Mining in a Blockchain

Short introduction to Blockchain

In real-life, tangible things and commodities can be tracked physical. Either one has possession of a certain thing, or they do not. This entails that there cannot be a copy of the commodity with both the sender and the receiver. However, in an online network, when currency, media, emails, votes, IP rights are shared, both the sender and the receiver end up with their copies of the commodity. For example, a video shared among two people cannot be tracked openly by the network. The question, therefore, is Who owns the property if you cannot trust the sender or receiver? Classically, this is known as the double spending problem, which was a vulnerability of online transactions.

In 2009, an author by the pseudo name Satoshi Nakamoto solved the double spending problem and published a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” which describes an ingenious solution to the double-spending problem. He called the technology as Blockchain. I highly recommend you watch the Ted Talk from Don Tapscott, in which he describes the theory and applications of the blockchain.

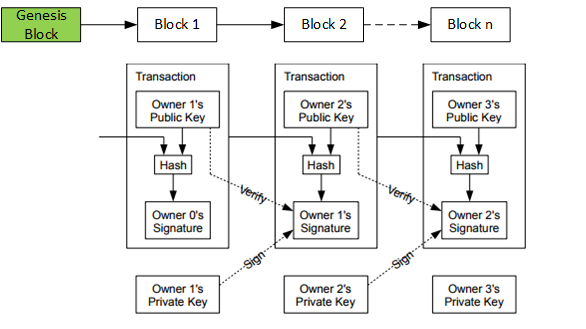

Figure 1 Example of a Blockchain transaction adapted from “Bitcoin: A Peer-to-Peer Electronic Cash System”

In summary, the four cornerstones of a blockchain network are

- Transparency/Immutable: All transactions are open for scrutiny by the entire network and cannot be manipulated

- Trust: Historical proof of transactions cannot be hidden, delete, edited (can be edited if the majority of the network agree 51%). Transactions can only be added to the block.

- Security: For a rogue to infiltrate a massive network and edit, delete, hijack a transaction history is currently impossible

- Distributed network: There are no centralized nodes controlling the transactions

As seen in Figure 1, Block 2 contains all the information forwarded by Block 1. However, to decrypt the message sent from Block 1, the node (computer) handling Block 2 needs to validate the earlier transactions. This task is called proof of work. Simply put, a proof of work is the work (decryption) the computer has to perform. Once the computer does the proof, it is ready to transmit the information to the network by forming a new block and attaching a signature from node 2. Now information from all previous blocks is contained in the new block. Hence the name BlockChain

As nodes (computers) process blocks and are successful to show the proof of work, they get rewarded with an overall share of block size and their proof of work abilities. This activity is called mining. A miner is part of the blockchain network, his computer the tool to capture the previous block and validate the earlier transactions of the blockchain. For the effort, the computer gets a small fraction of the overall block value.

There are different kinds of proof of work system. Proof of stake, proof of space, etc. Some are CPU intensive, some are GPU intensive and some HDD intensive. Some require high-performance and specialized hardware e.g., Bitcoin.

Why is BitCoin mining not profitable for small miners?

In 2013, a new kind of chip was introduced called the Application Specific Integrated Circuit (ASIC) chips. ASIC outperform any modern GPU in solutions/second and therefore are fine-tuned to mining BitCoin. As more of the BitCoin blockchain network converted to ASIC chip based mining, the mining difficulty raised sharply. This killed the aspirations of many small-scale enthusiast miners as their hardware could not complete with ASIC chips and the profitability of mining bitcoin tanked.

Development of Altcoins, i.e., alternative coins started to grow, and investors started to diversify their portfolios to ensure safe investments in cryptocurrencies.

Hint: research for coins which are resistant to ASIC chips. It ensures all miners in the network are relatively well balanced with either CPU or GPUs. This means that your rig may compete with other miners. Leveling the playing field so to speak.

How to select a suitable cryptocurrency to mine?

- A strong community-based blockchain network is primary. This is because there will be forums, which can help you understand the mining process and more developers to maintain the network.

- Type of proof-of-work system used. Is the mining resource intensive? For example, CPU and GPU intensive?

- Market cap of the cryptocurrency. How many coins are available to be mined and how many are already in circulation and what is their current and historic value?

- Initial investment. Do you want to be a miner or trade in exchanges? How much would a high-end rig cost?

- Exchange availability: Is the currency listed in any of the major cryptocurrency exchanges? If not, you will have to wait until an exchange accepts the currency to get a payout in dollars or other nationalized currencies.

- Current difficulty of the network: higher the difficult, lesser the chances of winning blocks. The difficulty of the network fluctuates depending on the block sizes and block generation frequencies.

- Legality: is the cryptocurrency mining legal in your country?

Pool mining is mining with other miners in a pool. If you win a particular block, you share your earnings in the pool and vice-versa. In the long-term, this will payout because you will have a steady income.

Solo mining, on the other hand, is dependent on your hardware capabilities. Mainly, you compete with all the miners in the network to have the best possible and fastest solution to validate a transaction/block. Winning blocks in solo mining may be very hard and rare to come by, but if you do win, you get to keep the total payout for that block to yourself.

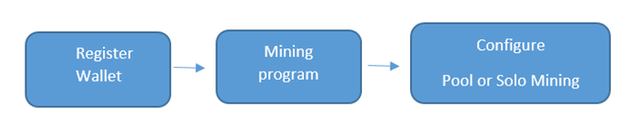

The process to mine any cryptocurrency

Step 1 Wallet: You first need to register a wallet in the homepage of the cryptocurrency you are interested. A wallet is similar to a bank account. It mainly contains three essential things

- Your public key: The one used during Hashing

- Your public account: Your wallet address which can be shared online similar to your bank account number

Figure 2 Process of mining cryptocurrency

Step 2 Mining Software: A mining software links you to the blockchain as a node and also links your wallet to the mining instance. It links you to the pool as well. Usually developed by third parties. Do research in the forums to find out a reliable mining software for your mining setup.

Step 3 Pool or Solo mining: If you choose to pool mine, you have to research, which pools offer you the best return considering your hardware capability. More miners in the pool equate to lesser payout (more people claim block winnings). Again, official forums should help you identify a suitable pool. If you decide to pool mine, the pool may have a dedicated pool website where you need to register and link your wallet so that the winnings can be transferred automatically as you continue to mine. Pool payout schemes also vary. While some pay you instantly, others wait for 24 hours or more before payout. Pools may also ask you to register the name of the worker. A computer doing the mining is called a “Worker”. Registering workers in the pool ensures you can run multiple workers if you intend to and all workers can be linked to a single wallet.

Solo mining is easier to setup, but payouts are rare and high.

References and useful links

Exchanges

| Most popular exchange, but has had some issues in the recent past | https://www.coinbase.com/?locale=en |

| Up and coming exchange | https://bittrex.com/ |

| Probably the least reliable exchange as of now | https://poloniex.com/ |

| Shows an overview of all the cryptocurrencies | https://coinmarketcap.com/ |

Is mining an option considering power supply cost? These calculators can help you decide.

| Calculator showing payoffs for different decryption algorithms | https://www.nicehash.com/?p=calc |

| A calculator for many Cryptocurrencies | https://www.cryptocompare.com/mining/calculator/btc?HashingPower=4&HashingUnit=MH%2Fs&PowerConsumption=9&CostPerkWh=0 |

| Imineblocks is an ideal channel to follow if you want to setup a mining rig. He covers a broad variety of Cryptocurrencies and gives walkthroughs | https://www.youtube.com/channel/UCjYHcWGAjUVqU49D2JOKD3w |

| Guntis Vitolins is a hardware expert and helps build high performing mining rigs | https://www.youtube.com/channel/UCkYCnjVcFJDN6Cp_uP0pv_A |

| Ameer Rosic is good at analyzing cryptocurrencies and provides valuable advice to build a portfolio | https://www.youtube.com/user/AmeerRosic |

I end this post by adapting a famous quote from Benjamin Franklin:

"An investment in a hobby pays the best interest."

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://jeevith20.wordpress.com/2017/07/03/mining-in-a-blockchain/

Congratulations @jeev! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP