TRADING S&P 07/14/2017 Daily insight, S&P futures, ES

This is my daily preparation for S&P futures (ES) trading and it is for your educational purpose only and definitely cannot be considered as financial advice. There is a substantial risk in derivative trading and it might not be suitable for you. Don't rely on past performance as it is not indicative of future results.

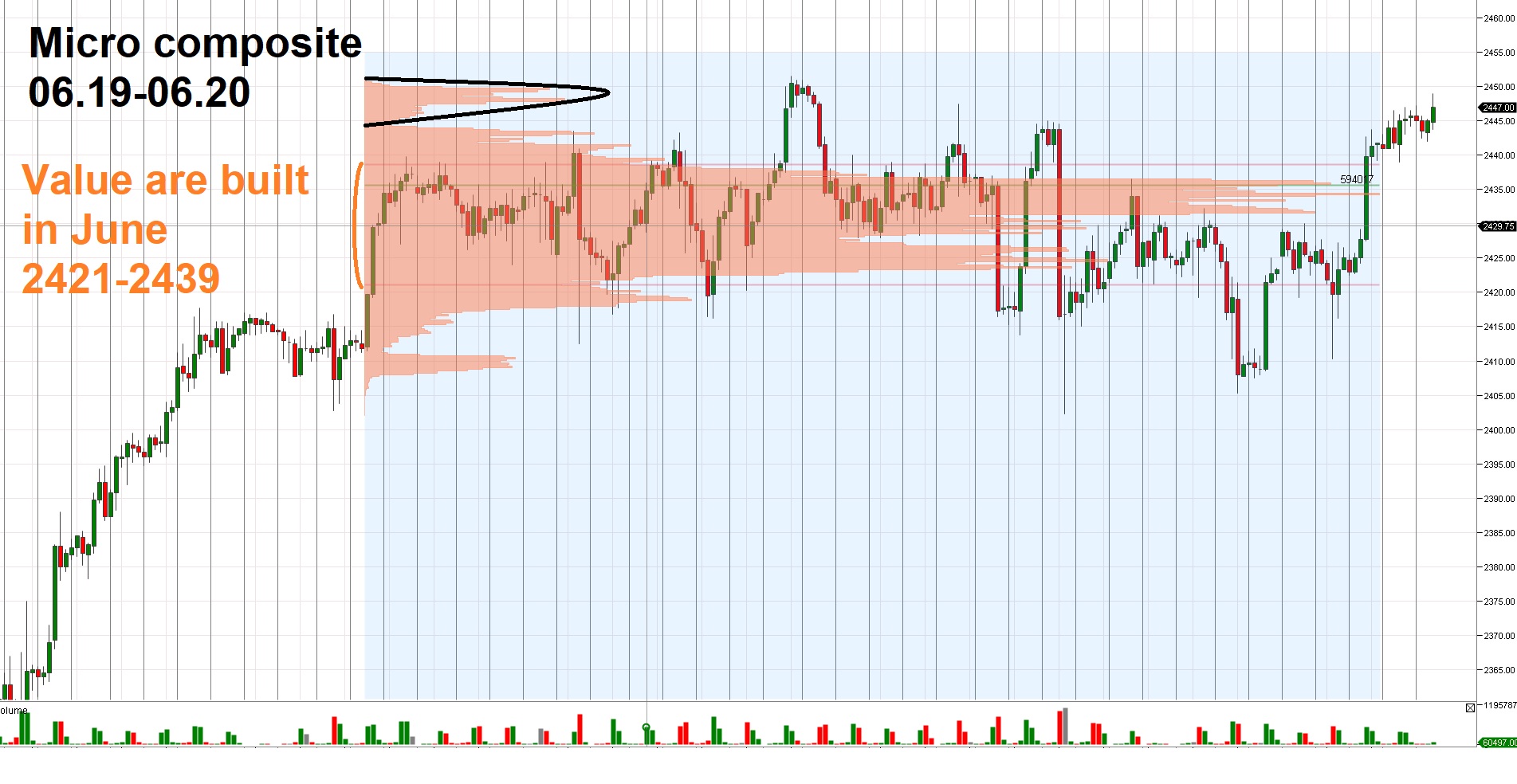

Yesterday we were trading above value area that was built during June, but market failed to reach 2447.5 level and was in balanced state despite high volatility on Tuesday and Wednesday. Relatively low volume opening didn't allow the market to get above 2445, which was perceived as a sign of weakness by short term traders who actively sold down to 2439, which is also high of June value area. Lack of participation of mid-term traders at yesterday's low and short covering of daytraders returned the market back to the daily value area, resulting in weak bottom. After this, market made another attempt to reach 2447.5, but was able to reach only 2446.5 and continued to build volumes around 2445 for the most of the day remaining in tight range between 2444-2446, market made the final push towards 2447.5 before the close, but accomplished only 2447.0 level.

As a result, market instead of continuing towards 2447.5 and new all time highs started to fill in the space between the micro composite built on 06.19-06.20 and major value area. On one hand, this show that longer term players were passive yesterday. On the other hand, volumes started to build above major value are and sellers were not as active, as I was expecting.

As of today, it seems that we are likely to open slightly above yesterday's range and POC (point of control). Considering that ES had much weaker reaction on 8:30 Retail and CPI numbers in comparison with Nasdaq, Bonds and Gold futures. Based on this, my primary expectation is that market will return to yesterday's daily range and most trading will occur between 2439 and 2447. Considering that we above June value area and close to all time high, I will be more active in buying lows. In case of large volumes at the highs, I might also try selling, but will keep my stops tight.

Considering the critical prices we are at, markets ability to reach 2449 before market open lots of liquidation might evolve above 2449 level and might result in more decent move up. Most resistance above yesterday's range is expected between 2448.5-2450. If it will not hold with there is a good chance for potential rally for the rest of the day and new all time highs. If we break below 2439, we are likely experience a quick move down to the level 2428.

Congratulations @egoism4beginners! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP