The Great Depression: A Banking Crisis by Design? Biblically Avoidable!

The Great Depression: A Banking Crisis by Design?

The Great Depression is often framed as an inevitable economic downturn, a natural cycle of boom and bust. But when you dig deeper, it becomes clear that key financial policies, particularly from the Federal Reserve and the U.S. government, played a massive role in both triggering and worsening the crisis. In many ways, the collapse of the banking system wasn’t just a consequence of the Depression—it was a driving force.

The Creation of the Federal Reserve and the Long Game of Financial Control

To fully understand the Great Depression, we need to go back to the origins of the Federal Reserve in 1913. The creation of the Fed was driven by powerful banking interests in response to financial panics, but its true purpose went far beyond stabilizing markets. It centralized control over the U.S. money supply, allowing a small group of elite bankers to manipulate interest rates, inflation, and currency values. This same system would later be used to exacerbate economic crises for strategic gain.

The Treaty of Versailles and the Seeds of Economic Turmoil

After World War I, the Treaty of Versailles placed crushing financial reparations on Germany, effectively ensuring economic collapse. The U.S. and its banking institutions played a critical role in this arrangement. American banks loaned money to Germany so that it could pay reparations to France and England—who in turn used those payments to settle their own war debts to the United States. This circular debt system was unsustainable, and when American banks began collapsing in the late 1920s, the entire fragile house of cards came down with it.

Meanwhile, the power struggles of this era were not limited to economic policy. The same financial forces that pushed for the Federal Reserve’s creation in 1913 were also deeply involved in shaping World War I, the collapse of the Russian Czar, and the weakening of Europe’s imperial houses. By dismantling old power structures and creating financial dependency through war debts and monetary manipulation, a new elite class consolidated control over the global economy.

The Federal Reserve’s Role: Tightening When Expansion Was Needed

The stock market crash of 1929 didn’t immediately cause the Great Depression. In fact, if banking policies had been different, it might have remained a painful but short-lived recession. But the Federal Reserve, which had been inflating the money supply throughout the 1920s, suddenly reversed course in 1929 and 1930, contracting the money supply when liquidity was needed most. This deflationary move strangled businesses and individuals, making it harder to get loans or pay off debts.

Milton Friedman and Anna Schwartz, in their seminal work A Monetary History of the United States, highlighted this as one of the Fed’s greatest failures. Instead of acting as a lender of last resort—its supposed purpose—the Fed stood by as thousands of banks failed. This inaction directly caused a cascade of bank runs, where depositors rushed to withdraw funds before their banks collapsed.

The Banking Collapse: Wiping Out Wealth Overnight

Before the creation of the FDIC in 1933, bank deposits weren’t insured. So when a bank failed, depositors lost everything. Between 1930 and 1933, over 9,000 banks failed, wiping out billions in personal savings. The panic fed on itself—each failure led to more fear, which led to more runs on banks.

The collapse of so many banks didn’t just harm individual savers; it crippled businesses, which could no longer secure loans or even access their existing funds. This deepened the economic downturn and turned what might have been a sharp recession into a decade-long depression.

FDR’s Gold Confiscation: A Bold Move Toward Monetary Control

In 1933, President Franklin D. Roosevelt took an unprecedented step: Executive Order 6102 made private gold ownership illegal and forced citizens to turn in their gold to the government at a fixed price of $20.67 per ounce. Shortly afterward, the government revalued gold to $35 per ounce, effectively devaluing the dollar overnight.

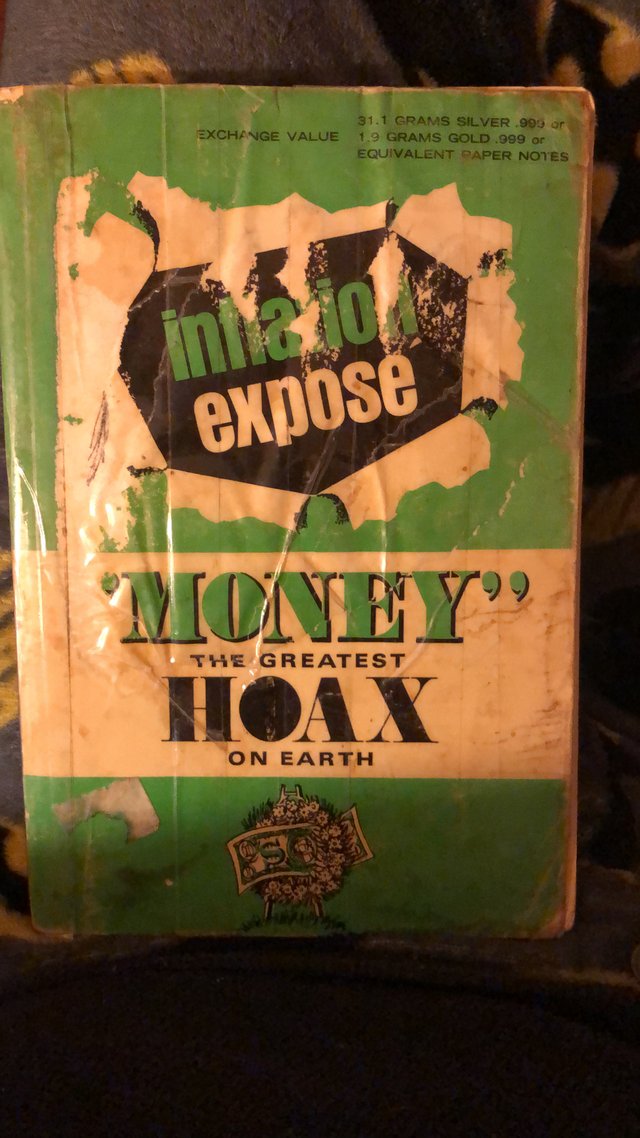

This wasn’t just about gold—it was about control. The U.S. had been on a gold standard, meaning every paper dollar was backed by a certain amount of gold. By seizing privately held gold and removing it from circulation, the government freed itself to expand the money supply without the restraint of a hard-backed currency. While this eventually helped ease deflation, it came at the cost of individual financial sovereignty.

The Great Depression: A Planned Power Grab?

Given the interconnectedness of these financial crises, it’s hard to believe they were purely accidental. The same banking elites who had engineered the creation of the Federal Reserve, influenced World War I, and orchestrated the Treaty of Versailles also stood to benefit enormously from the economic collapse of the 1930s. When the Great Depression wiped out small banks, businesses, and individual savings, major banking institutions and corporate giants were able to buy up assets for pennies on the dollar. The crisis consolidated wealth and power in fewer hands—those who had helped create the system to begin with.

This raises the question: Was the Great Depression an engineered event? At the very least, it was a crisis that was not only preventable but was exacerbated and leveraged by those who stood to gain the most from widespread economic ruin.

The Biblical Perspective: When Nations Reject Sound Principles

Scripture warns against the very kind of economic manipulation that led to the Great Depression. Proverbs 11:1 states, “A false balance is abomination to the Lord: but a just weight is his delight.” The banking system of the early 20th century was built on deception—artificial inflation, centralization of money, and government interference in markets. The shift from hard-backed currency to fiat money directly contradicts biblical principles of honest weights and measures (Leviticus 19:36, Proverbs 20:10).

Furthermore, debt-driven economies—like the one engineered through war reparations and central banking—are inherently unstable. Proverbs 22:7 warns, “The rich ruleth over the poor, and the borrower is servant to the lender.” The forced dependency created through the Treaty of Versailles, the Federal Reserve, and later, the Great Depression, placed entire nations into economic servitude, benefiting only those who controlled the system.

Throughout history, every time nations have abandoned sound economic principles in favor of manipulation, corruption, and centralized control, it has led to suffering and collapse. The Great Depression was no exception.

Lessons for Today

The Great Depression serves as a stark warning about central banking power and the consequences of poor monetary policy. The same institutions that promised stability ended up exacerbating the crisis. Today, we see echoes of these policies in modern banking practices—quantitative easing, inflation control measures, and digital currency discussions all stem from the same core principles that shaped the Great Depression’s monetary policy.

Understanding history isn’t just about looking back—it’s about recognizing patterns so we don’t repeat them. If we’re not careful, central banks and governments could once again use financial crises to justify drastic measures that ultimately strip individuals of their economic freedom.

God’s Word offers a better way—honest scales, debt-free living, and trust in Him rather than manipulated markets. If nations and individuals returned to these principles, we could avoid repeating the mistakes of the past.

⸻

What do you think? Do you see parallels between then and now? Let’s discuss in the comments below.