Half of ICOs die four months after finalizing cryptocurrency fundraiser

The year 2017 was a record year for bitcoin cryptographic currency. Valued at $ 1,000 from the beginning of January, the virtual currency has reached in the last month of the same year a value of over $ 18,000 before falling. An ascent that has not left indifferent to many people and companies.

Indeed, with the gains that some people have begun to amass by investing in these cryptographic currencies, new projects have begun to flourish around these cryptocurrencies supported by many ICOs. By definition, an ICO is a fundraising method used by a company to raise funds in cryptographic currencies from investors against the sale of tokens (tokens) in most cases and which allow investors to make gains in the event that the project became a great success.

In 2016, for example, Stratis launched an ICO to create an as-a-service blockchain platform for financial institutions. After launching its ICO in the course of 2016, Stratis raised approximately $ 600,000 in cryptocurrency. After selling 1 token at $ 0.007 at the launch of the ICO, the price of a STRAT token passed in February 2018 to more than $ 7, offering first investors a good return on investment.

But ICOs are not just success stories. The DAO, for example, which raised about $ 150 million in May 2016 by launching its ICO was talked about because of its failure. A hacker managed to exploit a vulnerability within the DAO code and took away the tidy $ 50 million in cryptocurrency out of the $ 150 million raised. In the lot of companies that have suffered a sad fate, we also have the company Tezos, which raised 232 million dollars at its ICO in July 2017. After starting its activities, the chips issued by the company have lost almost a third of their value on some trading platforms. And to add to the misfortune of the company, internal wars broke out within the company, delaying the effective start of the project.

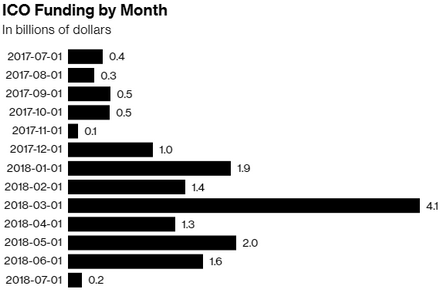

Faced with these happy and unfortunate ends linked to the ICO, the site Bitcoin.com conducted a study on the year 2017 to get a better idea of the figures related to the successes and failures of its ICOs. According to TokenData, the ICO tracker, 902 cryptocurrency fundraisers were launched in 2017. Of these 902 ICOs, 142 failed at the funding stage and another 276 failed, either because the ICO pocketed the under harvested and disappeared in the wild either because the companies are falling slowly in the darkness. In summary, of the 902 ICOs that were launched in 2017, only 484 were able to stay in the race. This represents a 46% ICO rate that went bankrupt, leaving their investors without a penny in return.

A situation that is getting worse

About 56% of crypto startups who collect money through ICOs die within four months of their initial offer.

This is the conclusion of a Boston College study that analyzed the intensity of Twitter tweets from startups to infer signs of life. The researchers determined that only 44.2% of startups survive after 120 days of the end of their ICOs. The researchers, Hugo Benedetti and Leonard Kostovetsky, examined 2,390 ICOs completed before May.

Acquiring chips in an ICO and selling them on the first day is the safest investment strategy, Kostovetsky said in a phone interview. But many individual investors can not participate in ICOs, so this option is not open to them. Yet, all investors should probably sell their chips in the first six months, if we refer to this study.

"What we have found is that once you go in the period between three months and six months, they do not outperform other cryptocurrencies," said Kostovetsky. "The best return is actually the first month."

Yields have declined over time as startups have become more savvy about the price of token offers and more people have jumped into the ICO investment. Returns of people who sold tokens on the first day they were traded fell by four percentage points a month, Kostovetsky said.

"They are much lower now, so I would not expect them to continue to decline at this rate," he said.

"People often just look at potential returns to decide if a deal is a good deal, but we teach in finance that the return is a compensation for risk," Kostovetsky said. "These are issues in platforms that have not yet been built, that have not yet participants, there are many risks, the majority of ICO fail."

I gave you a positive vote in your publication! Please, give me a next vote!

Yes of course