The 100 Year Mortgage Amortization Period Coming To A Suburb Near You!

If interest rates continues to rise for millennial home owners, they may be forced into a 100 year mortgage term.

Image source: Political Cartoons. 27 February 2008. Web. 22 July 2017. politicalcartoons.com

According to the MNP Consumer Debt Survey more than half of Canadians are $200 a month from paying their debt obligation. This doesn’t leave much room when renegotiated the mortgage term for the amortization period. The average home price in Canada is reaching $660,000, and the average salary in Canada is almost $50,000 a year: one could take a pretty good guess that Canadians are reaching their monthly debt and housing expense limit. If the lessee has mortgaged his home at the max total debt service ratio to disposable income when interest rates were lower. The lessee will be forced to increase the amortized period of the loan after the 5 year term.

Let’s take a look at an example if your average Joe/Jane purchased their home and is unable to afford the increase in interest rate payments.

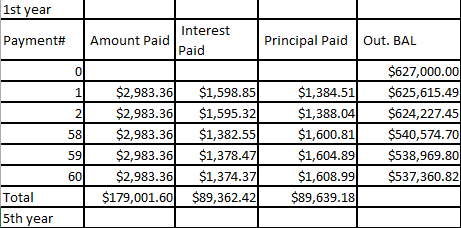

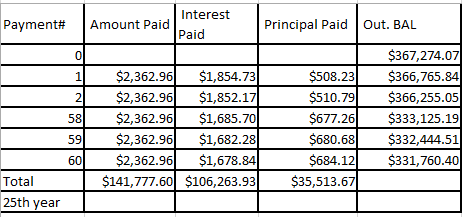

Joe/Jane finances a home for $660,000 with a minimum down payment of 5 percent. The mortgage will be finance at a 5 year term fixed rate of 3.06 percent with a 25 year amortization period.

Calculation: (PV= 660,000 – 5% down payment = 627,000)(rate (i) = 3.06/12 payments =0.255%)(compounded semi-annually)(monthly payments)

In the schedule below the first two payments and last three payments are shown for each 5 year term.

During the 5 year term the Bank of Canada raises interest rates 0.75 points to cool the housing market. The recent rate hike will increase Joe/Jane’s monthly payments, and surpasses Joe/Jane’s total debt service ratio (TDS). In order to keep their home they will have to renegotiate the amortization period to 25 years (30 year total including the 5 year term).

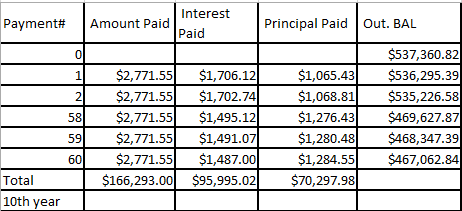

The mortgage will be financed at 5 year term fixed of 3.81% (3.06+0.75).

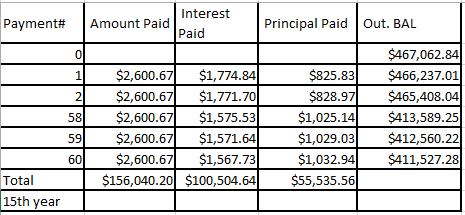

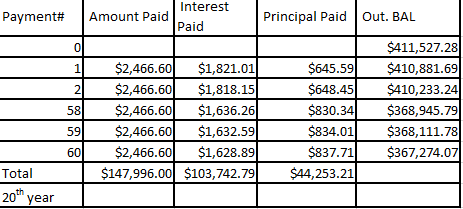

Notice in the amortization schedule that at the beginning of the period, the majority of the payments (amount paid) goes toward interest paid. As interest rate increase and the continuous renegotiating of the amortization period increases, the amount contributed to Principal Paid will decrease while the amount contributed to Interest Paid will increase. (The larger the down payment the less the lessee will pay in interest paid)

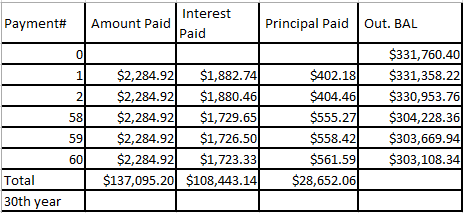

With the economy “recovering” the Bank of Canada begins slowly increasing interest rate 0.75 points every 5 years to begin normalizing interest rates. (From 1984 to 2017 Canadian average 5 year fixed rate 7.37%) http://www.mtgoptions.ca/mortgageratehistory_000.php

Any increase in household costs due to inflation will decrease real income. Allowing for your average Joe/Jane to not meet the required total debt service ratio (TDS). Joe/Jane must renegotiate the amortization period to another 25 years, totaling 35 years with the past two previous terms. With a rate hike every 5 years, if Jane/Joe does not meet the TDS ratio they will be forced to continuously renegotiate the amortization period to 25 years at the end of every 5 year term in order to keep their homes.

Rate hike 0.75 points. (3.81+0.75=4.56%)

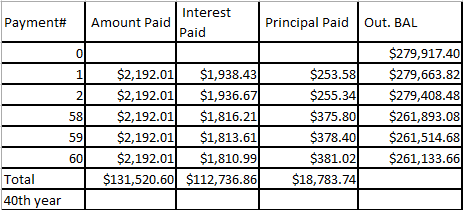

Rate hike 0.75 points. (5.31%)

Rate hike 0.75 points. (6.06%)

Rate hike 0.75 points. (6.81%)

Rate hike 0.75 points. (7.56%)

Rate hike 0.75 points. (8.31%)

This example could technically go on for 50 or 100 years, and will be a reality for many home owners who have financed with the maximum percentage of gross annual income required to cover their debt payments. I hope this example is an eye opener for young home owners who wish to finance their dream home with a minimum down payment and the required annual income before getting ahead of oneself.

Countries that have introduced 100 year mortgages: Sweden and Japan.

Happy 40th year mortgage anniversary!

Please leave a comment of your thoughts on the article.

Kindest regards,

The New Barter Economy

Good job on this! Now you have a new skill to develop and share with steemit!

@barter-economy

Thanks for the response. I will be sure to post more!