CRYPTOCOIN INSURANCE: THE FIRST OPTION EXCHANGE PLATFORM

Trading on the cryptocurrency market has already passed several development stages: from the first centralized exchanges where there were almost no volumes up to several hundred exchanges where the leaders have a turnover that exceeds one billion dollars a day. Recently the US Securities and Exchange Commission (SEC) has authorized trading of Bitcoin futures at the largest US stock exchanges. The market is getting more and more like ordinary stock and commodity markets. However, one of the segments many players and especially hedgers cannot avoid is completely inaccessible today. It goes about options.

What is an option?

An option is a contract according to which the option buyer acquires the right, rather than the obligation, to buy or sell an asset at a predetermined price during a certain period of time in the future. In this case, the option seller has an obligation to sell the asset accordingly or buy it from the option buyer in accordance with its terms and conditions. In the habitual world options are traded at stock exchanges that have a huge turnover. Usually one party of the transaction is represented by speculators who want to make a profit, while the other party is companies that want to insure their risks (for example, from a sharp fall in prices).

Benefits

An option for a share of the ZZZ Company. Today is Saturday, and the market is closed. There is unexpected good news and the stock grows 2-10 times at the opening of the market on Monday. In its turn, the option seller suffers huge losses. The advantage of the cryptocurrency market unlike the stock or commodity one is that it operates 24 hours a day. And for the whole period of its existence (about 10 years), there has never been any news that would quickly shift the price of Bitcoin or Ethereum by at least 30-50%. In fact, if it goes only about blue chips (coins), the cryptocurrency market is much safer for option sellers than other markets that we got accustomed to.

Market Volume

The capitalization of the cryptocurrency market amounts to hundreds of billions of dollars. The size of the options market for commodities and shares differs from country to country, and is 1-5% of the amount of the basic asset market. Thus, we can calculate the potential volume of the options market for basic cryptocurrencies in the amount of $50-250 million per day. However, the calculations do not take into account that options actually provide the opportunity for short sales that today cannot be carried out on cryptocurrency exchanges. This will contribute to the additional increase in the sellers’ demand for the instrument.

Problem

There is no response for shield the store in Bitcoin or Ethereum from falling. Meanwhile in this market there is extended unsteadiness that impacts people to be reluctant to store considerable funds in the cryptographic cash. Of course, far reaching associations are move back to enter the market (for example, to recognize portions in advanced cash) for a comparable reason.

Solution

The exchange will start working with 5 cryptographic types of cash that have the most extraordinary market. Additionally, as the demand and turnover increase, we will incorporate diverse computerized monetary forms. CRYPTOCOIN INSURANCE offers both Bitcoin or Ethereum advancement and fall security. In this way, it underpins its danger. No resistance in the market licenses keeping up a basic edge on the level of 20%. CRYPTOCOIN INSURANCE repackages and offers/buys its own specific danger as decisions isolated exchange.CCIN Token

CCIN tokens

CCIN tokens will be placed during the ICO. Their total number is strictly fixed. All tokens that are not redeemed during the placement will be destroyed. They will never be issued additionally. They will be placed by using the Ethereum smart contract. The fixed number of CCIN tokens guarantees their buyers the increase in their value as the exchange earnings grow. Tokens will be introduced to the cryptocurrency exchanges within 30 days after the end of the ICO.

ICO Structure

Coins Price: 3,000 CCIN coins = 1 ETH

ICO's Date: November 1, 2018 - December 27, 2018

Minimum collection amount: 0.5 million M

ICO main goal: 5 USD

Maximum collection amount: $ 10

•When placed, all symbols that are not purchased are destroyed. The CCIN coin is purchased using Bitcoins or Et

Token Allocation

•75% - ICO

•18% - Reserved for the project team

•5% - Mentors

•2% - Bounty program

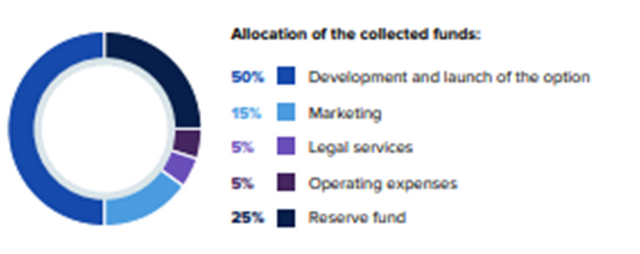

Allocation of the collected funds

•50% - Development and launch of the option

•25% - Reserve fund

•15% - Marketing

•5% - Legal services

•5% - Operating expenses

For more consequential information about this exceptional innovation, please visit the links below.

WEBSITE: https://ccin.io/

WHITEPAPER: https://ccin.io/doc/Whitepapereng.pdf

ANN TREAD: https://bitcointalk.org/index.php?topic=4948618

BOUNTY THREAD: https://bitcointalk.org/index.php?topic=4969375.0

TWITTER: https://twitter.com/ccin_official

FACEBOOK: https://web.facebook.com/ccinofficial/

TELEGRAM: https://t.me/ccin_official

Author: Ever-young

BTC Profile Link: https://bitcointalk.org/index.php?action=profile;u=1760289