Cryptography in the Crossfire: Now Ethereum is also caught

The US financial market supervision is investigating the causes of the "flash crash" at the Bitcoin rival in June. The trading platform Coinbase has to explain how it can happen that a price loses 99.97 per cent within a few milliseconds.

Intraday traders sometimes say jokingly that they sometimes do not even have time to go to the toilet. Who is trading on the trading platform "Coinbase" Ethereum, had not even more time for a lash stroke in June of the year.

Within milliseconds, the price of the world's second-largest cryptowogy behind Bitcoin fell from US $ 317.81 to US $ 10. Relatively speaking, this corresponds to a loss of 99.97 percent. But, oh miracle: Only ten seconds later the course had recovered to 310 dollars. Lastly, an ether recorded at around 290 dollars.

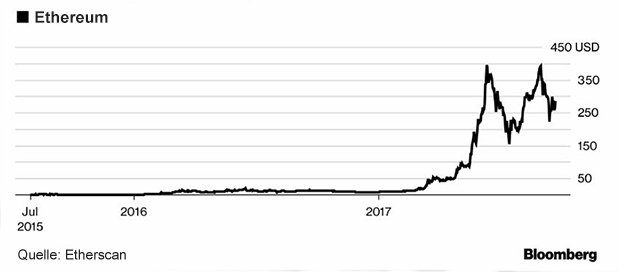

The crypt diet Ethereum, like Bitcoin, has a volatile past. The Flash Crash of June has not necessarily contributed to a strengthening of the feeling of security

The CFTC (Commodity Futures Trading Commission), which is responsible for currencies and commodities, wants to know from the settlement platform what happened. According to news agency Bloomberg, the CFTC Coinbase had made a written request regarding so-called "Margin Trades". In the case of these leveraged trades, additional risks may arise in the event of losses occurring. The market participant therefore risks not only the capital employed, but also far-reaching indebtedness. Coinbase has offered this type of trading in March to attract institutional investors who want to move larger sums. After June 21, when a $ 12.5 million order triggered a chain reaction that led to the already described flash crash,

Everything in compliance?

The problem with leveraged orders is that they can quickly penetrate trade barriers, which in turn trigger further, automatic buying or selling orders. Coinbase states: "As a regulated financial institution, Coinbase operates fully within the regulatory framework and cooperates fully with the competent authorities." Coinbase has a base of 10.6 million customers, according to its own data, and so far has allowed transactions worth 20 billion US dollars.

In fact, incidents of this kind are more likely to show the problems of the fragmented infrastructure of cryptic currency than the currencies themselves. In Bitcoin, hacker attacks on various trading platforms led to escalating volatility. Ethereum is, according to Bitcoin, the second-largest crypt diet in the world. It functions not only as a means of trans- action, but also to enable its own economic ecosystem, in so-called smartcontracts, the contractual framework of a transaction.

Congratulations @macstrong! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP