Once a Debter: How We Paid off Our Credit Cards ($25,599.34) Without Paying Too Much Interest Within 2 Years

We live in a society where most of us have at one time or still are in debt. Debt is becoming a normalcy but it really needs to be seriously discussed since it's hurting you more than you may realize. It's stopping you from really saving for yourself and investing in your future.

LET ME FIRST EXPLAIN TO YOU HOW MUCH MONEY CREDIT CARD COMPANIES MAKE OFF OF YOU. It's essential to see the big picture to motivate you to pay off your debt. If you want to skip this section just go straight to five paragraphs below and in bold HOW WE PAID OFF OUR CREDIT CARDS IN 2 YEARS WITHOUT PAYING TOO MUCH INTEREST :

Do you want that BMW? If you were in living in any other country, the chances are the BMW was paid in full. Meaning the owner of the BMW has money (translation rich since that person can drop $35,000-120,000) but in the USA since anyone can lease, rent, or be put on a payment plan, it doesn't necessarily mean that person is rich. It just means that person is in debt. Although, the interest in car payment plans can be pretty good (if you have good credit you can get 0% interest - 3%), a credit card is something completely different (looking at 10% - 22%)

So when people are purchasing multiple things and putting it on credit, they get use to the idea of paying a minimum payment. Then they put it behind their minds because the minimum payment doesn't seem to effect the overall big picture.

So let's create a quick scenario. You have a credit card balance of $10,000 and the interest rate is at 10%. Your minimum payment is 2% ($200). It would take you 286 months (23 years) to pay off your entire debt and you would have paid $6,831.31 in interest (since you are paying an extra 10% each month!).

You can look at it as if you paid an extra 68% for everything you purchased. That $10 meal turned into a $16.68 meal. The outfit you purchased for $100 you thought was on sale turned out to be $168. Doesn't sound so good anymore does it? Also I was giving the calculation for the interest rate at 10%. The average is about 15%. IF I redid the entire calculation at 15% at a credit balance of 10,000 and paying the minimum 2% it would take 424 months (35 years) to payoff and you would have paid $15,851 in interest! Imagine if you were paying yourself that interest! Credit cards can be useful (like for traveling) but when you are paying interest you are just making the credit card companies richer. Every wonder why they spend so much money sending you applications to sign up with their credit card? It's because they are very profitable in the interest that you owe. They want you to make the minimum payment.

You can check out this calculator at http://www.bankrate.com/calculators/managing-debt/minimum-payment-calculator.aspx

Check for yourself so you know what you are getting or have gotten yourself into. Knowledge is power.

HOW WE PAID OFF OUR CREDIT CARDS IN 2 YEARS WITHOUT PAYING TOO MUCH INTEREST

I never thought I was going to be in this situation, after all I was too smart. My husband and I just purchased our home and it was great achievement for us. We wanted to remodel it and so we made repairs because to us making our living space to our ideals was an investment in ourselves. However, we got a carried away and decided to make some purchases on our credit cards. Why not we thought? We were responsible and had good jobs. It's not a problem to"rewards" ourselves a little bit.

Fast forward, we let things slip and we made the minimum payments. Months went by (14 to be exact) and I noticed the bill was basically the same as it was before. How was this possible? Shouldn't this have been paid already? We are both responsible but somehow this felt wrong. See the thing was, we had never used our credit card in this way before. We usually put our health insurance and phone bill to automatically be paid by the credit card and paid it in full. However, because the card had almost been maxed out, we paid the same amount but it turned out it was just covering the health insurance and phone bill. We weren't really paying the extra we had put on it and not only that, but interest was accruing and it was about to really max out the card balance. We used a credit card calculator and realized that we were putting ourselves in a bad situation. We want to save not be taking our hard earned money to pay credit card companies interest.

Now I must point out a few things. My husband and I both have good credit. This was something that happened to us after our home purchase. We also only have had two open credit lines so the method I'm about to explain will only work if you don't already have too many credit lines.

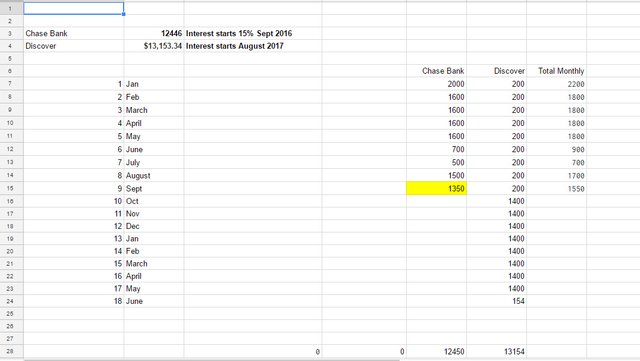

We looked at balance transfers that allowed 0% with a transfer balance rate of 3%. After our balance transfer, we owned $25,599.34. We had to look into two different other credit card companies to do this. We struggled but were approved for a Chase Bank Card at 0% APR for 12 months and a Discover Card that gave us 18 months 0% APR. We spent the first three months of our lives making a lot of changes (so we lost 3 months on the Chase Bank Card). I'll write a post later on how to minimize everything to save money.

We created an excel sheet. So we know that we have to put most of our money to pay off the first credit card which the 0% will end. Here is our spreadsheet:

Okay so, we have paid off one card completely: the Chase bank. We have four more months to pay off our Discover Card. A total of 17 months in our plan. We even have a little time leftover. But we really don't want to be put into that situation ever again. Had we stuck with the minimum payment at 17% interest we would have taken 692 (almost 58 years!) months to pay off and paid $60,909.61 in interest! That's crazy!

A few other things to keep in mind is we were really aggressive because we did not want to pay anymore interest then we absolutely have to. I'll write a post on how I minimized everything. Also we have dual income so it helped a lot. But it's very possible if you want to make a change you can.

If you enjoyed this post, please subscribe @theminimalists !

I'm always open to suggestions of what to write about and feel free to reach out anytime!

Thanks!

Thanks for sharing your story! I'm sure many others are in a similar situation and will greatly profit from your experience!

You are welcome and thank you for reading. I really do hope to help out as much as I can! =)