Cryptocurrency and Central Banks: The Quest to Dematerialize Money

Eugene Etsebeth is a former central bank technologist with the South African Reserve Bank. There, he notably chaired the virtual currency and distributed ledger working group.

In this opinion piece, Etsebeth outlines why he believes all central banks will attempt to dematerialise notes and coins eventually, and what that means for central banks.

Today, nation states have a monopoly on the issuance of notes and coins, one enforced with acts and regulations.

One just needs to revisit history to see how Liberty Dollar creator Bernard von NotHaus wascharged with federal crimes for trying to mint his own private currency. Agents of the U.S. Secret Service and FBI raided the Liberty Dollar offices in 2007 and confiscated all its gold, silver and platinum. Bank accounts were frozen and computers seized.

Fast forward to 2017 and central bank-issued currencies and privately issued cryptocurrencies have been co-existing for almost a decade. Libertarians are acutely aware that it is only the decentralized and cryptographic nature of cryptocurrencies that keep the government agents from the door.

And there is reason for suspicions. A larger drive by central banks to dematerialize money has been ongoing since long before the advent of cryptocurrencies, and it can be said that the technology is emboldening central bank attempts to issue digital money.

New motivation

Key to this trend is that bitcoin and other decentralized cryptocurrencies have shown a potential answer to how the dematerialization of money may be rolled out by central banks.

Recently, Kaspar Korjus, managing director of Estonia's e-Residency scheme, posed the forward-thinking question: "Should Estonia begin issuing its own crypto tokens to e-residents (as well as citizens and residents)?" On the flip side, a South African Reserve Bank official made a statement that cryptocurrencies are "too risky."

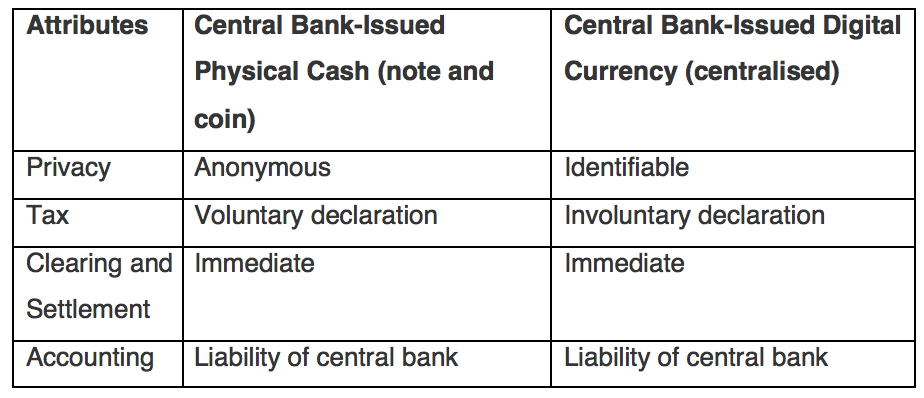

Central bankers are interested in the choices and advantages of the dematerialisation of currency.

And there is upside here.

Currently, chief cashiers and currency mangers at central banks around the globe are faced with enormous challenges when it comes to issuing physical notes and coins.

These include:

Cost: printing polymer- or cotton paper-based notes is expensive. The minting of coin costs money. This cost affects the seigniorage income of central banks (profit made by a central bank by issuing currency, especially the difference between the face value of note and coins and their production costs).Counterfeiting: there has been an increase in technologies to assist criminals in forging notes and coin.Market readiness: vending and ticketing machines need template changes when new notes and coins come to market. Citizens must also be educated on the new features.Distribution: distributing notes and coins to banks, branches and ATMs is expensive and time consuming.Theft: often violent robberies are attempted on cash-in-transit vans. ATMs are blown up and banks robbed.Destruction: the lifecycle of notes and coin require the mutilated and marred notes and coin be returned to the central bank depots to be destroyed.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.coindesk.com/central-banks-cryptocurrency-and-the-quest-to-dematerialize-money/

Congratulations @zaidragie! You have received a personal award!

Click on the badge to view your Board of Honor.

Congratulations @zaidragie! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!