200K Bitcoin? Here's How!

$200k Bitcoin???

Some may see this number unreasonable, however; with all the money in today's world and with Bitcoin becoming more attractive to investors with real world application, this number $200k becomes more and more realistic.

Technology within society

Technology such as irrigation and agriculture, the internet, medicine, and much more, has allowed the world to become a more efficient and advanced economy. These are trillion dollar industries which the world uses on a daily basis, that are not only a necessity but allow the human race to live comfortably. Among these technologies is blockchain, a secure and efficient way of recording and storing information. This adoption of blockchain technology solves real world problems and allows for businesses and ecosystems to connect and run more efficiently.

At the heart of this blockchain technology and cryptocurrency, is Bitcoin. It was put to work in 2009 as a means for an "honest" currency. Although far from perfect, Bitcoin has been adopted and backed by investors and those that believe in its use case. Bitcoin has a total supply of 21 million and a circulating supply of just over 16 million. With a current market capitalization of over 160 billion, it is comparable with big name companies like Disney and International Business Machines Company.

Bitcoin will not fail because it has come so far. Many investors, developers, and the blockchain community has seen the value Bitcoin provides. Not only does it have the largest community backing, Bitcoin is one of the main the mediators between fiat and other cryptocurrencies. These reasons give it an important role in the crypto asset market. With that being said, it is just a matter of time before blockchain technology and cryptocurrencies are implemented in our everyday lives, Bitcoin at the heart of it all.

Not IF but When

It's not a matter of if Bitcoin will reach $200k, but when will Bitcoin reach $200k? Many analyst have said cryptocurrencies will be a five to ten trillion dollar market. "RBC Capital Markets analyst, Mitch Steves, says in a Wednesday report that his $10 trillion estimate comes from taking a third of the roughly $30 trillion in assets held in offshore funds and gold."

Other Investors like the Winklevoss twins say “We’ve always felt that bitcoin, given its properties, is gold 2.0,” he told CNBC on Friday. “Gold is scarce, bitcoin is actually fixed. Bitcoin is way more portable and way more divisible [than gold].”Winklevoss then compared bitcoin’s market cap, around $300 billion yesterday, with gold’s at $6 trillion. “If bitcoin disrupting gold is true . . . then you can see 10 to 20 times appreciation because there is significant delta still.”

“Long term, directionally,” Winklevoss continued, “[Bitcoin] is a multitrillion-dollar asset – I don’t know how long it takes to get there.”

Another big investor Michael Novogratz says "Bitcoin could be at $40,000 at the end of 2018. Novogratz said he expects that could increase by about six times to $2 trillion at the end of next year."

These are reputable investors alike, with confidence in this growing market of cryptocurrencies.

Now for the numbers

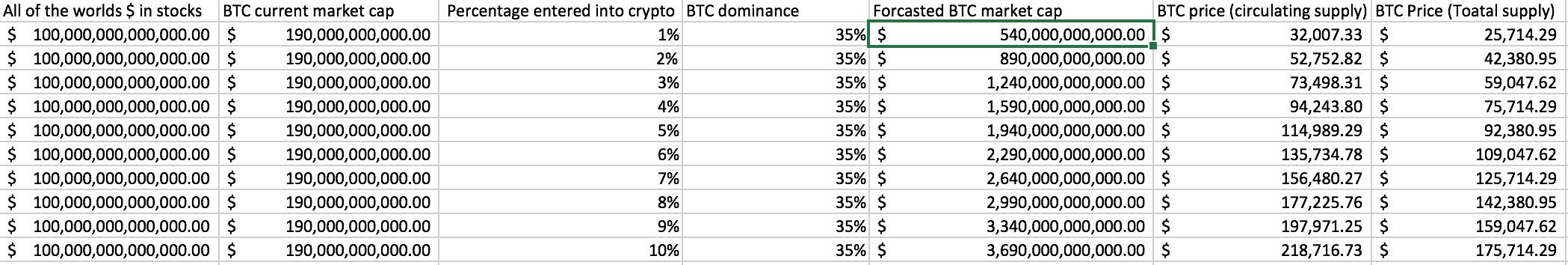

According to the money project, the world's money tied up in global liquid assets amounts to almost 100 trillion dollars. Since Bitcoin and cryptocurrency markets are becoming a global phenomenon, we can use basic models and assumptions to see how an influx of money would influence Bitcoins market capitalization and price.

The first column represents all of the worlds money tied up in liquid assets. The second column represents Bitcoins current market capitalization. The third column is the hypothetical amount of money that could spill over from other global assets into the crypto market. The fourth column holds Bitcoins dominance at 35 percent of the total market capitalization of the cryptocurrency market constant. The fifth column is the forecasted market capitalization of Bitcoin. This is done by with the formula in excel as =(ACD)+B which gives us a forecasted model for Bitcoin prices, dependent on money entering the cryptocurrency market. Once we have the forecasted market capitalization of Bitcoin we can divide it by the circulating supply, or the total supply, to reach a target price around $200k per Bitcoin.

Disclamer: This is not financial advice. This is a basic model using market capitalization of worldwide assets.

Sources

Cheng, Evelyn. “One stock analyst's $10 trillion bull case for cryptocurrencies.” CNBC, CNBC, 4 Jan. 2018, www.cnbc.com/2018/01/03/one-stock-analysts-10-trillion-bull-case-for-cryptocurrencies.html.

“Winklevoss: Bitcoin Will Be Worth Trillions of Dollars.” Fortune, fortune.com/2017/12/09/cameron-winklevoss-bitcoin-multitrillion-dollar-asset/.

Desjardins, Jeff. “All the World's Money and Markets in One Visualization.” The Money Project, 26 Oct. 2017, money.visualcapitalist.com/worlds-money-markets-one-visualization-2017/.

Cool Post. Since you got the bitcoin tag do you have a prediction for Bitcoin over the next few days? Also followed you for future posts :)

I more trade on fundamentals, but Bitcoin has been looking strong over the last week. I would be very surprised if we fell below 10k again. Many were waiting for another 8k dip, but I couldn't tell you if I am being honest. Long term I am extremely bullish. Bitcoin will be the mediator for all crypto (or at least the main one) between fiat and other cryptos. Stayed tuned for my future posts. I plan on delivering unique and relevant content for my followers and will up vote them in the future after power up. Thanks cryptoissweet!