What makes a person qualifed for a mortgage?

View the original post on Musing.io

Most people are aware of the benefits of owning a house, but most of these ones don't know what it takes to buy a house. There is a lot of misinformation about mortgage deals but I'll be listing and discussing the basic four(4) factors that determines ones qualification for a mortgage loan.

Most people are aware of the benefits of owning a house, but most of these ones don't know what it takes to buy a house. There is a lot of misinformation about mortgage deals but I'll be listing and discussing the basic four(4) factors that determines ones qualification for a mortgage loan.

Factor No1

CREDIT STATUS:

This is the most important thing to be considered when determining if you qualify for a home loan. Unfortunately, this crucial factor isn't known by many today. The history of your credit is what the lender will examine before any loan is granted in order to ascertain if you will payback the money they lend you.

Credit scores will be used to determine if a person qualifies for a loan and the amount of interest to be paid too. For most mortgage banks ,the scores range between 350(low) to 850(high). Lenders also want to check if you have taken a loan in the past 12months and if you made a late payment more than once, if so, you might have difficulties gaining the loan.

Factor No 2

EQUITY (DOWN PAYMENT)

A 3.5% sales price minimum down-payment is acceptable for a mortgage loan. This enables one get an FHA loan. When buying a house, remember also that you do not need money only for the down payment, but for other settlement fees as well.

Factor No3

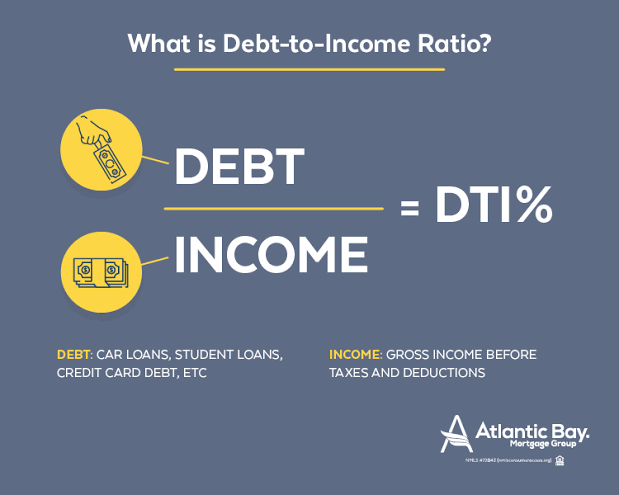

DEBT-INCOME RATIO(DTI)

This is simply your fixed expenses compared to your gross monthly income. Typically, lenders want to see that you spend less than 50% of your gross monthly income on fixed expenses which exclude utilities, phone and cable bills. Lenders will also verify your past two years of employment to ensure you have a good reputation at your place of work.

This is simply your fixed expenses compared to your gross monthly income. Typically, lenders want to see that you spend less than 50% of your gross monthly income on fixed expenses which exclude utilities, phone and cable bills. Lenders will also verify your past two years of employment to ensure you have a good reputation at your place of work.

Factor No 4

ASSETS

Lenders will verify that the allotted money for your down payment is in a liquid state, i.e, you will be needing a savings or checking account. In addition to the cash you would use for the down-payment, there is also a requirement for cash reserve. This varies from among lenders and it paramount to the kind of financing you are trying to get.

In summary, these are the basic requirements you need for a mortgage loan but in addition, it is advisable you contact a proficient mortgage lender in order to know about some other ethics of the deal.

Congratulations @essiential! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP