Title: Comprehensive Analysis of XEM on the 15-Minute and Daily Timeframes

Today, I'm excited to share with you a detailed analysis of XEM (NEM) cryptocurrency, covering both the 15-minute and daily timeframes. Let's dive into the specifics:

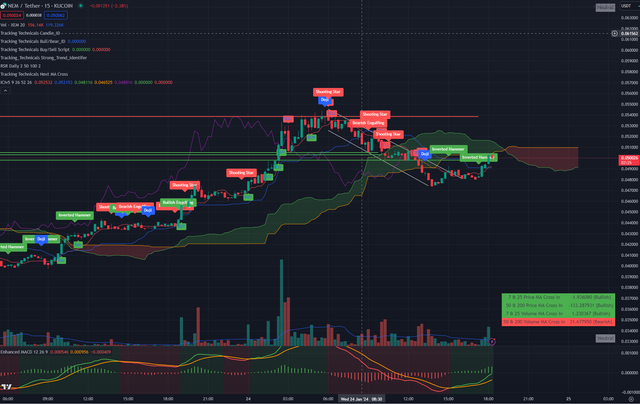

15-Minute Timeframe Analysis:

Observation: XEM showed a strong run on the 15-minute chart but eventually displayed signs of exhaustion.

Pattern: A significant development was the formation of a huge bull flag.

Technical Indicators:

MACD: The MACD signaled a buy.

Resistance Breakthrough: We observed a breakthrough on the resistance trendline followed by a healthy retest.

Signal Generator Analysis for XEM:

Pair: XEM/USDT

Signal: Long

Current Price: $0.051291

Market Cap: $463,588,279.73

Entry Prices:

EP1: $0.043217924

EP2: $0.045380038

EP3: $0.0471275

EP4: $0.048874962

Exit Prices:

EP1: $0.060189038

EP2: $0.063683962

EP3: $0.069341

EP4: $0.074998038

Pair: XEM/BTC

Signal: Long

Current Price: 1.29e-06 BTC

Entry Prices:

EP1: 1.100588e-06 BTC

EP2: 1.149206e-06 BTC

EP3: 1.1885e-06 BTC

EP4: 1.227794e-06 BTC

Exit Prices:

EP1: 1.482206e-06 BTC

EP2: 1.560794e-06 BTC

EP3: 1.688e-06 BTC

EP4: 1.815206e-06 BTC

Insight: Observing long signals on both USDT and BTC pairs for XEM is a very bullish sign.

Daily Timeframe Analysis:

Overall Trend: Our indicators on the daily timeframe couldn't be more bullish.

Key Highlights:

Volume: Exceptionally positive volume.

Trend: A very strong uptrend.

Signals: Numerous buy signals.

Price Action: Marked by higher highs and higher lows.

I hope this analysis helps you in your trading journey. As always, remember to do your own research and consider your risk tolerance before making any investment decisions.

Happy Trading!