Ethereum Open Interest (OI) Hits New All-Time High

The smart contract giant is challenging the market with unprecedented open interest and a price rally that sparks hopes for a new bullish cycle. Could this be the prelude to an assault on its all-time highs?

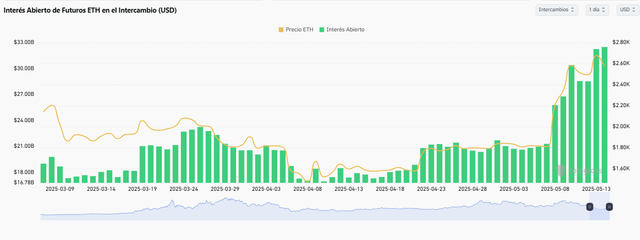

Ethereum (ETH) has just reached a historic milestone that is sending markets into a tailspin. Open interest in the world's second-largest cryptocurrency soared to a staggering $32.49 trillion, according to the latest data from Coinglass. This influx of capital coincides with a vigorous price rally that began on May 8, catapulting ETH above the crucial 50- and 200-period exponential moving averages (EMAs), sending a clear bullish signal to the crypto ecosystem. Are we on the verge of a new parabolic rally for Ethereum?

The massive increase in Ethereum's open interest is not an isolated event. It occurs amid increasing trading volume over the past 25 days / Coinglass

Open Interest at Record Levels: Fuel for Ascension?

The massive increase in Ethereum's open interest is not an isolated event. It occurs against a backdrop of rising trading volume over the past 25 days, suggesting strong conviction behind the current bullish move. A simultaneous increase in open interest and volume often indicates a well-established trend with the potential to continue. Analysts suggest this momentum could take Ethereum to even higher prices following a potential technical correction or a period of healthy consolidation. At press time, Ethereum was trading around $2,574, holding firmly above the 200-period EMA, a key indicator of long-term bullish sentiment.

Regaining Dominance: Challenging Bitcoin's Reign?

In an encouraging sign for Ethereum bulls, the cryptocurrency managed to regain ground on its dominance against Bitcoin (BTC). Its market share rose to 9.3%, recovering significantly from the low of 7.1% reached on April 20. While Bitcoin remains the dominant safe-haven cryptocurrency in the market, Ethereum's recent strength suggests a growing appetite for assets with greater growth and utility potential in the decentralized finance (DeFi) and non-fungible token (NFT) space.

Global Tailwinds: Tariffs and Risk Appetite

Ethereum's recent price rally coincides with a major geopolitical event: the negotiations between the United States and China regarding tariff reductions at the beginning of the week. These agreements injected optimism into traditional financial markets and increased demand for risk assets, including cryptocurrencies like Ethereum, which many investors perceive as assets with high return potential in an environment of lower global trade tensions.

Is a New Bullish Cycle on the Horizon? Caution First

Despite the enthusiasm generated by the new all-time high in open interest and the strong price rally, the Ethereum market has yet to conclusively confirm the start of a new sustained bullish cycle. While current signs are promising, investors should remain cautious and watch for potential market corrections. Confirmation of a new bullish cycle could propel Ethereum toward its all-time highs in the coming weeks or months, but the inherent volatility of the cryptocurrency market demands diligent risk management.

The record-high open interest and the resurgence in Ethereum's price mark a pivotal moment for the world's second-largest cryptocurrency. The question now is whether this bullish momentum will translate into a sustained assault on its all-time highs. Investors and crypto enthusiasts will be closely watching the market's next moves to determine if Ethereum's "bullish fury" has the strength to reach the moon.

Disclaimer: The information provided in this news article is for informational purposes only and does not constitute financial advice. Cryptocurrency trading is highly volatile and carries a significant risk of capital loss. Please conduct your own thorough research before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.