The journey to start a small online company and why I joined the e-residency programme

If you are a digital mobile “micropreneur” like me, chances are you have heard of, and are considering the e-residency programme from Estonia as well.

Indeed through their e-residency programme that was launched in 2014, Estonia is welcoming digital entrepreneurs to establish their small business online and to manage it remotely.

“As of June 2018, over 41,000 people from over 160 countries have applied for e-Residency — and over 39,000 of them have already received their digital ID cards. A whopping 3,977 of them have established a new company in Estonia, and there are more than 5,900 Estonian companies in total that have at least one e-Resident owner or board member.” (Source: What is Estonian e-Residency and how to take advantage of it?)

In my case, I first read of the Estonian e-residency programme in a plane magazine in 2016 and it got my interest right away. I had been visiting Estonia a few times and know it was a pretty welcoming and Tech-friendly country: Think free Wi-Fi everywhere or companies such as Skype, Transferwise, Pipedrive,... I thought the idea of a digital nation and managing one’s company remotely sounded great but I had no use for it back then. So after finishing the article I just put the magazine back into its tray, switched to another book, landed safely in Paris and forgot about it, or so I thought…

Later on, in 2016, I launched my Personal Finance blog (www.joneytalks.com) and since recently it started to generate revenues! (Yaay!) The time is thus ripe to either establish a company and become a small entrepreneur in the country I am living inor to join the e-residency programme I read about 2 years ago,…

And yes after a lot of research I went for the e-residency option!

Along with the almost 4000 e-entrepreneurs, You are probably excited too about launching your own small business and are wondering

- Why should I start my company in Estonia? Is this right for me?

- How to actually start up my company in Estonia?

- How safe is all of this?

Why should I start my company in Estonia?

The e-residency programme as mentioned above is aimed at mobile entrepreneurs looking at managing their company remotely from any place in the world. For those of you who have been following the blog, you know this resonates with my lifestyle: I started the blog when I was living in Paris, carried on while I moved back to Norway and recently moved to Luxembourg,…oh yes and I am Belgian.

The reasons for me to choose for this set-up instead of starting a company in Luxembourg (which is also entrepreneur-friendly) is mainly twofold :

- The location-dependent part and being part of a digital nation

I applied for the e-residency while still living in Norway and was considering to move out of the country and at the same time start my own small business. Estonia is the synonym to me of a forward-thinking country in terms of the way they approach entrepreneurship and embrace new technology. This fits perfectly with my location-independent mindset.

- Simplicity

Once you have the e-residency accepted by the Estonian authorities, you are entitled to take the next steps to establish your company. I started that process once in Luxembourg and despite the Luxembourgish entrepreneur-friendly environment, I went for the Estonian-based company mainly since it was so simple to find the information quickly and the administration part, thanks to LeapIN, felt like a breeze. Since the blog is currently a side activity to my main job, the less time I spend on admin and accounting, the better.

So it looks as if I found my perfect match, but would the e-residency set-up work for your small business?

It will work for you if

- You are a digital entrepreneur: Blogger, App developer, you sell online services/products, etc.

- You are a solopreneur, freelancer, offer consulting services, etc. and can do it from anywhere on the planet.

- You are looking at growing your company in a tax-efficient manner: One of the greatest competitive advantage as well of launching your company in Estonia is that as long as you do not distribute profits as dividends or income, the corporate tax is 0%. This means that in the startup phase you can focus on growth and reinvest all profits in the company.

- You currently reside outside of the EU, are struggling to start your business in your home country and/or you are looking at expanding to the EU market benefiting from an EU-based legal system to do business. LeapIN told me the story of some Brazilian e-residents that took the trip to Estonia just to visit the Estonian bank and flew back after a couple of hours. They claimed to have saved both time and money by creating their online company thanks to the e-residency programme!

It will not work for you if

- You want to sell physical products, this is mainly due to VAT issues which are difficult to handle. It is not impossible but it will be a lot of hassle, LeapIN currently does not support this type of business for instance.

- Your company needs permanent premises in another country (a factory, a restaurant, a barber shop, a laundromat,…). The company will then be deemed taxable in its country of residence.

- You want Estonian residency and travel VISA-free in the EU. The e-residency offers access to the digital services (online taxes, digital signatures,… ) but the e-residency card is in no way a travel document, nor does it confer Estonian citizenship.

- You are looking at avoiding taxes in your country of residence. E-residency does not confer tax residency similar to the point above.

For more on taxes, this article by Entrepreneur Ignacio (or Nacho) is the best and most complete resource I have found!

How to actually start my company in Estonia?

The process is absolutely simple and straightforward here are the 5 (or 4) steps to follow :

- First things first, apply for e-Residency here. No surprises, fill out the form, pay the 100 EUR subscription and provide the necessary details. You will then get an e-mail confirmation that your application has been submitted and that the Estonian Police and Board Guard will keep you informed further. I did it on the 19th of January.

- Pick up your card. My application was approved on the 2nd of March and it was sent to the Estonian embassy in Oslo on the 13th of March, I went to pick it up the 19th of March. Depending on where you apply from and if there is an Estonian embassy nearby or not you might need to travel to pick up your card. So, all in all, it took 2 months from the application until the receipt of the card. If you made it here as well, Congratulations! You achieved the biggest step! Now you can start setting up your remote Estonian-based company.

- Register your company. There are a few players out there that can help you here. Since I did not want to make it complicated for myself and overthink it I went with LeapIN which seemed reliable and enjoys a very positive feedback. To be honest I did not find any negatives during my search online. Once you register the onboarding will be very straightforward, the interface user-friendly, once again hassle-free just the way I like it! You pay the registration fees the company (190 EUR state fee for registering, 25 EUR state service fee for company online registration in Estonian Business Registry and your first month as a LeapIN user 49 EUR), you fill out info about the purpose of your company, you choose your future million-dollar company name, it gets reviewed and after a few days there you go, you are in bizniss my friend! This process took me 1 week and I was helped all along by their onboarding staff.

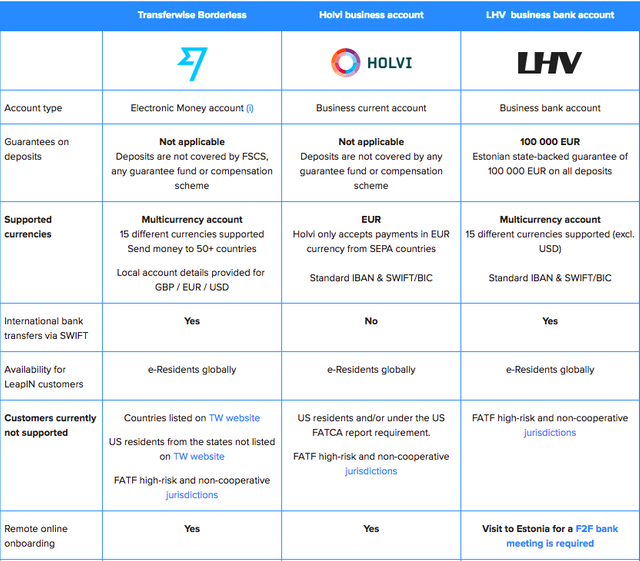

- Now that your business is ready, you need to choose your business banking system. You can choose Holvi, Transferwise or the Estonian bank LHV (LeapIN’s banking partner). With Holvi and Transferwise you can apply and manage everything without setting foot in Estonia, with LHV you will need to come physically to Estonia for a face to face meeting with a bank representative. I went for the latter as I would like to distribute dividends which is not possible with the other banking solutions, depending on how things go I might reinvest part of the profits furthermore as an EU bank your account is backed up to 100 000 EUR. This is not the case with Holvi or Transferwise. You can also start with Holvi and then switch to LHV, if you plan to travel to Europe later on but cannot wait to get started with your new venture! Here is a short comparative table LeapIN compiled.

Source: The Ultimate Guide to e-Residency and Borderless Business Banking — Your Options

5. Travel to Estonia and open your bank account at LHV if you choose to do so.

If you have not traveled to Estonia before, I’d recommend you visit the country where your business is established. I went last week and it was a joy again to be there. The people are welcoming and friendly, I personally have some long-time friends I had the chance to meet, the old town in Tallinn is absolutely charming and I also took the opportunity to meet the people at LeapIN. Oh, and I almost forgot, the travel costs and accommodation for this trip are considered business expenses (I double checked with my LeapIN accountant :).

In total it will cost you 364 EUR and depending on your choice of business banking solution, it will take you approximately 2,5–3 months from the moment you apply for e-residency until your company is up and running.

Is it all safe?

If you are not familiar with Estonia, it might seem strange to establish your business in an unfamiliar place. Rest assured, Estonia is one of Europe’s fastest growing economy, according to Eurostat, Estonia had the lowest ratio of government debt to GDP among EU countries at 9.4% at the end of 2017. This is what you will find on the economy of Estonia page in Wikipedia: “A balanced budget, almost non-existent public debt, flat-rate income tax, free trade regime, competitive commercial banking sector, innovative e-Services and even mobile-based services are all hallmarks of Estonia’s market economy.”

Sounds good Jonathan, what about the service providers? LHV and LeapIN, are those reliable?

LHV Bank

As per now, LHV is the only physical “traditional” bank that is accepting e-residents as customers. And yes I checked for myself: They are a real bank and have offices in downtown Tallinn and Tartu.

I personally went to the Tallinn office which was the main purpose of my visit. The process went smooth, the lady I spoke to just asked a few KYC (Know Your Customer) questions confirming what LeapIN already had communicated to them. And after about 20 minutes I received a bunch of papers and my business bank card (Woohooo!). The bank has a startup mindset and is eager to attract new customers, that is why they are the only bank accepting e-residents. The traditional ones Nordea, SEB, and Swedbank will require you to have a proven “connection to Estonia” or simply refuse your application.

LeapIN

You can already read quite a lot about it through their own blog and their FAQ, they already provide so much value without you even being a customer that it felt right to have my admin managed by them. What LeapIN will do for you is to help you set up your company, apply for a bank account at LHV, provide you with a virtual address and be the contact person in Estonia, do the accounting, and ensure compliance. Their main office is located in the Ülemitse area close to the airport. Since I was in Tallinn anyway, I reached out to them to ask for a short meeting and so I had the chance to meet with Kadi and Meelik.

- The start-up was founded 3 years ago and is growing rapidly, it counts about 50 employees (!) and is spread over two sites: Tallinn and Tartu (this is where most of the accounting is).

- Regarding the customer base it is about 1400 but as per today it lies around 1500 (Source: LeapIN) and it is still growing every month. (I also complimented them on their marketing as they are everywhere)

- Their focus is principally focused on digital businesses and the majority of their customers are single company owners. Their customer base is literally global, they have customers from Brazil, Ukraine, Thailand, Germany,…

- From their customers’ survey it seems that their customers are extremely satisfied.

- The most visible changes we should see as customers in the near future are an improved user interface, an even faster processing of information (improved automation) and there are also plans for integrating an own business-banking system (whether that means to have to have a face-2-face meeting, this is not known yet).

- Although there is a high demand for it, there are currently no plans to support companies selling physical products.

- LeapIN is currently doing well and they have grown quickly, never the less I asked about the unlikely situation where LeapIN would go bankrupt, what happens to my business then? LeapIN is “just” a service provider so there is as such, not much to worry about: The business and the bank account will remain registered on your name, you will simply need to find a new Estonia-based service provider/accountant.

- The average accountancy costs for a starting business in Estonia usually revolve around 50 EUR/month plus 50 EUR for the yearly tax report. I double checked with my friends at Mashmachines and they confirmed this is what they were paying in their “early days”. The LeapIN starter plan is 49 EUR/month and will become 79 EUR/month once you have reached a turnover of 1000 EUR. For the level of service they provide, the time you gain to focus on what you are passionate about and the headaches you avoid, the price is definitely fair. And frankly, if you are like me “value-negative” on administration, a service like LeapIN is absolutely worth it!

My experience so far is very positive: The contact is friendly and professional, there is a lot of available information, the onboarding went smooth and took me 1 week, the interface is user-friendly, I now have a dedicated accountant and I feel absolutely safe.

There are of course other service providers and you could even try to do the accounting yourself and establish an address in Estonia, it is all up to you, but once again LeapIN felt like the right choice for me (simple, transparent, user-friendly).

And here is a little extra for you if you have decided to start your online business in Estonia with LeapIN. They are offering both you and I a discount of 100 EUR by using the code “Joneytalks” when signing up. If you found the post useful, I would be grateful if you use it, it is a win-win after all ;)

I hereby thank LeapIN again for their time!

Bringing it all together

My goal was to share my experience with starting up my online business so far, detail how it worked for me in practice and last but not least show you that it is a reliable programme backed by professional companies.

It took me 2,5 months in total to have everything set up, the process was smooth and hassle-free, my research and trip to Estonia reassured me that my small business was in good hands.

If you intend to start your own online company in a hassle-free way, the e-residency programme may be something for you as well (If you are a digital nomad, it should be a no-brainer, this is the way to go!).

This post does not cover all aspects so for further info you can consult the e-residency pages, the LeapIN blog and FAQ, and Ignacio’s blog (which is a goldmine of information).

If you have started your online business as well or are still hesitating let me know in the comments below I would love to hear from you!

If you liked this article, do follow us on social media as well for more great content, check our Facebook, Instagram, Twitter, and join our e-mail list. I would love to connect with you!

Disclosure: I am the author of the same article on www.medium.com. This post may contain affiliate links. That means I may make a small commission (at no cost to you) if you make a purchase. This will help to support Joney Talks!