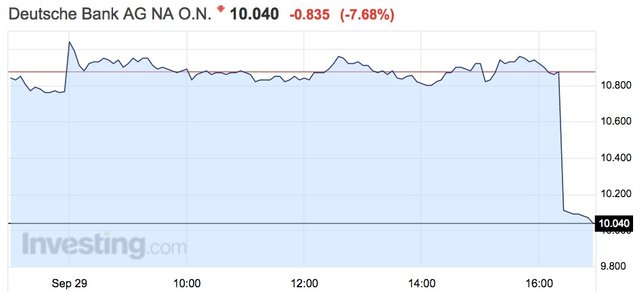

A quick note on the political / geopolitical ramification of the (becoming apparent) Deutsche Bank failure.

In case you are new to the planet / colony that is Earth or may have been in a coma for the last 8 to 10 years i'll try to explain it simply:

A type of 'meme' has developed that QE or 'money printing' or 'Fed printing' can continue to 'kick the can' down the road, lets explain that.

kicking the can down the road has consequences and they all relate to the monetary unit that is being printed i.e the Dollar the QE is attached to.

to not put to fine of a point on it (and without rambling) China will not allow the USA to engage in another 'QE' China is the largest holder of 'real' US dollars.

Japan is a significant bag-holder however they are at now the absolute limit of what thier economy can sustain if you want to learn more you should investigate Japan's bond issuance, buying and 'printing'

so basically there is no more 'road' for the can to be kicked.

Deutsche bank is basically a US Corp 'owned' asset, it received a large amount of 'Fed' money in the first 'financial crisis' of 08-09

The only way forward for Deutsche is to 'Bail-in' creditors and account holders , which is why you are now seeing the spike in countrparty risk, but this will also extend (like in other places ) to account holders.

So basically the only options Deutsche really have left on the table is to take account holders capital and try to cause a political situation in which the Government will extend them money (which they have said they will not do)

This is likely why the German gov recently told citizens to keep a storage of food for at least 10 days.