The rise of bitcoin, ethereum, and other cryptocurrencies shows just how weird markets are right now

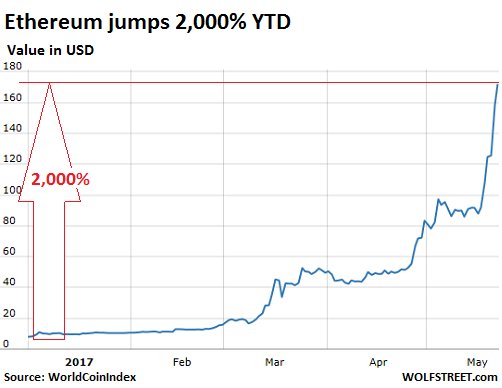

The market capitalization of Ethereum, the second biggest "digital currency," has taken off 88% of every seven days, from $8.4 billion, when I pooh-poohed it on May 15, to $15.8 billion right now. Today, the cost of the token hopped 15% to $172.26, as I'm composition this. It has soar 2,000% from January 1 when it was $8.15, and 25,000% since September 2015, when it was $0.68. A veritable marvel of making riches out of nothing (graph by means of WorldCoinIndex):

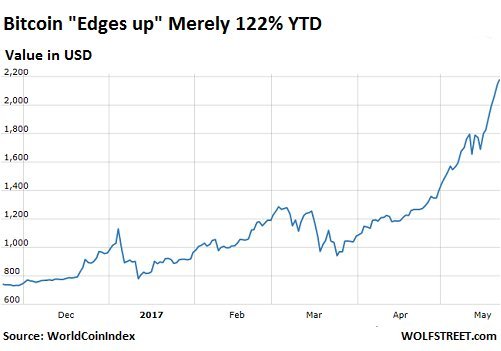

Bitcoin, the biggest of the cryptographic forms of money, is up 7% today, subsequent to taking off all end of the week. At $2,211.56 right now, Bitcoin has a market capitalization of $36 billion, up from $30 billion seven days prior. It has multiplied since April 1 and "edged up" – contrasted with a portion of the others – a simple 122% year-to-date (diagram by means of WorldCoinIndex):

Each one of the 800+ "cryptographic forms of money" other than Bitcoin – from the ones that are as of now dead to the new ones that appeared out of the blue – is the alt-coins. What's more, there, as with Ethereum, the enjoyable to be had is considerably more noteworthy.

Take a gander at Ripple, the third biggest. It's now smashing. It had gone from $0.006 on March 15 to $0.42 on May 16, an expansion of about 7,000% out of two months. When I criticized it on May 15, it was at $0.215. By the following day, it had multiplied to $0.42.

Presently at $0.29, it has lost around 30% of its incentive since its pinnacle, including the present 10% swoon. Its market top, now at $9.9 billion, has dove $4 billion of every seven days (outline by means of WorldCoinIndex):

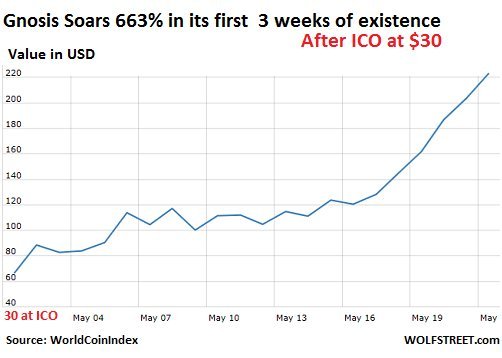

Next biggest alt-coin is Gnosis, which appeared suddenly on May 1, after its "underlying coin offering" (ICO) – which resembles an IPO for stocks however without the legitimate circles, divulgences, and enlistment to bounce through – at a cost of $30 per token.

The ICO raised $12.5 million for somebody. Since its ICO, the cost hopped 663% out of three weeks, to $229 (outline by means of WorldCoinIndex):

On the off chance that exchanging these tokens isn't exactly sufficiently wild, you can likewise exchange subordinates of these tokens. For instance, as indicated by BitMex, you might need to exchange Gnosis prospects. You can even utilize use to put some zest into it:

"Brokers who feel that the cost of GNO will rise will purchase the prospects contract. Then again, brokers who trust the cost will drop will offer the fates contract.

"All edge is posted in Bitcoin, that implies dealers can go long or short this agreement utilizing just Bitcoin. The GNO fates contracts highlight a use of up to 2x.

"For instance, to purchase 10 Bitcoin worth of agreements, you will just require 5 Bitcoin of Initial Margin."

Is this the encapsulation of the better approach for riches creation? Anybody makes a "cryptographic money," gets trades on board, buildups it, gets different players to direct in real cash, and take an interest in this marvel of an advanced number upheld by nothing and speaking to nothing, with no coupon installment and no responsibility for other than the computerized token, trusting intensely to offer it forward and backward among each other with the consent to not ever attempt to change over it once again into genuine cash since that would make it fall – see Ripple.

After these rankling surges of thousands of percent in the briefest time, nobody is notwithstanding endeavoring to imagine that these are usable monetary standards. That thought has completely fallen by the wayside. They're not called "cryptographic money" any longer. They're cryptocoins or alt-coins or bitcoins or just tokens.

Of these 800+ plans, the best ten alone have now swelled to a joined market top of $70 billion. That is a genuine sum. One week from now it may be $100 billion or $40 billion, whatever the case might be.

They have turned into the most loved play area of some speculative stock investments that can with – for them – moderately little measures of cash drive up the cost by a large number of percent.

In any case, how do speculative stock investments receive the genuine cash in return – the cash that they have to convey to their customers? They'd need to offer their stake for genuine money, and after that the amusement is finished, in light of the fact that simply like their entrance causes a tremendous surge, their leave causes the inverse – the kind of occasion that Ripple may as of now be encountering.

The most clever thing is to tune in to all the intelligent sounding pseudo-reasons why this surge has happened, extending from the approaching breakdown of the fiat money, for example, the dollar, to getting in on the ground floor without bounds, or something.

On a more philosophical premise, these insanities make you ponder about the condition of the psyche of the present "financial specialists" including flexible investments that play these diversions with progressively heavy measures of cash. It's symptomatic for something bigger.

Be that as it may, at that point individuals likewise play the lottery, which somebody once called an extraordinary duty for the individuals who can't do math. So taking a gander at these digital forms of money, I'm not yet anticipating that humankind is completely damned. In any case, it makes me wonder about in what manner or capacity much liquidity for such a variety of years has swelled resource costs all around and to such a degree, to the point that the wildness in these digital forms of money scarcely makes a, well, swell.