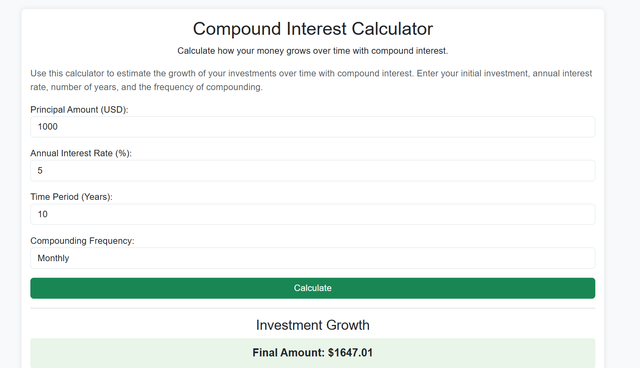

Compound Interest Calculator

The compound interest calculator is a powerful tool designed to help users understand the growth of their investments through the concept of "interest on interest." Here's a detailed review of its features and functionality:

Ease of Use: The calculator features a clean, user-friendly interface with clearly labeled fields for inputting essential information such as the principal amount, interest rate, compounding frequency, and time period. This simplicity makes it accessible to individuals regardless of their financial expertise.

Educational Features: The tool provides clear explanations of each term, ensuring that even those unfamiliar with financial jargon can use it effectively. Additionally, it offers visualizations of results, such as graphs showing the growth of investments over time, enhancing comprehension.

Accuracy and Versatility: The calculator accurately applies the compound interest formula. It supports various compounding periods, including monthly, quarterly, and daily, making it versatile for different financial scenarios. However, it currently does not account for fees or taxes, which are important considerations in real-world investments.

Target Audience: This tool is particularly beneficial for individuals planning long-term investments, students exploring financial concepts, financial planners, and educators. It serves as an excellent resource for understanding and demonstrating the power of compound interest.

Limitations and Considerations: Users should be aware that the tool presents ideal scenarios and may not reflect real-world complexities. It is advisable to consult with a financial advisor for personalized advice and to consider real-world factors such as fees and taxes.

In summary, the compound interest calculator is an invaluable tool for anyone looking to plan and understand their investment growth through compound interest. Its simplicity and depth make it a valuable resource, but users should remain mindful of its assumptions and seek professional advice for comprehensive financial planning.