FED , Q2 Results , FANG , EUR/USD, Tesla

July 24

This week, Investors are focusing on the Federal Reserve, because on Wednesday the policy vote of the FED is due.

After the ECB Council meeting last week EUR/USD erased some of its recent gains,

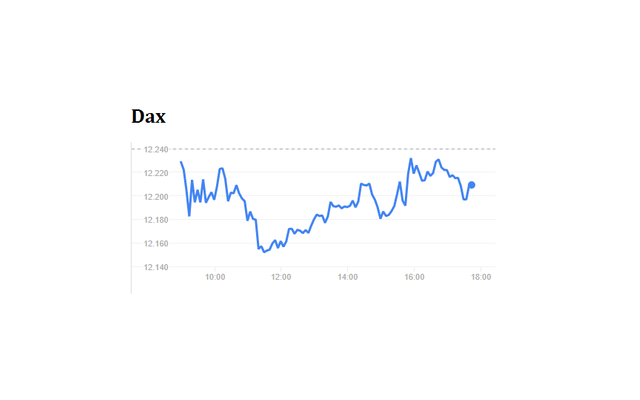

falling 0.23% to $1.1637, which on Friday resulted in a drop of the german major stock indexes.

Also german auto stocks took a hit in early trading on monday, by the cartel accusations against numerous German carmakers, the DAX droped by 1.7%.

In St. Petersburg, shareholders of energy companies such as Shell and Gazprom are looking at the meeting of the OPEC representatives and other important subsidies such as Russia.

The stabilization of oil prices is the focus. A difficult task, if OPEC's promotional targets are not met, a sharp drop in the price is likely. Ecuador has already announced its abolition of reductions.

The Dow held a modest loss with -0.2%.

This week many interesting companies including some of the FANG values present their Q2 results.

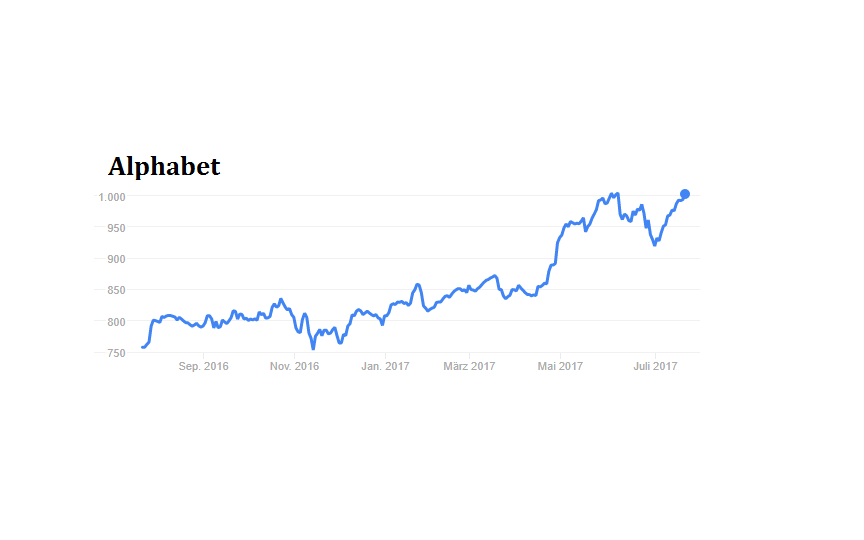

Today, the focus is on the alphabet, while Mc Donalds presents his Q2 results on Tuesday and Facebook and Paypal on Wednesday.

Thursday we are looking forward to Amazon.

In the case of Alphabet, due to the many investments made by the company, e.g. In the Cloud business and CI expected a stagnation of the result.

Revenue is expected to grow by 20% to 25.6 billion dollars

One event that I was eagerly awaiting was the handing over of the first 30 Tesla Model 3, maybe this event will give some momentum to the stock again.