Flattening yield curve could be a YUGE problem for the U.S. economy

A year ago today a 1 year treasury yielded .87% while the 30 year was 3.05%, fast forward a year later and the 1 year is at 1.82% while the 30 year has fallen to 2.79%.

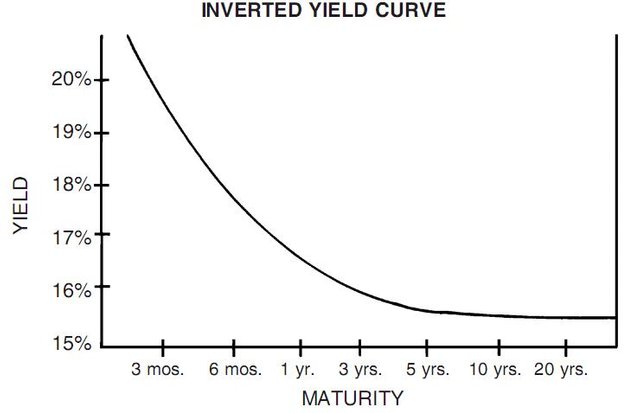

This is what we call a flattening yield curve which could be an indication of an economic slow down the road. Now if the yield curve inverts which I believe will happen later this year the you know what is going to hit the fan and the economy and the stock market is going to crater.

What will invert the yield curve?

-short terms rates rising the Fed has said they will increase rates 3 times this year

-inflation oil prices, insurance premiums, rising minimum wages, housing prices etc, prices are going up in a number of things. Don't believe the 2 percent CPI numbers it is total BS, just ask anyone who scraps by pay check to pay check.

-dollar weakness

-debt , debt and more debt government continues to burden the economy by drowning it with more red ink. Tax cuts are great however you need to cut spending as well.

-Have not had a recession in 8 years and have had one of the longest so called recoveries in history. We are probably due sooner rather than later.

Keep an eye on the bond market because it tells us what is coming down the road. The curve will continue to flatten with short term yields rising and long term yields declining until this thing inverts. Just know that it is probably a good time to exit the casino.

interesting ideas and stories can be made inpirasi and examples in writing ... really beautiful post ...))) $$

Congratulations @bythenumbers432! You have received a personal award!

Click on the badge to view your Board of Honor.