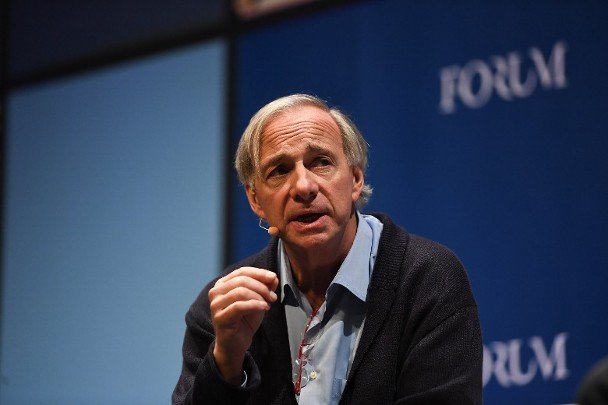

Bridgewater’s Ray Dalio Softens Stance on Bitcoin,Claims It Has Place in Investors’ Portfolios

Bitcoin and blockchain have been debatable in the past two years. Blockchain is an indispensable technology in the future, but most people probably still have a little understanding, with only roughly concepts, and even experts hold a polarized attitude towards the feasibility of Bitcoin.

Ray Dalio, the founder of the world’s largest hedge fund, Bridgewater Associates, has offered a more positive stance on bitcoin than in comments that made headlines last month.

In a Reddit Ask Me Anything (AMA) on Tuesday, Dalio said he thought bitcoin (BTC, -2.70%) and other cryptocurrencies had “established themselves” over the last 10 years and were interesting “gold-like asset alternatives.”

The billionaire hedge-fund manager also noted that cryptocurrencies share similarities and differences to gold and various “limited-supply, mobile (unlike real estate) storeholds of wealth.”

Bitcoin “could serve as a diversifier to gold and other such storehold of wealth assets,” said Dalio. “The main thing is to have some of these type of assets … including stocks, in one’s portfolio and to diversify among them.”

During the AMA, Dalio also said, when comparing bitcoin to gold, he had a “strong preference” for assets central banks will want to hold and use to exchange value.

In addition to Dario, many experts also have a positive attitude towards Bitcoin and encourage the public to buy BTC in moderation. A few days ago, Bityard and Binance have worked together to build the strongest spot system, in the meanwhile, providing more than 30 pairs of spot trading, contracts, derivatives and copy trade, allowing you to enjoy a diversified experience at the same time!

(For more details: https://www.bityard.com/?ru=jRbMwV&f=zendesk)