dVest Labs - Decentralized Autonomous Organization (DAO)

Introduction

dSurance offers coverage for a wide range of products, markets, and protocols. This coverage and protection is purchased by the user and is insured through other protocol participants that supply the capital.

The protocol relies on the dSurance DAO for the different protocol and policy parameters, it also leverages integrations with DeFiVest lending and borrowing protocol and Crypto Price Index dETP fund management protocols for the Asset Management side and an integration with Kleros for Independent Claims Assessments.

What is the dVest Labs DAO?

dVest Labs is a decentralized self-administering affiliation (DAO) worked by its neighborhood engineers. All decisions are dealt with by open vote, and all errands, accounts, hypotheses, property, and dynamic are 100% clear, blockchain unquestionable, and totally decentralized.

dVest (Decentralized Investing) was at initially started as a suspected between a segment of people working on the advancing and improvement bunches behind the Crypto Price Index project. It began as a side undertaking, cultivating a show called DeFiVest for DeFi gaining and crediting that is chain-pragmatist and can manage ERC20 assets, BEP20 assets, and some other practical asset. Eventually this exploded in to various headway projects, across different gatherings, along these lines, all things considered the gathering behind CPI decided to “acquire” the undertaking, embrace the checking and improvement gatherings, and bend everything into totally democratized decentralized self-administering affiliations (DAO). The dVest Labs DAO stands firm on circumstances (up to 49%) in the DAOs of it’s signs, joint undertakings, and branch projects in the dVest Ecosystem.

dDEXX.io is the dVest Labs robotized market maker (AMM) based decentralized exchange (DEX) on both Ethereum and Binance Smart Chain associations, with Polygon support coming soon moreover. dDEXX incorporates basic and speedy exchange value, gainful liquidity pools, and high APR yield farms, where customers can obtain dDEXX tokens, costs from exchange trades, and altogether more.

dVest.io is the dVest brought together computerized money exchange (CEX). dVest CEX customers can trade all notable advanced monetary standards fuse BTC, ETH, DVEST, CPI, LTC, UNI, DOGE, ADA, XRP, DOT, BCH, LINK, XLM, TRX, XMR, XTZ, and some more.

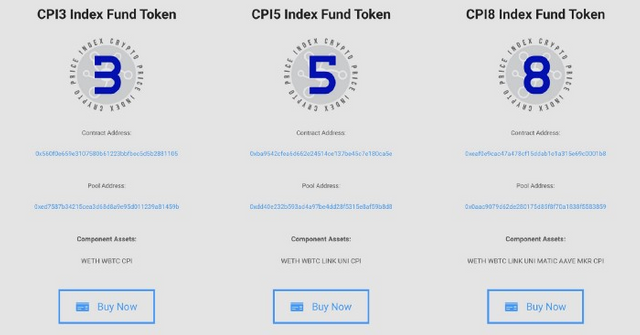

Crypto Price Index is without a doubt the main emblematic natural arrangement of its sort, which offers options in contrast to customers to get sweeping receptiveness to the advanced currency market through our ‘CPIx’ tokens. As opposed to different records of its sort, CPIx tokens are novel in their system of showing token holders a separated extent of assets across a cross-portion of the computerized money markets. The (CPI) pioneer tokens are an organization token, used to address an interest in the strength of the CPIx token climate. CPIx tokens are upheld by fragment assets, held through an escrow splendid understanding, and each CPIx token holds the secret assets which can be recuperated at whatever point without pariah incorporation.

- DeFiVest [COMING SOON] — a non-custodial decentralized cash liquidity show for securing and advancing of tokenized assets and acquiring income on stores.

- OPTIONZ [COMING SOON] — a DeFi decisions stage allowing anyone to buy or sell decisions for any token, offer liquidity to any options market, and track/pull out yield at whatever point.

- dSurance [COMING SOON] — a decentralized assurance show covering ordinary risks for crypto asset the board, stores, and other use cases. dSurance engages nearly second liquidity to security buyers and danger underwriters, ensures predictable collateralization, and guarantees straightforwardness through a reasonable cases measure.

Tokens

Additionally, the going with tokens expect huge parts inside the dVest Ecosystem:

dVestDAO (dDAO) tokens are the organization tokens for dVest Labs and its assets. dDAO holders vote on the course of the affiliation and how resources are to be spent, and resources should be proceeded with a bigger part vote. dDAO holders share in the advantages created by dDAO property and adventures.

dVest Labs (dLABS) tokens are the organization tokens for the dVest Labs Venture Fund. All profits from obtaining of dLABS tokens go clearly into the dVest Labs experience save, where dLABS holders vote on which undertakings should be upheld, and resources should be proceeded with a bigger part vote. All resources, flows, theories, assets, property, and dynamic are 100% decentralized, public, and blockchain certain. dLABS holders share in the advantages made by dLABS theories.

(DDEXX) tokens are the honor token paid to customers who give liquidity and use the farms/pools on dDEXX, the dVest decentralized exchange (DEX).

(CPI) tokens are an organization token, used to address an interest in the sufficiency of the CPIX token climate.

(CPIx) tokens are upheld by part assets, held through an escrow sharp agreement. To mint CPIx tokens, componement assets ought to be saved to the balancer pool. Customers can mint CPIx Tokens by putting away symbolic assets, as ETH or wrapped BTC. To recuperate tokens, customers can redeposit their CPIx back to the sharp arrangement, simultaneously tolerating their secret assets and burning-through the CPIx unequivocal to that understanding, for instance CPI5. The emblematic will then self harmony.

Unbiased Claims Assessment

dSurance will leverage Kleros and its decentralized dispute resolution protocol. Independent assessors and arbitrators review the claims based on the policy documents provided for each insurance policy and the pieces of evidence presented by the claimant.Claims are therefore treated fairly and in an unbiased fashion. The Kleros Jurors are independent from dSurance.

You can learn more here.

dDEXX.io Opportunities

Providing liquidity for pairs including primary tokens (BNB, BUSD, etc.) and our native tokens (dDEXX, CPI, dDAO, dVest, etc.) on Binance Smart Chain. Liquidity providers earn a 0.3% fee on all trades proportional to their share of the pool. link

Providing liquidity for pairs including primary tokens (ETH, USDT, WBTC, etc.) and our native tokens (dDEXX, CPI, dVest, etc.) on Ethereum Network. Liquidity providers earn a 0.3% fee on all trades proportional to their share of the pool. link

Providing liquidity for pairs including primary tokens (ETH, USDT, WBTC, etc.) and mAssets (mAMZN, mMSFT, mTSLA, mNFLX, mBABA, etc.) on Ethereum Network. Liquidity providers earn a 0.3% fee on all trades proportional to their share of the pool. link

CPI Opportunities

Providing liquidity for pairs including CPI and primary tokens (BNB, BUSD, etc.) on various DEXes on Binance Smart Chain, including dDEXX, PancakeSwap, and more. Liquidity providers earn a 0.3% fee on all trades proportional to their share of the pool. dDEXX PancakeSwap

Providing liquidity for pairs including CPI and primary tokens (ETH, USDT, WBTC, etc.) on various DEXes on Ethereum Network, including dDEXX, Uniswap, and more. Liquidity providers earn a 0.3% fee on all trades proportional to their share of the pool. dDEXX UniSwap

Providing liquidity directly to the CPIx asset pools by minting new CPIx tokens. Liquidity providers earn a 2% fee on all trades proportional to their share of the pool. CPI

Providing liquidity for pairs including CPIx tokens and primary tokens (BNB, BUSD, etc.) on various DEXes on Binance Smart Chain, including dDEXX, PancakeSwap, and more.Liquidity providers earn a 0.3% fee on all trades proportional to their share of the pool. dDEXX PancakeSwap

Providing liquidity for pairs including CPIx tokens and primary tokens (ETH, USDT, WBTC, etc.) on various DEXes on Ethereum Network, including dDEXX, Uniswap, and more. Liquidity providers earn a 0.3% fee on all trades proportional to their share of the pool. dDEXX UniSwap

dDEXX

dDEXX is an AMM based DEX also using the x*y = k model, also known as the constant product model, with modifications. It allows a user to swap any two Binance Smart Chain, Ethereum, or Polygon based tokens. These swaps are facilitated by LPs who provide liquidity to pools. For each trade performed on dDEXX, a 0.2% fee is paid. 0.17% goes to liquidity providers, and 0.03% goes to the dDEXX treasury.

dDEXX is rapidly increasing its position in the DeFi space in terms of volume and daily active users, and is rolling out several new products and offerings over the next month in addition to it’s already popular yield farms, liquidity pools, and other products.

Value accrual

Liquidity providers (LPs) earn 0.3% trading fee right now. LPs can also stake their LP tokens in yield farms to earn additional variable interest rates for as long as their tokens are staked, in order to incentivize long term liquidity provision.

- Volume last 30 days: $2.12M

- Balance of assets across all smart contracts last 30 days: $1.56M

- Active Users last 30 days: 575

- Circulating Supply (non-treasury): 7,444,882.93 dDEXX

- Price per dDEXX on July 15th, 2021: $0.007

- Value of dDEXX held in treasury on July 15th, 2021: $5,517,018.74

Conclusion

Exchanges have been a thriving business in the digital assets landscape. Centralized exchanges such as Coinbase, Binance, and FTX have flourished over the few years. 2020 witnessed the Cambrian explosion of DeFi powered by DEXes. Given that DeFi users accrue actual cash flows, we think that DeFi and DEXes will find higher representation in the digital assets market. We expect DEXes to grow at a high rate during the next couple of years, and dVest, dDEXX, and our other DeFi products are all well positioned to absorb a significant percentage of that growth.

For more info check below links:

- Website : https://dvest.org/

- Bitcointalk Announcements : https://bitcointalk.org/index.php?topic=5350936

- Twitter : https://twitter.com/dvestproject

- Medium : https://medium.com/@dvestlabs

- YouTube : https://www.youtube.com/channel/UCLnrGT2xZCwpoCzMfon_mAQ

- Discord : https://discord.gg/56ESaPCdpx

- Telegram : https://t.me/defivest

https://dvest.org/

https://main.ddexx.io/

https://cryptopriceindex.io/

Bitcointalk Username: Ozie94

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=2103066

BSC Wallet Addrees : 0xEfd7255D5b89Ceffa7d0E297b556286C143e779B