Distributed Credit Chain (DCC) Blockchain Project Review - The world’s first distributed banking public blockchain

The market

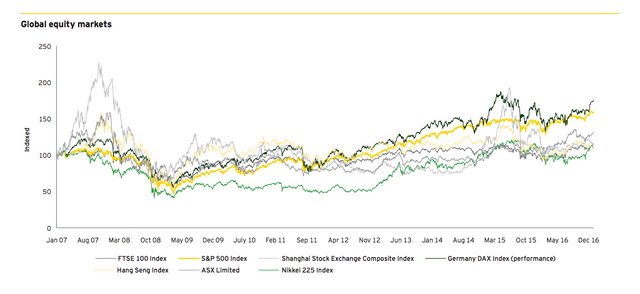

An outlook at Global equity markets

And here is the snapshot of the U.S. leveraged loan market reaching $1tn and quickly keeping up with US high yield or junk bonds.

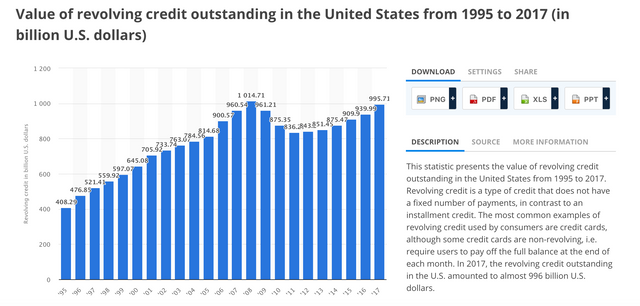

Regarding the value of revolving credit outstanding in the United States alone from 1995 to 2017. For those who don't know, revolving credit is a type of credit that does not have a fixed number of payments, in contrast to an installment credit. The most common examples of revolving credit used by consumers are credit cards, although some credit cards are non-revolving, i.e. require users to pay off the full balance at the end of each month.

In 2017, the revolving credit outstanding in the U.S. amounted to almost 996 billion U.S. dollars.

And I think, by showing you those figures, it would be easier for you to imagine how enormous this market is.

The problem

The conventional banking and financial services industry has been there for a while. Yet there is hardly any significant change in this sector which is considered to be totally under the control of giant firms. And that is saying, institutional amorality is the root of all problems constraining the field.

Typically, considerable transaction fees are charged even though the customer experiences are not satisfying to them. Wait, did I just write "customer". Well, my friend, in this industry, "customer" is not well-treated like other sectors' customer: You'll be under the microscope scanning for every detail, every data that they - other their connections - have about you, giving them the absolute right to determine all funds' cash flow as well as interest and lending rates - meaning not just normal centralization but the outright monopoly - and eventually bringing them huge profits (Yes, in addition to the gigantic fees that they charge you above). And all of those activities are being done within the company itself, non-disclosable. That is saying only heaven knows what is going on in there and if the integrity and authenticity are maintained. And even they are, by being such an opportunist in-between connecting supply and demand, they can easily manipulate both sides and take most of the profits, leaving lenders and borrowers poor gains. That intermediary role does not worth that much.

Moreover, the monopoly of giant companies is not only causing direct damages to the customers but also constraining the growth of the traditional financial system itself: small financial institutions cannot compete with them, making it not place for innovation, changes, disruption to the industry.

Another problem in the industry is its verification process's inefficiency - It is just a tedious procedure. Millions of USD every year, both in term of monetary, time and effort, is wasted on studying the customers' credit data instead of being used in a much more sensible objective, improving the customer experience, for example?

The solution

Distributed Credit Chain (DCC) aims to open up an innovative decentralized cooperative service relation among financial institutions thanks to the disruptive blockchain technology. But, don't get me wrong, Distributed Credit Chain is much more than just a blockchainized banking system. It's actually more than that. Let me show you how:

1. Power to the people and more efficient process

Instead of being investigated by banks, financial service firms and their networks, for a long period of wasting time, borrowers can just register an account on the DCCID blockchain to give service provider consent to access their data and send in borrowing application.

Apparently, the established-on-blockchain account's data security is in a way better safety since there is no single point of failure within the network for malicious hackers to conduct any attack into it. Therefore, all the credit data and transmission information won't be manipulated or tampered. Moreover, that is the movement of bringing individual data network from centralization to decentralization, giving them more power regarding their data - which they should already have had in the first place.

Moreover, with this distributed banking public chain, there is no more place for enormous transactions fees to existing. And that is saying irrational charges won't take place, instead, individuals participating in the process get more profit with a transparent process of lending and interest rates as well as cash flow determination.

2. Interoperability among the services, heading to a healthy network and a thriving industry

For better interoperability among the system, a data standard set is introduced for people to comply with so that integrated individual data stored on the chain could be transferred through it, making it easier for providers to clean dirty data as well.

Regarding other companies like algorithm & computation service providers, information like characteristics could be extracted from the database stored on the chain, enabling better judgments as well as its measurements of qualification.

Other businesses like risk management and bearing as well as loan management and collecting could also thrive in the environment that Distributed Credit Chain creates since every data-related issues are minimized, lowering the industry entry bar -> more players in the competition, more place for innovation and progress.

Any companies wanting to involve in the Distributed Credit Chain network can create develop their own Dapp or establish smart contracts to integrate and work with their stakeholders, making it a healthy environment for industry growth (Less monopoly and more future for small and medium-sized enterprises).

3. Credit History Record

For the sake of integrity as well as fairness among the community, a record of approved credit history would be added on the blockchain, making it immutable and almost irreversible (unless the community agrees to vote to reverse it, which might be impossible), so that long-term bad debts or annoying recurrent test borrowing.

4. Positive Macro-reforms

Banking and financial services industry is a long-term established field with none critical changes. In certain ways, this is a good sign, like, the process is well-developed and smoothly operated. Yet, from another angle, that is the destruction of innovation, of progress and growth.

And DCC's distributed banking public chain is something novel and disruptive that could be the new standard of the industry. Specifically, the peer-to-peer and all-communications model everywhere, creating a better communication system and more efficient transmission. Moreover, the conventional business structure would be definitely altered, obviously since decentralization is now achieved, meaning no more multi-levels arrangement and improving overall business efficiency.

Team

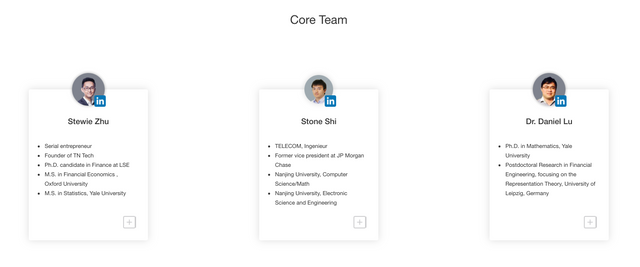

The Distributed Credit Chain Team consists of experienced experts in their respective fields with well-known achievements

Especially, their CEO and Founder - Mr. Stewie Zhu who is a behavioral economist and game theorist from Oxford and LSE, has been a serial entrepreneur in the internet and Fintech industry for years before immersing in the cryptocurrency world.

Mr. Stone Shi, Former vice president at JP Morgan Chase is a specialist in quantification, derivative pricing, quantitative risk analysis and their applications with blockchain technology. For your information, the leading investment bank worldwide with regards to revenue as of December 2017 was JP Morgan.

Dr. Daniel Lu who got his Ph.D. in Mathematics at Yale University also has years of experiences in finance and banking as well as blockchain development.

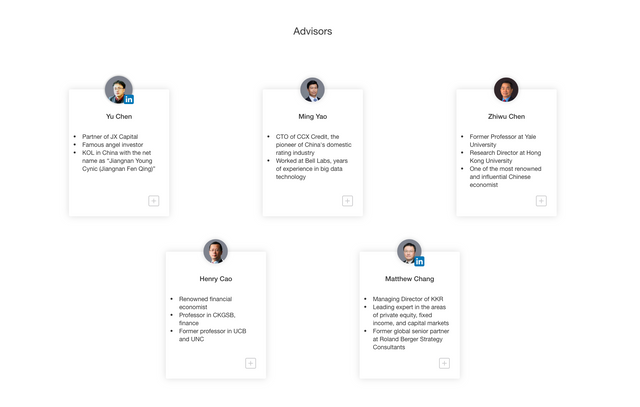

DCC's progress is also secured with the support from high-profile economists and well-known investors, such as

Social Media Presence

The Distributed Credit Chain Marketing team has worked quite well with some remarkable results on the most popular social networks in the cryptocurrency community like Telegram and Twitter. Specifically, a Twitter followed by nearly 12k people and a Telegram channel with almost 40k members filled with active discussions about the project.

Their performances on other platforms are just acceptable, I highly suggest them to improve it. For example their 5k-followers Facebook Page.

As they have already finished their ICO, I think it's reasonable for them to come up with more improvements on other platforms as well since, apparently, these 2 networks are not enough to attract and educate the community. Starting with their Medium first would be a great idea as this platform somehow shows the credibility of the project (The project team must have gone through some procedures working with the Medium crew to establish and maintain that blog on the network). Frequently publishing more articles updating their progress with the crowd can be a suitable movement.

Token Economics — Token sale

Token symbol: DCC

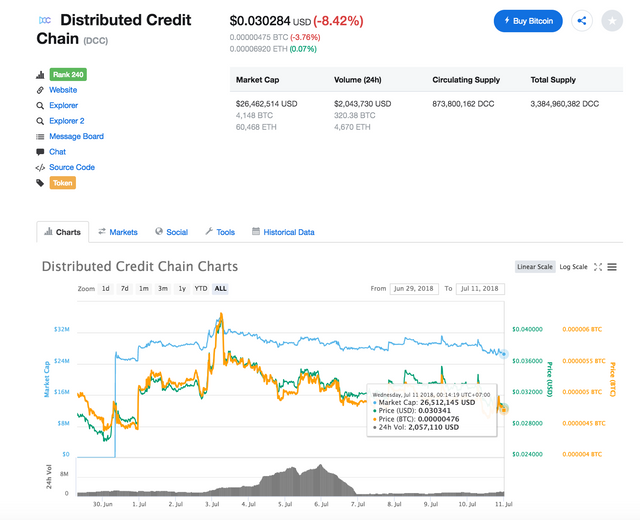

At the time of writing:

Market Cap: $26,462,514 USD

Volume (24h): $2,043,730USD

Circulating Supply: 873,800,162 DCC

Total Supply: 3,384,960,382 DCC

Exchanges: Kucoin, Bibox, IDEX

As can be seen, their 24h volume is nearly 10% of their market capitalization - a healthy proportion - which means that the token is frequently traded and apparently used a lot. And that is saying this project is way undervalued.

With their being listed on Kucoin, Distributed Credit Chain is slowly gaining recognition from the community. In fact, the feat that they got listed on Kucoin quite recent after their ICO somehow indicates the team's capabilities in the execution phase - the part that most blockchain projects lack and as a result, 80% of them faded in vain.

My thought

With the help from Distributed Credit Chain, everyone can now acquire back their own credit data ownership, giving them the accessibility to the financial services as they need with higher security. I believe any visionary contributors can totally foresee the huge potential profits this project can bring up to them if they back it up from the very first place.

Links

Website: http://dcc.finance/

Whitepaper: http://dcc.finance/file/DCCwhitepaper.pdf

Bitcointalk ANN: https://bitcointalk.org/index.php?topic=3209215.0

Telegram: https://t.me/DccOfficial

Twitter: https://twitter.com/DccOfficial2018/

Facebook: https://www.facebook.com/DccOfficial2018/

Citations

https://www2.deloitte.com/global/en/pages/financial-services/articles/gx-banking-industry-outlook.html

https://www.ft.com/content/e3bc6c46-4ebf-11e8-a7a9-37318e776bab

Author: Bitcointalk username: rueisnax (a.k.a. Vincentle — Le Huu Quang Vinh)

Profile link

Disclaimer: Statements on this site do not represent the views or policies of anyone other than myself. The information on this site is provided for discussion purposes only, and are not investing recommendations. Under no circumstances does this information represent a recommendation to buy or sell securities.

If you found this helpful, please like and share to help others find it since it’s free! Or if you have any idea to exchange, drop a comment below so that I can respond! Follow me for more review on cryptocurrency.

#cryptocurrency #blockchain #ICO #ICOreview #review #TrevonJB #CraigRant