The Introduction of Fear Into Economics

Sometimes people complain about how ‘capitalistic’ employers do everything they can to get away with paying as little as possible to their employees. Well, how many of these same people go around trying to pay as little as possible for the goods, services, and ideas they want and or need to maintain and or improve the quality of their lives? The entire idea of negotiating a higher pay rate and haggling for a lower price is directly proportional to the value held by the employer concerning the work needing accomplished and how much money the seller is willing to settle for.

It is the same concept from two separate perspectives. The problem is not that one side is greedy and the other is not. The problem lay squarely on the fact that cost of living continually rises beneath governments which impose taxation. And here it is revealed what the issue is. The unintended consequences of taxation!

“But Jim, governments wouldn’t exist without taxation!”

That’s exactly correct.

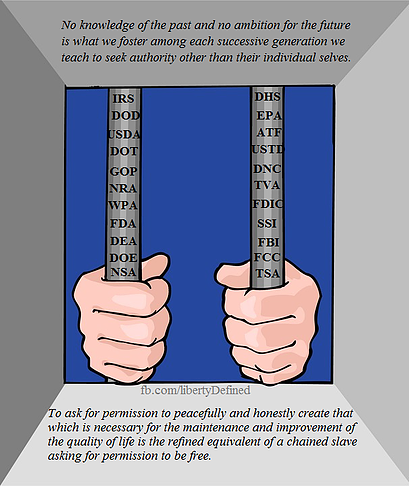

The unintended consequences of taxation cause so much trouble. This trouble begins with the implementation of taxation and the common mantra today that states: Taxation is Theft!

The first unintended consequence of taxation is that it silently demands people assign more value to whatever money or currency is useful in the satisfaction of tax debts imposed. That may seem like such a small, insignificant, and unlikely concept. However, consider the fact of being arrested and jailed for noncompliance with tax laws.

Wal-Mart and other retailers beneath the jurisdiction of a government, such as the Federal government of the United States, will not refuse to collect sales taxes because the local and state governments agreed to use Federal Reserve notes by acceptance of admittance and position within the union of supposedly sovereign ranks. Failure to comply will be met with physical force to shutdown whatever location or locations which do not comply. So in order to remain in operation, Wal-Mart and the alike will comply.

Similar actions are taken in due time with land property ownership and taxes. Failure to pay taxes on land property and the taxing entity will eventually confiscate the land in question leaving the supposed owner without. That’s a horrendous and immediate effect of taxation.

Yet these are not even the bulk of the issues concerning why taxation is so dangerous. Sure these effects so far show how taxation is theft, but the real issues are what the theft does to the ability of others to create. For most people, what I am about to discuss will seem illusionary or sophistic in nature. However, I encourage you to return to my previous work, Liberty Defined, to see what foundation I build upon to make this particular work possible.

The first thing people may notice when looking into the effects of taxation from the positive perspective is that the money supply is regulated. What does that really mean?

Well, the regulation of a money supply means typically that there must be a monopoly maintained over it. That monopoly is made possible by the enforcement of laws through direct physical violence as previously noted or threats to engage in such. This means that people will work to acquire whatever money is in question to satisfy tax debts in order gain a temporary stay of execution from whatever penalty is drafted for noncompliance with tax demands.

These demands in the early years of the fledgling United States were tariffs on imports. This meant that importing merchants were required directly to pay in gold or silver. This burden meant that they could not pay with a portion of the imports they acquired or offer store credits in the stores they may have supplied from. In others words, they were coerced in pushing such a burden upon their customers. This is how the unintended consequences of taxation affect others not directly levied with tax burdens.

What this means is that in order to pay these taxes, the importers would have to sell at least some of their goods for gold and silver or find a way to convert a portion of their profits into gold and silver after sales were made. I understand gold and silver was commonly accepted as money during the fledgling years of the American Democratic-Republic. I also understand that importers may not have had to worry so much about acquiring gold and silver from sales.

This doesn’t mean that their customers didn’t still feel the pinch in some fashion. These additional costs levied upon the shoulders of importers were not patriotically accepted. The importers didn’t ‘bite the bullet’ so to speak. They passed that burden down onto their customers in the form of higher prices. Maybe in the beginning of such tariffs being imposed the increase was of little notice.

However, with the advent of additional taxes levied and further regulations, the cost to comply increased. Therefore the customers were putout more in costs to acquire the goods and services. Today we expect sales taxes. We know in the United States that we will pay anywhere from one percent additionally to amounts over even twenty percent of any or all goods and services purchased pending where we are shopping.

Yet, I’ve not even mentioned the worst part of all of this. While the customers of these 17th century importers in the United States were accustomed to using gold and silver to make some of their purchases, many of them were able to barter and trade other goods and services to acquire what they wanted. In fact, I’m sure many people over the age of 30 may remember a time when they were allowed to simply wash dishes in a local restaurant or remember older television programs that would allow a patron to do so if they were short of money.

Not so anymore today! Regulations have seen fit to do away with that kind of peaceful resolution and voluntary interaction. No. These kinds of intervening policies still are not the worst kind of negative unintended consequences of taxation. They are merely another symptom atop other symptoms of destructive and hindering interference.

The worst culprit of all is when government actually forces its citizenry to use a specific kind of money that is not naturally occurring in their otherwise voluntary lives. FIAT CURRENCY!

The introduction of fiat currency is the most invasive and destructive and manipulative tool ever imposed through taxation. The implementation of fiat currency by the federal government has done more to destroy the potential of its citizenry to create AND exchange goods, services, and ideas; or what I call real wealth. It has also been the main symptom of taxation. This has been the culprit that is at the heart of so many ill thought out protectionist style economic treaties which prevent goods, services, and ideas from crossing borders.

And as a philosopher of old once said, “If goods do not cross borders then soldiers will!”

So what do you think may have happened to those citizens of the various states of the slightly aged United States by the time the early 1860s came about? For starters they were forced to use paper money backed by the full violent credit of the federal government and maybe some gold and silver.

“Maybe it’s not so bad,” you think to yourself.

Well, maybe being forced to go find something to trade with a merchant for when it is already fairly rare is easy. I am betting that it’s not all that easy. But what is worse in when the government decides to play God with the money people are using that is also desired for the purpose of tax debts. What happens when a government states that silver will no longer be useful for the satisfaction of tax debts?

What do you do then?

It’s easy to give the solution of trading in your silver for gold. But what if everyone in your area is trying to do that? What kind of situations might exist that you don’t understand could exist which end up leaving people at bayonet point because some taxman just doing his job to earn a living leaves you homeless. Or what if the taxman leaves you injured for trying to defend your property against his unjust seizure of it?

This is a very real scenario which played out in the early 1870s under President Grant’s administration when he demonetized silver. Of course this is while the greenbacks Lincoln issued were also being recalled. And then there is the creation of the Federal Reserve Bank in 1913 which inflated the amount of money in circulation from 1913 till the early 1930s. Then, as Murray Rothbard wrote about, I believe it was Man, Economy, and State but don’t quite quote me on that, the cause of the Great Depression was the Federal Reserve banks quick retractions of so much of that tangible money from circulation.

That caused men to starve and be kicked of their land. It’s precisely why there were plenty of houses and farms to be worked by no workers on them since there was no money to be exchanged. People were allowed to accept handouts but they were not allowed to actually farm any land in order to sell the crops created. Of course this is the most destructive problem which enabled the Great Depression in the United States if one understands the Federal Reserve is just a symptom of a lazy congress and the issuance of tax debts.

Of course the lesser problems with the economic woes of the Great Depression stem from all of the regulatory acts of congress and sometimes the smaller states. How these regulations directly affected the starving citizenry is well explained in other books such as The Forgotten Man by Amity Shlaes and New Deal or Raw Deal by Burton Folsom. And just for transparency, I’m not paid to endorse these books. I’ve done my research personally by making phone calls to several dozen historical archives for copies of documents and various libraries to verify such works for my own satisfaction. They are well done works and shed a lot of light on the unintended consequences of taxation.

These works mentioned are not discussing directly the unintended consequences of taxation. They do however discuss what happens beneath government which shows the lack of comprehension or compassion to understand or stop the horrendous economic slaughtering of otherwise innocent and nescient people.

So the problem is not that people are greedy. The problem certainly isn’t that people are capitalistic either! The problem is that what would otherwise be voluntary and peaceful exchange between two or more interested individuals is not a horrific exercise of who can come the closest without cheating the other in order to get a piece of this now finite pie of legal wealth useful to satisfy tax debts in order to have the greatest long term chances of staying the executioner’s hand.

While that is not the case for the common individual, it is true for land owners, automobile owners, and all business owners. Because of the way taxes are imposed in the United States, they now directly affect everyone who makes any kind of economic interactions with a legally compliant merchant. That is invasive, manipulative, and absolutely controlling past the point of a tyrannical police state.

What might you be able to do with the thirty percent of income the federal, state, local, and sales taxes tax from you if you didn’t have to relinquish it? Now what might you be able to do with negotiating a wage or salary in gold coins, company credits, or any kind of mixture of what you and your potential employer can think of?

If you make $100,000 dollars a year and all the taxes combined equate to a mere $30k, what could you purchase with that? How many toll roads might you be able to pay for and still not have to pay as much as you do at a generous $30k tax bill? Now what if you could be freer to create more goods, services, and ideas without having to conform to a multitude of regulations which are not guaranteed to help or are wasteful because they don’t actually help when more efficient or equally safe yet cheaper solutions are available?

Now imagine the potential for what you could do when not limited by a manipulated certain money supply. What other money could you work with?

That’s the question so many people have a difficult time understanding. In the 1800s people often used a mixture of local bank notes, gold and silver coins, and local merchant credits in order to make exchanges all atop bartering. Unfortunately I’m not convinced that moving away from fiat money will happen very quickly. People today seem to be less economically literate in terms of what money is, what gives it value, and why we use it at all.

I make that statement in response to the seemingly infinite number of statements made about why businesses are greedy and don’t want to pay and then demand lower prices for the goods they want to pay for themselves in the same breath.

I realize that is not all people. I know there are many wonderfully educated people in the world. The trouble lay in getting these people to speak up more frequently; maybe even getting more of these people into the mainstream spot light for the world to see. And perhaps it would go a long way to see fewer people who do have some understanding of these subjects to not look down upon those who do not. Instead of demanding that corporations own government, why not recognize that big name brand corporations were once upon a time successful businesses built upon more fairly acquire profits and transparent loyalty to their customers. Now they play the games that governments allow, just as we the individual consumer play, because of the unintended consequences of taxation.

Government creates division and only those who are able to control their knee-jerk reactionary emotions in to some degree will ever be able to recognize this.

-JLD

Find out more about my works here:

I base all of my posts on previous content I've created in two books and multiple audio programs.

Download and read for free Liberty Defined and Morality Defined here,

https://www.smashwords.com/books/byseries/20333

Listen to my Liberty & Morality Defined presents audio series here, http://bit.ly/2eT3ZxN

If you're a Star Wars fan and would like to start the journey into a realm of fantasy following a journey of struggle against two separate empires and a galaxy of souls lost in a conflict still raging on after 10 million years, download and read for free book one of my Hunter's Gambit series, Revelations here, http://bit.ly/2b1QoBh

And visit me on Facebook at http://www.FB.com/LibertyDefined

& http://www.FB.com/JLimberDavis

Twitter @JimLimberDavis

Steemit @JimLimberDavis

If you enjoy the work I create, please encourage more of it with one time or reoccurring donations here,

http://www.jimlimberdavis.com/#!donation-support/c22og

I agree. Taxation is extremely distorting and jacks up the cost of living in both known and unknown ways; the incidence is always hardest on the poor, which is ironic bc so many of the taxes are justified to help the poor.

Expansion of the money supply is another insidious form of taxation that hurts those on the bottom most and distorts economic activity.