DISTRIBUTED CREDIT CHAIN (DCC) ico - “We build a public blockchain to transform financial services” (part 2)

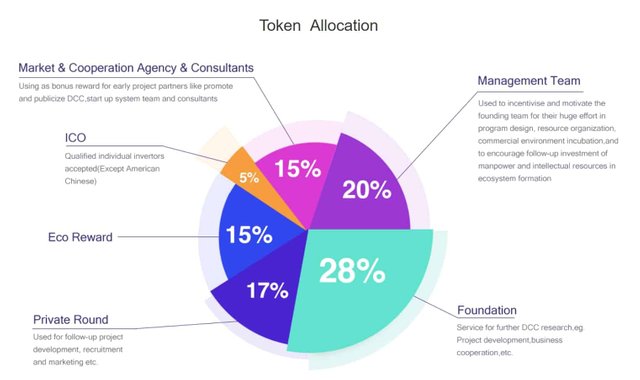

DISTRIBUTED CREDIT CHAIN (DCC) token allocation:

ICO release of 500 million tokens

The final allocation:

17% Private purchasers

5% ICO

28% Foundation

15% Market and Cooperation Agency and Consultants

15% Eco Reward

20% Management Team

DCC use of funds:

- Labor Costs 30%

- Marketing 25%

- Cooperation 10%

- Consultancy 5%

- EcosystemOperations 5%

- Reserve Fund 25%

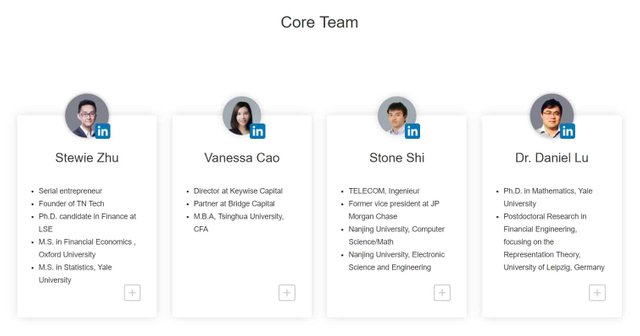

Team and Advisors

Stewie Zhu - Bachelor in EE, Nanjing University; MA in statistics,

- Yale University M.s Statistics,

- Oxford University M.s in Financial Economics

- Ph.D. (Candidate) in Finance, London School Of Economics

- Research focusing on finance and game theory.

- Serial entrepreneur in the internet and Fintech industry

- Led a leading SaaS financial technology company in China to develop internet-based credit systems for over a dozen of trusts with multibillion USD annual loan facilitation amount, which was successfully sold to a publicly-listed company in three years.

Daniel Lu

- PhD in Mathematics, Yale University, USA; Postdoctoral Research in FinancialEngineering, focusing on the -Representation Theory, University of Leipzig, Germany

- Head of investment banking and asset management, general manager of financialdepartment of a large commercial bank

- Years of experience in financial institutions at home and abroad, working successively at Deutsche Bank headquarters and Finance Department at a joint-stock bank headquarters.

- Possesses solid professional knowledge and research abilities, and has been invited to give keynote speeches at academic conferences and financial conferences in China and abroad. Specializes in capital & capital market business, asset management, bank assets and liabilities management, internal fund transfer pricing, product pricing, market risk management and modeling, financial derivatives pricing, and the Basel New Capital Accord in investment bank/commercial bank.

Stone Shi

- J.P. Morgan, Vice President, Quantitative Research, Focused on Derivative Pricing, Quantitative Model Risk

HSBC, Internship, Rates, Educatio - TELECOM, Ingenieur, Majored in Computer Science and Applied Maths

- Nanjing University, Majored in Electronic Science and Engineering

Vanessa Cao

- Years of experiences at Sequoia Capital,focus on early stage of fintech sector

- Director at Keywise Capital

- Partner at Bridge Capital , focus on China A-share listed companies M&A(mainly Fintech )

- Tsinghua University, MBA, CFA

- Vanessa is mainly focused on DCC program administration

More info:

Website: http://dcc.finance/

Whitepaper: http://dcc.finance/file/DCCwhitepaper.pdf

Telegram: https://t.me/DccOfficial

Github: https://github.com/DistributedBanking/DCC

Medium: https://medium.com/@dcc.finance2018

Reddit: https://www.reddit.com/r/dccofficial/

Twitter: https://twitter.com/DccOfficial2018/

Facebook: https://www.facebook.com/Distributed-Credit-Chain-425721787866299/

Author: https://bitcointalk.org/index.php?action=profile;u=1334820

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://icoguide.com/en/ico/distributed-credit-chain

Congratulations @thanhbinhhe! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!