Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and Ripple: Price Analysis, 4th Week- 29th June

Namasthe,

The current bear state of #cryptocurrency markets has completed a 6-months of bear #cycle today irrespective of the positive fundamentals moving around in the industry.

On one side, where profound individual like the Judge of US Supreme Court views Bitcoin as a possible asset for payment of salaries and other utility; we also have the infamously known Wolf of Wall-Street – former stockbroker Jordan Belfort who believes that it is the “beginning of the end” for Bitcoin.

I believe in Nicolas Darvas theory of analysis and not forecasting the fate of any given evolution. The acceptance or rejection of any given innovation is known with time and having said that cryptocurrencies have brought a disruptive technology of blockchain that already has found huge acceptance in traditional industries.

Let’s look what we have in store for a trade set-up of the respective cryptocurrencies:

Bitcoin:

Bitcoin is representing a fall of about 3.3% in last 24-hours trading close to the $5,900 mark.

Like we mentioned in our previous weekly analysis, our expectations for retest of the levels of $6,000 proved accurate with BTC facing consistent selling pressures on every attempt to move upwards.

Also, given in our daily analytics, BTC failed to confirm a pull-back move that we anticipated above its intraday resistance of $6,360 and thus, lacking substantial volumes, it dropped back below the $6,000 mark.

BTC for the first time in last 7 days has given a close below the crucial support of $6,000 and Bears have successfully deepened the hole to test lower supports. On lower side, the support lies around $5,400, $4,950 and $4,550. Amongst the respective support, the $4,950 marks the most important important support from where the new leg of bull-run to the top of $19,891 had started.

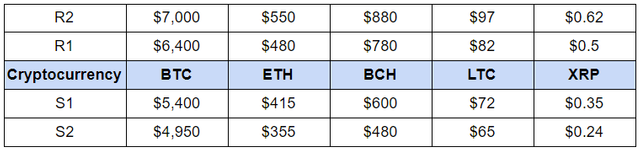

- Bitcoin at present is bearish and will face strong resistance against $6,400, $7,000 & $8,000.

- Testing the support of $5,400 is likely if Bitcoin is unable to hold above $6,000.

- The most important support lies around $5,000 mark where a pull-back can be expected if it gathers respective volumes.

- The second most important level lies at $4,550 which is the 50-week MA which has never been broken since December 2015

Ethereum:

Ether is representing a fall of about 3.8% in last 24-hours.

Facing constant selling pressure against the downtrend line and the the 20-day EMA, Ether has turned its face down as we expected with no sentimental support from the overall cryptocurrency markets.

ETH is trading at par with its intraday support of $415. On current level, ETH lacks volumes to defend the intraday support and is likely to slip down to its April low of $358. Ether will complete a descending triangle at $355 and it will be important to see if the level holds for a relative pull-back.

Forming lower high’s and low’s, Ether faces line of resistance along $450, $485 and $525.

Traders are expected to be on the sidelines till ETH comes out of this bearish cycle or validates a pull-back defending its only support of $355.

Ripple:

#Trading at $0.44, #XRP is representing a fall of 4.5% in last 24-hours.

XRP has slipped below it’s crucial support of $0.45 and hence has opened the bear avenues to test even lower support of $0.35 and $0.24 in the coming time. If observed, XRP has seen sharp decline in volumes and thus, trading such an inactive asset will be irrational.

It is better to wait for the right trend to be established in the respective currency and waiting would form any trader’s likeliness for the same. XRP has supports now only at $0.35 and $0.24 whereas it faces fierce resistance on multiple levels on the upper side at $0.5, $0.57 and $0.62.

Weekly Price Pointers:

Traders can smartly use their skills and can refer to the technical levels above to make optimised trade decisions. Happy Trading..!!

Sources:

https://www.zebpay.com/blog/weekly-crypto-price-analysis/

cryptowat.ch

moneycontrol.com

ccn.com

Disclaimer:

This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choice when deciding if an investment is appropriate.

The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness or reliability of the information, opinions or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

#Trading & Investments in #cryptocurrencies viz. #Bitcoin, #Bitcoin#Cash, #Ethereum etc.are very speculative and are subject to market risks. The analysis by Author is for informational purpose only and should not be treated as an investment advice. This report is for educational purpose only.

link Others..

Luckygames : http://za.gl/XkVMiZ

Youtube :http://za.gl/Om13JKc

My Best ...5 % to 7% return daily on TOKENIZER

http://za.gl/kAEs

http://za.gl/aFwFOq3

Script download here..http://za.gl/aEhN8aY

Dogecoin Ratio calculation on chart 97% working on any bitcoin game :http://za.gl/Y64y5

Ratio calculator link (Also watch previous video how its working)

how to use..

http://za.gl/gWD17Tvy

Link..

http://za.gl/4BnNOMm

Popular

http://za.gl/gMznk8 (Translate Language and Use)

Thanks