ICO Review of LAToken ($LAT) Tokenization of real-world assets

One of the most visible trends in the blockchain industry is the tokenization of different real-world assets. It is directly connected to the fact that economic boundaries begin to blur, all financial and material assets become more mobile with each passing year. Tokenized assets give the opportunity to the seller of the asset to get the best price from the most interested customer. For example, I can tokenize my flat in Moscow and I will be able to sell it to the French citizen who will pay me the biggest price. Also, tokens are divisible, so the French citizen will be able to sell half of my flat to the Thai national by sending him 0.5 of asset token. Isn’t it useful? That’s why the community desperately needs the necessary legal frameworks for such things to happen.

Everybody knows about Digix, the project that will issue DGX tokens, which will be pegged to gold bars in Singaporean banks. As it turned out, the new player on the market appeared, LAToken, the Russian startup that tokenizes all the assets. I think that tokenization of real assets was the question of time and legal framework. Now we observe the creation of the borderless market where anyone can buy any kind of asset anywhere. By the way, I just wanted to add that countries that will try to prevent tokenization of real world assets legally will be left behind. They will not be touched by the wave of progress.

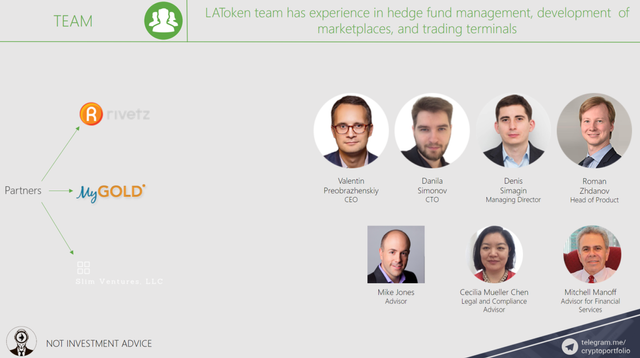

LAToken team has experience in hedge fund management, development of marketplaces, and trading terminals. Also, some members are ex-employees of McKinsey, investment funds, and big Russian banks.

The project is partnered with Rivetz International. Rivetz recently successfully conducted its own initial coin offering. This project will concentrate on safety in blockchain space.

Another company partner is MyGold, New Zealand gold buying solution. They will be the main supplier of precious metals in New Zealand for LAToken.

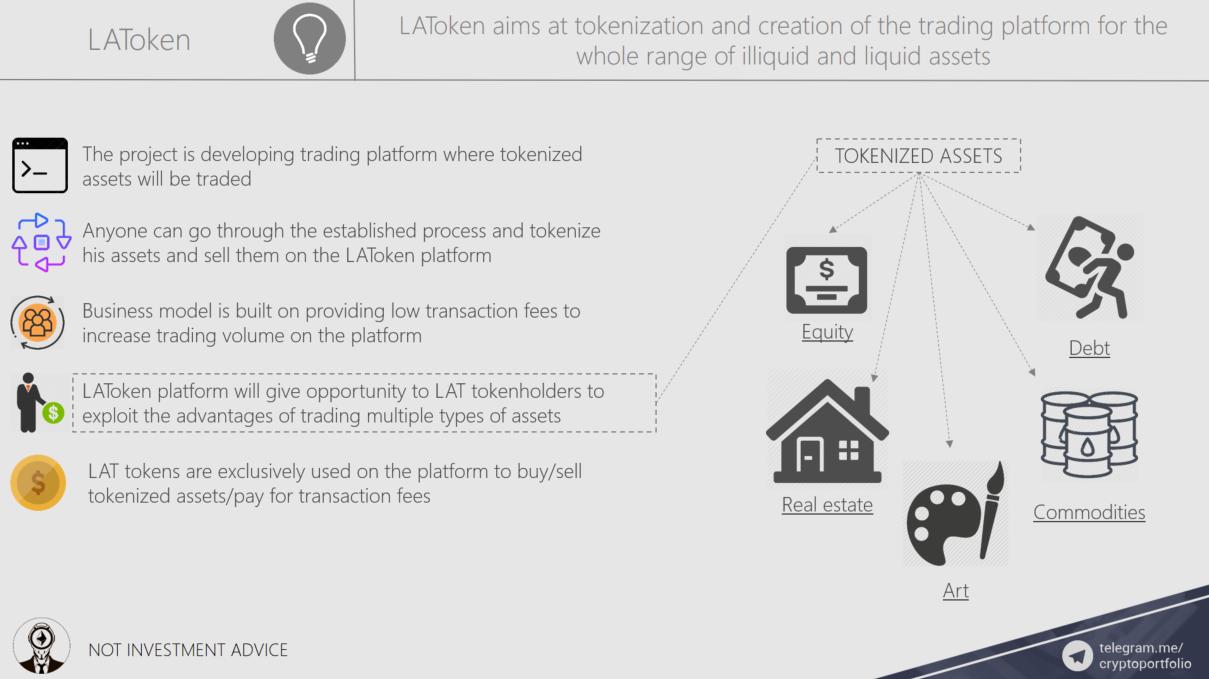

LAToken aims at tokenization and creation of the trading platform for the whole range of illiquid and liquid assets.

The project is developing trading platform where tokenized assets will be traded. Actually, their platform is already in operation and you can try it out if you bough LATs. There you can buy tokenized shares of Tesla, Apple, or some other currently popular company. I will show you what their platform offers in details a little bit later.

Anyone can go through the established process and tokenize his assets and sell them on the LAToken platform. You can check out the process in their whitepaper.

Business model is built on providing low transaction fees to increase trading volume on the platform. As a result, the LAT tokens will be more valuable.

LAToken platform will give opportunity to LAT tokenholders to exploit the advantages of trading multiple types of assets. What assets will you be able to trade on the platform?

• Equities or shares of companies

• People’s debt

• Real estate in particular countries

• Art

• Commodities like oil or gas.

LAT tokens are exclusively used on the platform to buy/sell tokenized assets/pay for transaction fees. It is interesting that if you want to buy $100 000 worth of real estate on LAT platform, you will have to buy $100 000 worth of LAT tokens. This way LAT tokens are destined to grow.

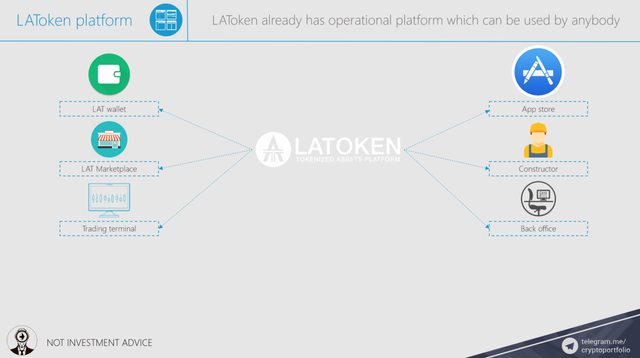

LAToken already has operational platform which can be used by anybody. I registered and took a look around and that’s what I found.

LAT wallet allows users to control token account balances, make transactions, create new tokens, and link tokens to assets.

LAT marketplace allows users to offer asset tokens for initial sale and manage personal portfolio.

Trading platform allows tokenholders to make offers, set trading criteria. You can either download client for computer or use web-based application.

Back office allows tokenholders to calculate the net asset value of their portfolio. Also, it provides risks and exposure analytics tools.

App store and constructor permit tailored apps to be built on the LAT platform.

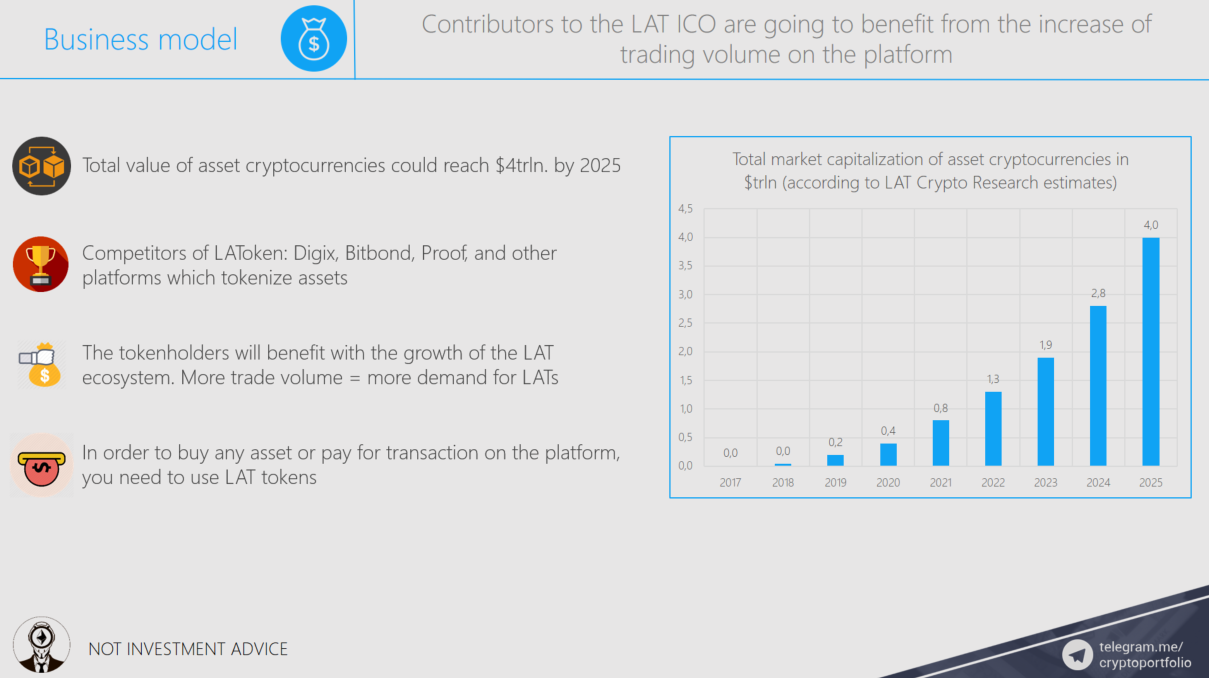

Contributors to the LAT ICO are going to benefit from the increase of trading volume on the platform.

Total value of asset cryptocurrencies could reach $4trln. by 2025 according to the project’s analytics department.

Competitors of LAToken: Digix, Bitbond, Proof, and other platforms which tokenize asset. The biggest difference between LAToken and other similar platforms is that this project is not concentrated on particular asset and allows almost anything to be tokenized.

The tokenholders will benefit with the growth of the LAT ecosystem. More trade volume = more demand for LATs.

In order to buy any asset or pay for transaction on the platform, you need to use LAT tokens. This way the capitalization of LAT tokens will grow with the trading volume.

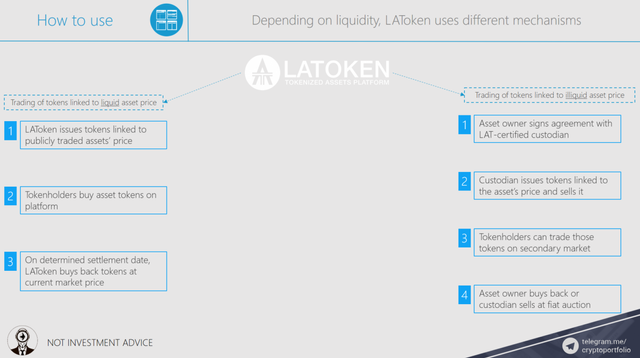

Depending on liquidity, LAToken uses different mechanisms of tokenization.

If the asset is liquid, the LAToken will issue tokens linked to the price of publicly traded assets. For example, Apple shares.

• Then, tokenholders can buy tokens at an auction on the platform using LATs.

• Finally, on the pre-determined date, LAToken buys back asset tokens from tokenholders at the current market price of the underlying asset. Using the same Apple shares example, they would use NASDAQ exchange to determine this value.If the asset is illiquid, Asset owner will sign an agreement with a LAT-certified custodian transferring ownership rights.

• The custodian issues tokens and sells them to the tokenholders on the LAT platform.

• Tokenholders can sell tokens on the secondary market.

• The asset owner buys back asset tokens on the settlement date or the custodian sells the asset at a fiat auction.

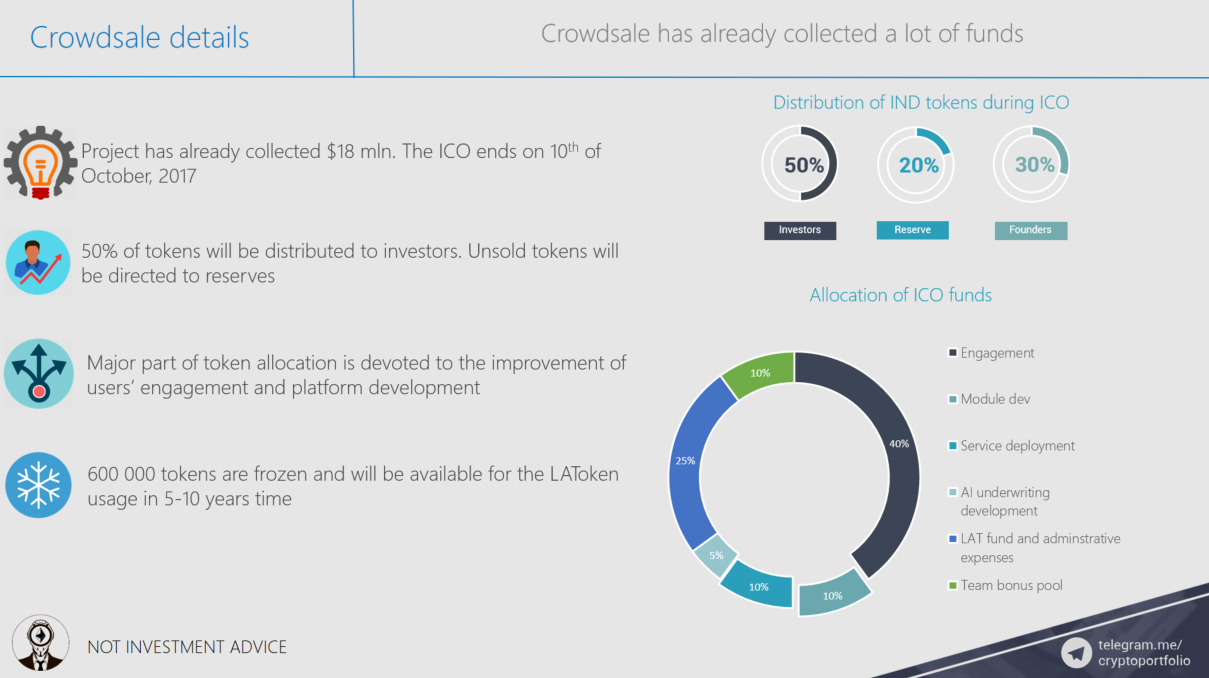

• Project has already collected $18 mln. The ICO ends on 10th of October, 2017

• 50% of tokens will be distributed to investors. Unsold tokens will be directed to reserves

• Major part of token allocation is devoted to the improvement of users’ engagement and platform development

• 600 000 tokens are frozen and will be available for the LAToken usage in 5-10 years time