Trump's Trade War Crashes the DeFi Sector

The decentralized finance market is expected to contract 24% in 2025 due to tariff fears and capital flight.

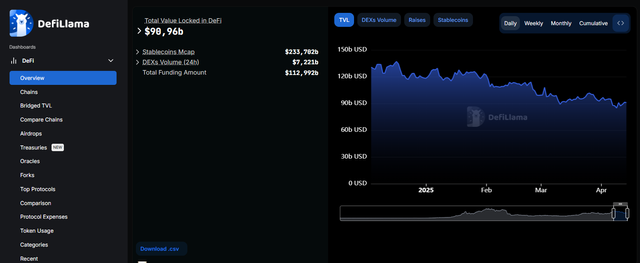

The decentralized finance (DeFi) market has entered a downward spiral so far in 2025, experiencing a widespread 24% drop in its Total Value Locked (TVL), which plummeted from $119.6 billion to $90.9 billion. This significant capital flight reflects a growing risk aversion among investors, who are seeking refuge in safer assets amid escalating global trade tensions triggered by Donald Trump's tariffs.

DeFi fell -24% in 2025, in line with the negative performance of the S&P 500 (-8% YTD) and Bitcoin itself (-9%). / DeFiLlama

The Trump Effect: The Catalyst for the DeFi Disaster

Fears of a global trade war, sparked by the former US president's aggressive tariff policy, shook emerging markets and the cryptocurrency sector, negatively impacting the DeFi ecosystem. The correlation with traditional markets is evident: DeFi fell -24% in 2025, in line with the negative performance of the S&P 500 (-8% YTD) and Bitcoin itself (-9%).

A Silver Lining: The Challenge of AAVE

Amid this bleak outlook, one protocol stands out as a beacon of resistance: AAVE. As the DeFi sector collapses, AAVE bucks the trend with monthly growth in its TVL, reaching $17.89 billion. This anomalous behavior suggests two key factors:

Increasing demand for loans: Investors are using AAVE as a tool to take short positions or to leverage rising market volatility.

Flight to Quality: AAVE is consolidating its position as the most stable and audited lending protocol in the ecosystem, attracting capital in search of security.

Lido experienced a sharp drop of -16.73%, while EigenLayer plummeted -11.67% in the last month. This decline in liquid staking and restaking reflects a loss of attractiveness due to the lower demand for ETH (whose price fell from $2,800 to yearly lows of $1,400) and the growing risk of slashing on EigenLayer.

Revealing Trends: The End of Yield Farming and the Flight to CEXs

Analysis of the first quarter of 2025 reveals worrying trends for the DeFi sector:

The collapse of yield farming: Protocols such as Ethena (-9.1%) and Sky (-25.37%) confirm that high annual percentage yield (APR) models are in crisis in a risk-off environment.

Bitcoin and Ethereum as a drag: Lido's decline is directly linked to the collapse of Ethereum's price, which has reached yearly lows.

Exodus to centralized exchanges (CEX): The decline in TVL on decentralized exchanges (DEXs), although not detailed in the figures provided, suggests that traders are migrating to centralized platforms like Binance and Coinbase in search of greater liquidity.

Macro Outlook: An Uncertain Future Pending Trump and the Fed

The macroeconomic outlook for the remainder of 2025 presents a challenging scenario for the DeFi market:

Baseline Scenario (2025): If Donald Trump aggressively implements his tariff policies, the total DeFi TVL could fall further, testing support in the $75 billion–$80 billion range, levels last seen in 2023.

Positive Catalysts: However, there are potential catalysts that could reverse this trend, such as the approval of DeFi exchange-traded funds (ETFs) (with AAVE as a potential pioneer) and an eventual interest rate cut by the Federal Reserve (which would ease pressure on risk assets).

The DeFi Trial by Fire

The DeFi market faces its toughest test since the fateful year of 2022, with a severe contraction driven by external macroeconomic factors. However, protocols with real, proven utility like AAVE are demonstrating remarkable resilience amid the storm.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency trading and DeFi investing are highly volatile and carry significant risks, including the total loss of invested capital. Consult a financial advisor before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.