensive and affordable.

In short, you have to have FUN SAVINGS ACCOUNT.

It doesn’t matter how much you allocate for your pleasures. The purpose of doing so is to “make saving money fun and exciting”

In that way, you don't get bored.

There is no such person who doesn't have personal guilty pleasures in life. And if we don't fulfill them at least at the minimum, we get miserable.

We will feel as if we have no freedom at all if we curb those little pleasures.

Do this every time you find your savings slowly building up. So that you get more motivated in saving money.

SIMPLIFICATION

The reason behind that is “they are living an expensive lifestyle over what they can basically afford”.

Most people I know are keeping up with the joneses, not wanting to get left behind by their peers, not wanting to seem obsolete in their outward appearance and not wanting to be oblivious with the latest trends.

As a result , they go broke.

The sad truth is people do not realize to themselves that they have been pleasing people they hate, they buy things they don't need and tHey are living a lifestyle based on other’s approval.

They buy expensive cars when they still have a functioning one.

They buy branded clothes to seem FASHIONABLE in the eyes of haters they want to compete with.

They eat out on expensive restaurants to flaunt on social media.

They buy expensive house to seem rich.

They buy basically anything expensive that will tell other people in a subtle way that “hey, i am successful”.

Buying luxuries is not a problem as long as someone can afford buying those many times without getting broke. Even if they don't get paid for several months.

Don't get me wrong.

But if you are living off paycheck to paycheck, might as well you’d better be living below your means but within your needs.

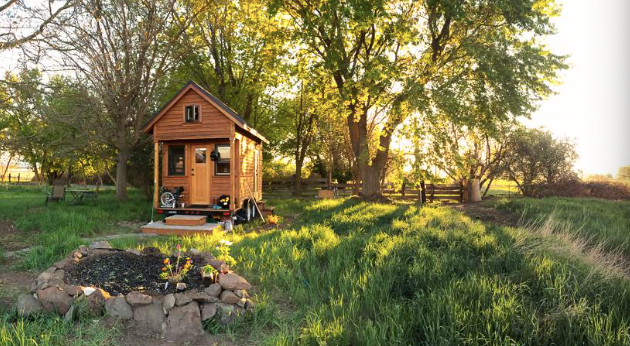

The secret to saving extra money is to live simply. Live a simple life in a way you can save spare amount of money.

You must change your perspective about being successful. You must define for yourself what being rich is to you. Not from the other’s definition.

And lastly, quit comparing yourself to others. Just live the life you envision . The life you want to live in as long as you are living a comfortable life.

Last but not the least…

RECALLING THE “HARD DAYS”

Have you experienced a moment in your life when you were starving and you had no money to buy food?

or

Have you ever been extremely broke, when you had a serious money problem and yet no one out there was willing to help you out?

That must be your serious incentive to save money by now.

If you’ve never been to that miserable situation. You are lucky. But this serves as a piece of advice for you to not experience that misery in the future.

There are problems arising which are beyond our control. Oftentimes they overwhelm our wallets. There is nothing more miserable than not having money in desperate times, especailly if you and your love ones are starving. It is a harrowing ordeal that you don’t want to ever experience.

In order to be safe from that problem, you’d better start saving or get caught up with serious misery.

Saving money is often an overlooked and underestimated habit. People do not realize its importance until serious money problems hit them hard.

One of the best thing about saving money is that it serves as your safety net in case of emergency. It will give you confidence and peace of mind if ever a huge problem comes across you.

Each time you save money, you are also buying a certain amount of FREEDOM for yourself.

You will make sound decisions in your life in general.

It will make you live a quality life in your own terms.

If you have enough savings, you will not be desperate to pick the wrong opportunity. You will have more choices, you will have more freedom on how you live your life.

Image Source: GOOGLE.COM