Revenue Strategy for All Markets: Buy LEO to Sell USDC

The goal of investing is to make a profit. It is a good way to earn a living. Often cryptocurrency investors sell their assets in order to take profits. Even when they don't do sell the asset, they sell the revenue generated through the assets. I do this with $SPS for an example. I get SPS + VOUCHER Rewards and I sell them to take profits. I finally feel that we are in a proper Altseason. It is important to be prepared to get the bets out of it.

There are no parabolic moves yet. We are seeing market activities such as the growth in Altcoin ETFs (which I dislike for being TradFi instruments). There has been a great deal of development across cryptosphere. I am happy to see that many developers are actually impressed by LeoDEX development speed + accomplishments. This is a great indicator that we are investing in an amazing team.

To make matters better, we have all the popular indicators listed by CoinMarketCap being negative. We have a long way to go to even see the top for $BTC prices. This long way up could happen at a rapid speed in a parabolic run to the upside. Selling right now for anything other than absolute necessities is a big mistake IMO.

Where LeoDEX Fit Into The Picture

Even if a person trade 10 $ETH, if the price of ETH has reached $10,000+ the fee earned by the DEX will be a much bigger one. Higher asset prices benefit the DEXs greatly even if no new users embrace self custody and trading native assets via unified interfaces such as LeoDEX.

Many projects with real revenue buy their own Token and even burns it at times. Some of them even engage in maintaining their own Liquidity Pools. These are great steps that make these operations sustainable. The problem is that the Token itself could continue to have some sell pressure due to investors cashing out their Rewards.

$LEO stayed flat during the time $HIVE was erasing at least a week's worth gains in a short period of time. Although the entire cryptocurrency market was having a bad time, LEO managed to do fine (despite small LPs that make massive volatility possible). Part of the reason is rewarding investors in something other than the Token of the project. USDC has done a good job maintaining the peg. It has been reliably devaluing itself at the same rate as USD. Most investors will have no qualms about getting paid in USDC or even spending them.

System Income Reward Pool (SIRP) + Delegations

These are the only two places where investors get their Rewards in $LEO. A large portion of this LEO goes to the most loyal community members who have been with us on this journey since 2019. I am proud to be one of the users that joined on the launch day. I have been an active member of the community throughout these 6 years without any hiatus.

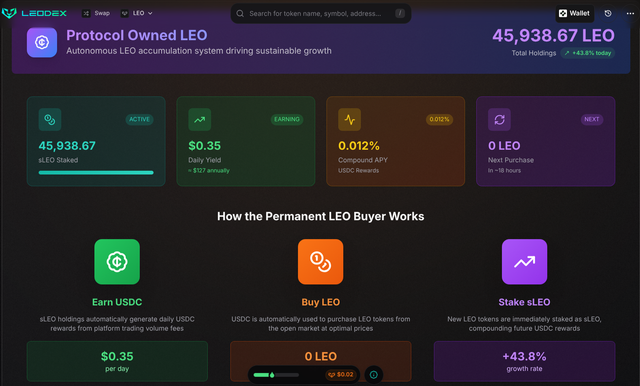

If most of the revenue comes from LeoDEX + LeoMerchants, INLEO Rewards will not add a large sell pressure on the Token. This helps to preserve the price of the Token giving less reason to sell it. @leostrategy will be functioning similar to Protocol Owned Liquidity (POL) in the sense that its goal is:

- Buy $LEO

- Earn $LEO

- Use The Earnings to Buy More $LEO

The Plan is to Never Sell

Since only ~30% of LSTR has been sold so far, it is not hard to imagine 2 million LEO ending up in the hands of @leostrategy. Even the USDC thy earn is dedicated to $LEO buybacks. This is the same case for POL.

Does Binance Sell and Leave During Bear Market?

I asked around on Brave Search and the following numbers came up for the cryptocurrency exchange volume. There must be a significant amount of volume from DEXs, OTC and small CEXs that is not represented in the data. That is fine because we are mainly looking at the trend.

2013: $258.49M

2014: $13.04B, a 4,945.30% increase

2015: $14.26B, a 9.35% increase

2016: $43.09B, a 202.19% increase

2017: $22.89T, a 53,020.28% increase

2018: $4.94T, a -78.41% change

2019: $22.50T, a 355.39% increase

2020: $44.44T, a 97.50% increase

2021: $131.43T, a 195.74% increase

2022: $82.26T, a -37.41% change

2023: $75.57T, a -8.13% change

2024: $150.25T, a 98.84% increase

As you can see, even the bear markets can be very profitable for exchanges and LeoDEX is one very good DEX. THORChain community is raving about the new feeless Interface LeoDEX made for them. It is bringing us a lot of attention within the cross chain space.

https://inleo.io/threads/view/khaleelkazi/re-leothreads-29bjrtevt

This is a perfect example of reaching out to a great community and delivering incredible features for them. What @leofinance team has done is a masterclass that rest of HIVE should learn from. Infighting does not help. We need to work to grow the pie. The onchain data does not lie.

Check out the full list if you want more information. It includes data for 2024. What INLEO has been doing did not bring us to the mainstream. At least it worked better than the other attempt. We need to get behind and support what grow the ecosystem. Being petty does not help anybody. The supportive nature of THORChain, @mayaprotocol and even Chainflip has been great. We are witnessing the birth of a very powerful revenue generator. Learn more by clicking the link below ⏬