ETH Accumulates $3.31 Billion in ETFs

While Bitcoin Experiences Profit-Taking, Ethereum is consolidating a historic streak of inflows into its ETFs, signaling a potential capital rotation and a promising future for the second-largest cryptocurrency.

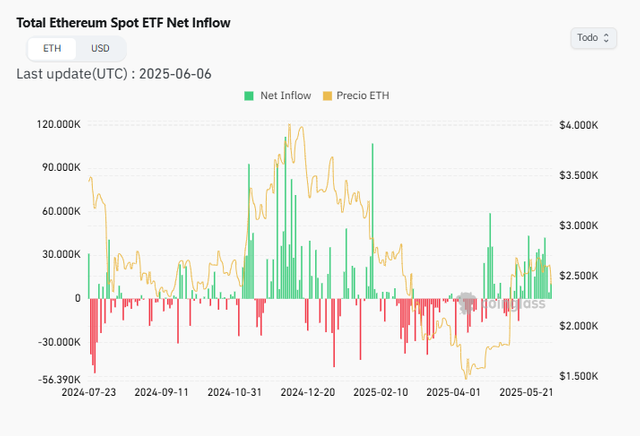

The cryptocurrency market is at an inflection point, with contrasting movements between its two main assets. While Bitcoin is experiencing capital outflows from its spot ETFs, suggesting profit-taking by some investors, Ethereum (ETH) is emerging with impressive strength, recording an unprecedented streak of capital inflows into its exchange-traded funds. This phenomenon could indicate a strategic reassessment by investors, with growing interest in the potential of Ethereum and its ecosystem.

ETH (Ethereum) ETFs extended their inflow streak to 12 consecutive days. / Coinglass

ETH Raises Alarm Bells: Streak of ETF Inflows

Recent market data reveals a divergent pattern. While spot Bitcoin ETFs saw $1.2 billion in outflows during the first three days of June, ETH (Ethereum) ETFs extended their inflow streak to 12 consecutive days. This contrast is significant, as it suggests a possible capital rotation from Bitcoin to Ethereum, or growing and sustained confidence in ETH's future.

Over the past seven days, the net capital flow into Ethereum (ETH) ETFs is notably positive, with inflows totaling $532 million. The leader of this trend is BlackRock's ETHA ETF, which captured the majority of these inflows. Since its launch, Ethereum ETFs have accumulated a net capital inflow of $3.31 billion, a figure that underscores the institutional appetite for this cryptocurrency.

What does this capital inflow mean for Ethereum?

The inflow of capital into Ethereum ETFs means that large investors, including institutional and retail funds that prefer regulated access through exchange-traded products, are actively channeling money into the Ethereum ecosystem. These funds purchase underlying ETH to support the ETF shares, which in turn exerts buying pressure on the cryptocurrency's spot market price. This is a strong indicator of growing legitimacy and demand from traditional financial markets.

ETH: Struggles to Reverse the Downtrend and Consolidate Its Rise

At the time of this report, the price of ETH is trading at $2,571.49, remaining bullish and clearly attempting to reverse a longer-term downtrend. Ethereum is strategically positioned above its 50- and 200-period Exponential Moving Averages (EMAs), a positive technical sign indicating an ongoing recovery. However, the 50 EMA is still below the 200 EMA, suggesting that the main downtrend has not yet been completely invalidated.

ETH found crucial dynamic support at $2,461, coinciding with the 200 EMA, providing a solid foundation for its recent surge. The next key resistance for ETH lies at $2,900. However, it is important to note that ETH's upward momentum has shown signs of slowing after reaching the $2,700 mark, indicating that bulls could face some selling pressure at these levels.

Is Ethereum emerging as the next rally star?

The sustained streak of capital inflows into Ethereum ETFs, coupled with its price resilience and technical positioning on important support levels, suggest a shift in the narrative in the crypto market. While Bitcoin remains king, the growing institutional interest in Ethereum, facilitated by these regulated investment vehicles, could lay the groundwork for ETH to lead the next phase of a significant rally. The market's eyes will be on Ethereum's ability to break through the $2,900 resistance and definitively consolidate a long-term uptrend.

Disclaimer: This article is for educational and informational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risks. Please conduct thorough research before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.