Markets Are Rich: Where To Find Value

The CAPE ratio measures the price of stocks divided by the average of ten years of earnings (moving average) and adjusts that for inflation. A high CAPE ratio often results in low returns in the subsequent decade. Only the 1999 tech bubble exceeded the current CAPE ratio by much.

The GDP to Total Market Ratio is another valuation measure, aka the Buffett indicator, that is at a very high level. The Wilshire Total Market, containing 5000 stocks, serves as a proxy for Total Market. The Wilshire’s total market value is exceeding GDP. Previously total market value exceeded GDP in the late nineties and just before the 08′ financial crisis.

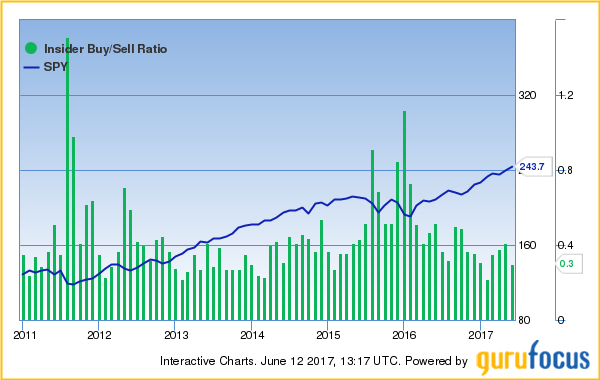

Insider buying and selling doesn’t just betray performance on an individual stock basis. It makes sense that if the indicator works for individual stocks, it should work for the market as well. Insiders are sellers on average. The average long term buy/sell ratio comes in at 0.4. We are currently below that level and have been since the fourth quarter of 2016. Insiders are bearish. The only sector where buying is very strong is the depressed energy sector. Energy insiders are on average big buyers compared to other industries with a long term average buy/sell ratio of 0.54 but the current 0.9 is still significantly above their average as well.

Companies and CEO’s are often criticized for buying back stocks at elevated levels or just before the stock crashes. As a population CEO’s buybacks do add value in the aggregate. They buy stock to boost EPS and hit their bonuses but they also buy stock when it’s opportune.

I try to differentiate between the two by investing in companies where the CEO owns shares instead of stock options. Buybacks are still at fairly high levels. We haven’t surpassed 2007 levels but we are fairly close.

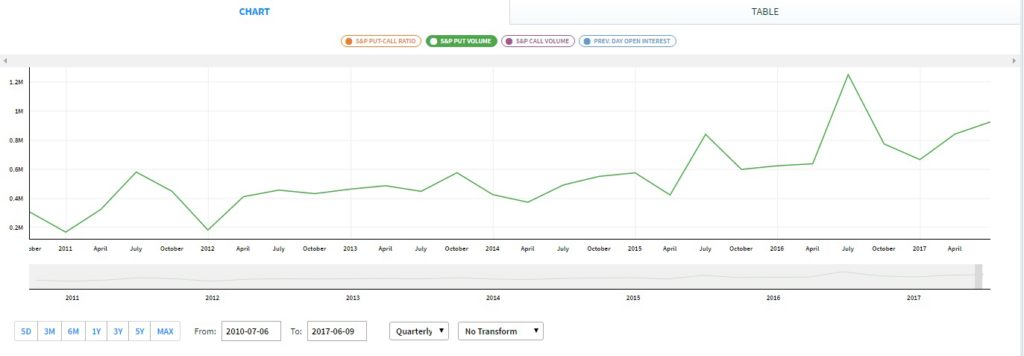

High put volume indicates low future returns (Kang e.a. 2016). Put volume is quite high. It also happens to be the case that call volume is fairly high. Both put and call volume up indicates traders are expecting volatility.

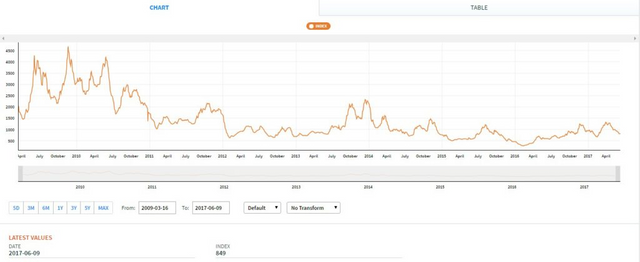

The Baltic Dry Index captures the market pricing of dry bulk shipping. Dry bulk shipping rates can rise fast when there is a supply/demand mismatch between available vessels and demand for dry cargo. When rates go up this indicates construction is going to pick up. The index can also go up due to high scrapping rates or few new vessels entering the market. It’s still sort of mute and will probably remain so until the BRIC’s really get going again. Countries that are a little bit earlier into their development require a multiple of what mature economies require in terms of commodities.

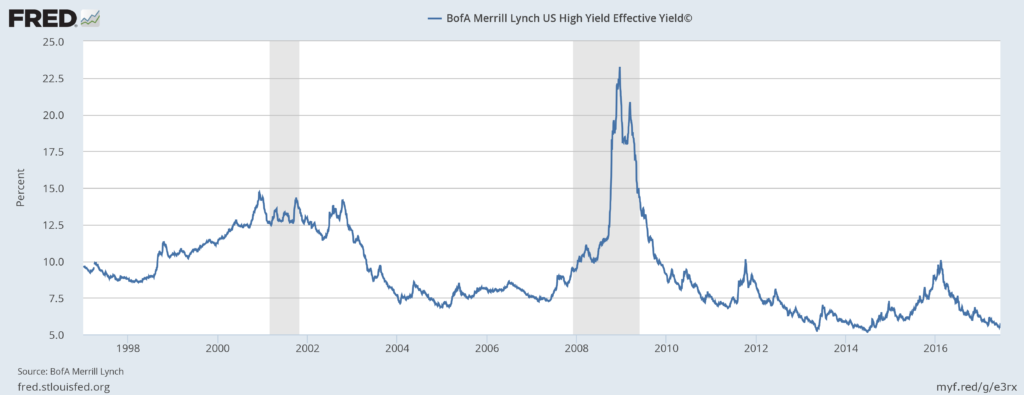

High yield bonds are at record low rates. Lyxor BofAML $ High Yield Bond UCITS ETF follows the Bofa Merrill Index and it has a duration of around 5. Modified duration is quite a bit lower but still that means a year of returns are wiped out if interest rates move up only one percent. Grabbing 5.5% on a basket of below investment grade bonds just seems like a really bad deal. It gets even worse if the exposure is acquired through ETFs. The underlying bonds aren’t liquid enough and in a sell-off the bag holder will take losses he or she likely did not anticipate from a bond fund.

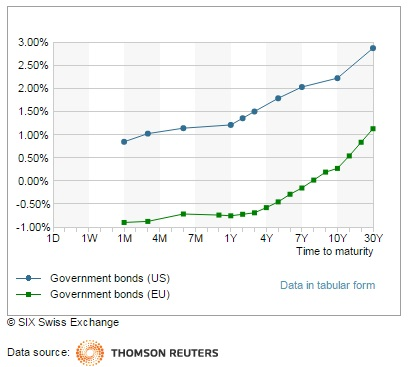

The yield curves in the U.S. and Europe show how bad it really is. U.S. interest rates have come off of record low interest rates a little bit and at 5 years they sit around 2%. With below investment grade bonds you are picking up just 3.5% of excess returns before factoring in defaults. Default rates are extremely low currently but that’s unlikely to remain so if interest rates pick up.

Yield curves U.S. vs Eurozone

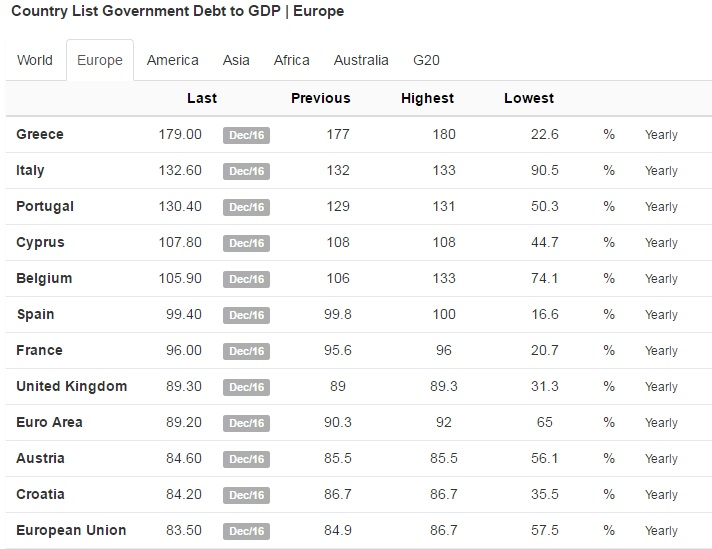

Ownership of European government bonds is lunacy. The Eurozone includes countries like Italy, France and Spain. These are not just highly indebted but very large economies as well. Any struggles here will have an effect on the Eurozone. Larger debtors are overrepresented within ETF’s. These issue debt in volume and the ETFs just mindlessly pick up a share. Under Solvency regulation, enacted after the financial crisis, institutions are incentivized to hold government debt. Easy money if you can get it.

Debt to GDP in the Eurozone 2017

Positive notes

When we go back to CAPE and aggregate valuation ratios, much more interesting companies are found in Russia, Czech, Turkey, Brazil, Korea and China. Valuations can be explained by 1) questionable leadership, 2) are engaged in conflict or have the potential to be 3) are in the middle of significant political turmoil.

To a few countries all of the above apply. Buying exposure to all of them can be justified but especially Brazil, Korea and Czech stand out to me. Their problems appear more fleeting. Now, finding the actual really great opportunities from the bottom-up within these countries, that’s a whole different story.

Increasing exposure to energy seems another good way to approach the current markets. Energy being the only industry where insiders were buying at an above average rate. There are few other explanations besides a relatively bullish outlook on prices. Russia and Brazil are well known for their giant energy producers which may well be priced at a double discount. Once for country specific problems and once for being in energy.

With this clearly not being a time for bargain hunting it is potentially very interesting to search out companies with the highest net cash balances. Preferably not just companies that are waiting on the governments next tax holiday to return cash to the U.S. but that are actively hoarding buying power in order to score when the cycle turns. Companies run by owner/operators and run by families could be a good start. One area I find is particularly attractive is private equity and other asset managers with large hedge fund or emerging market exposures.

My position on gold is the same as it is for other metals. Everyone should have a little bit of exposure at least. This is an especially opportune time, at least for base metals, as commodities will likely benefit most portfolios into monetary tightening cycles. Note that I’m not saying there will be a tightening cycle but a substantially expansionary one is no longer an option. Over the past ten years gold miners, both juniors and seniors, have underperformed the metal.

Chart

GDX Total Return Price data by YCharts

It could be that the growth among royalty companies, which provide financing to miners, may have had a favorable impact on miner dynamics. Royalty interests and streaming agreements take away from the upside but they aren’t as punishing on the downside. This industry has been expanding rapidly and are an important component of financing mines nowadays. The recent multiyear downturn in mining has also decreased exploration and CapEx spending to a point where capacity isn’t expanding much anymore. In some cases, like Zinc, supply is shrinking. I wouldn’t buy the GDX or GDXJ as the ETF format doesn’t work very well with, at times, illiquid stocks. An alternative if you don’t want to spend a lot of time on due diligence in the space is to ride the coattails of the PROs. Earlier this year I put together a table listing gold miners held by savvy, experienced investors with admirable track records like Dalio and Paulson.

Avoid

High yield ETFs

Government debt and especially Eurozone government debt

S&P 500 / U.S. large cap market

Opportunities

Brazilian energy companies

Russian energy companies

South-Korean stocks

Czech stocks

Companies with high-net cash balances and owner/operators at the helm

Mining stocks

Commodities

Originally posted here http://bramdehaas.com/ but I figured there could be 1 or 2 Steemians who like to think about this stuff.